Crop Insurance as a Risk Management Strategy in Bangladesh

Crop Insurance as a Risk Management Strategy in Bangladesh

Crop Insurance as a Risk Management Strategy in Bangladesh

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3.5 Limitation of <strong>Crop</strong> <strong>Insurance</strong>: Po<strong>in</strong>ts to ponder<br />

Agricultural <strong>in</strong>surance, although one of the most often quoted tools for risk management, can<br />

only play a limited role <strong>in</strong> manag<strong>in</strong>g the risks related with farm<strong>in</strong>g. The acid test of<br />

develop<strong>in</strong>g and operat<strong>in</strong>g an <strong>in</strong>surance program to complement other risk management<br />

me<strong>as</strong>ures depends on the cost/benefit ratio - to the farmer and to the potential <strong>in</strong>surance<br />

providers.<br />

Agricultural <strong>in</strong>surance is nevertheless a grow<strong>in</strong>g bus<strong>in</strong>ess driven by <strong>in</strong>cre<strong>as</strong><strong>in</strong>g<br />

commercialization of agriculture, <strong>in</strong>ternational trade, and foreign direct <strong>in</strong>vestment, and the<br />

development of new <strong>in</strong>surance products. The chang<strong>in</strong>g economic environment h<strong>as</strong> also<br />

triggered a renewed <strong>in</strong>terest <strong>in</strong> crop and agricultural <strong>in</strong>surance programmes and products<br />

among governments and development practitioners. (Roberts, 2005)<br />

There are a few po<strong>in</strong>ts worthwhile not<strong>in</strong>g about <strong>in</strong>surance. First, and b<strong>as</strong>ic to the<br />

understand<strong>in</strong>g of <strong>in</strong>surance, is the reality that <strong>in</strong>surance does not and cannot obliterate risk. It<br />

spreads risk. There are two dimensions to this spread. The first dimension is the spread<br />

across an <strong>in</strong>dustry or an economy, extended <strong>in</strong> the c<strong>as</strong>e of <strong>in</strong>ternational re<strong>in</strong>surance to the<br />

<strong>in</strong>ternational sphere. The second dimension of spread is through time. The important fact to<br />

note is that <strong>in</strong>surance does not directly <strong>in</strong>cre<strong>as</strong>e a grower’s <strong>in</strong>come. It merely helps manage<br />

risks to this <strong>in</strong>come.<br />

Second, <strong>in</strong>surance is a bus<strong>in</strong>ess. An <strong>in</strong>surance <strong>in</strong>demnity only becomes payable <strong>in</strong> the event<br />

of a claim under a policy. In any bus<strong>in</strong>ess arrangement, both sides of the transaction must<br />

expect to benefit. <strong>Crop</strong> <strong>in</strong>surance transactions are no different. This def<strong>in</strong>es the first<br />

boundary: crop <strong>in</strong>surance is sold and bought <strong>in</strong> a market. The purch<strong>as</strong>ers must perceive that<br />

the premiums and expected benefits offer value; the sellers must see opportunity for a<br />

positive actuarial outcome, over time, and profit.<br />

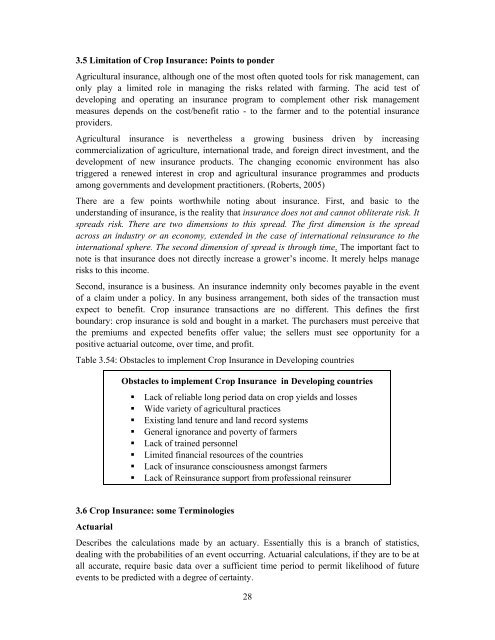

Table 3.54: Obstacles to implement <strong>Crop</strong> <strong>Insurance</strong> <strong>in</strong> Develop<strong>in</strong>g countries<br />

Obstacles to implement <strong>Crop</strong> <strong>Insurance</strong> <strong>in</strong> Develop<strong>in</strong>g countries<br />

� Lack of reliable long period data on crop yields and losses<br />

� Wide variety of agricultural practices<br />

� Exist<strong>in</strong>g land tenure and land record systems<br />

� General ignorance and poverty of farmers<br />

� Lack of tra<strong>in</strong>ed personnel<br />

� Limited f<strong>in</strong>ancial resources of the countries<br />

� Lack of <strong>in</strong>surance consciousness amongst farmers<br />

� Lack of Re<strong>in</strong>surance support from professional re<strong>in</strong>surer<br />

3.6 <strong>Crop</strong> <strong>Insurance</strong>: some Term<strong>in</strong>ologies<br />

Actuarial<br />

Describes the calculations made by an actuary. Essentially this is a branch of statistics,<br />

deal<strong>in</strong>g with the probabilities of an event occurr<strong>in</strong>g. Actuarial calculations, if they are to be at<br />

all accurate, require b<strong>as</strong>ic data over a sufficient time period to permit likelihood of future<br />

events to be predicted with a degree of certa<strong>in</strong>ty.<br />

28