Crop Insurance as a Risk Management Strategy in Bangladesh

Crop Insurance as a Risk Management Strategy in Bangladesh

Crop Insurance as a Risk Management Strategy in Bangladesh

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

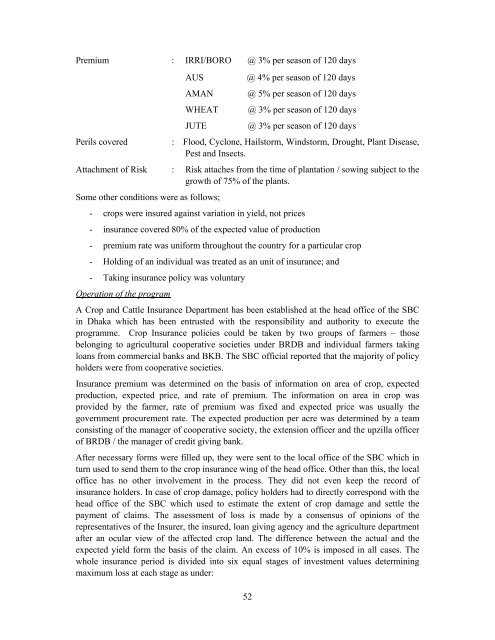

Premium : IRRI/BORO @ 3% per se<strong>as</strong>on of 120 days<br />

AUS @ 4% per se<strong>as</strong>on of 120 days<br />

AMAN @ 5% per se<strong>as</strong>on of 120 days<br />

WHEAT @ 3% per se<strong>as</strong>on of 120 days<br />

JUTE @ 3% per se<strong>as</strong>on of 120 days<br />

Perils covered : Flood, Cyclone, Hailstorm, W<strong>in</strong>dstorm, Drought, Plant Dise<strong>as</strong>e,<br />

Pest and Insects.<br />

Attachment of <strong>Risk</strong> : <strong>Risk</strong> attaches from the time of plantation / sow<strong>in</strong>g subject to the<br />

growth of 75% of the plants.<br />

Some other conditions were <strong>as</strong> follows;<br />

- crops were <strong>in</strong>sured aga<strong>in</strong>st variation <strong>in</strong> yield, not prices<br />

- <strong>in</strong>surance covered 80% of the expected value of production<br />

- premium rate w<strong>as</strong> uniform throughout the country for a particular crop<br />

- Hold<strong>in</strong>g of an <strong>in</strong>dividual w<strong>as</strong> treated <strong>as</strong> an unit of <strong>in</strong>surance; and<br />

- Tak<strong>in</strong>g <strong>in</strong>surance policy w<strong>as</strong> voluntary<br />

Operation of the program<br />

A <strong>Crop</strong> and Cattle <strong>Insurance</strong> Department h<strong>as</strong> been established at the head office of the SBC<br />

<strong>in</strong> Dhaka which h<strong>as</strong> been entrusted with the responsibility and authority to execute the<br />

programme. <strong>Crop</strong> <strong>Insurance</strong> policies could be taken by two groups of farmers – those<br />

belong<strong>in</strong>g to agricultural cooperative societies under BRDB and <strong>in</strong>dividual farmers tak<strong>in</strong>g<br />

loans from commercial banks and BKB. The SBC official reported that the majority of policy<br />

holders were from cooperative societies.<br />

<strong>Insurance</strong> premium w<strong>as</strong> determ<strong>in</strong>ed on the b<strong>as</strong>is of <strong>in</strong>formation on area of crop, expected<br />

production, expected price, and rate of premium. The <strong>in</strong>formation on area <strong>in</strong> crop w<strong>as</strong><br />

provided by the farmer, rate of premium w<strong>as</strong> fixed and expected price w<strong>as</strong> usually the<br />

government procurement rate. The expected production per acre w<strong>as</strong> determ<strong>in</strong>ed by a team<br />

consist<strong>in</strong>g of the manager of cooperative society, the extension officer and the upzilla officer<br />

of BRDB / the manager of credit giv<strong>in</strong>g bank.<br />

After necessary forms were filled up, they were sent to the local office of the SBC which <strong>in</strong><br />

turn used to send them to the crop <strong>in</strong>surance w<strong>in</strong>g of the head office. Other than this, the local<br />

office h<strong>as</strong> no other <strong>in</strong>volvement <strong>in</strong> the process. They did not even keep the record of<br />

<strong>in</strong>surance holders. In c<strong>as</strong>e of crop damage, policy holders had to directly correspond with the<br />

head office of the SBC which used to estimate the extent of crop damage and settle the<br />

payment of claims. The <strong>as</strong>sessment of loss is made by a consensus of op<strong>in</strong>ions of the<br />

representatives of the Insurer, the <strong>in</strong>sured, loan giv<strong>in</strong>g agency and the agriculture department<br />

after an ocular view of the affected crop land. The difference between the actual and the<br />

expected yield form the b<strong>as</strong>is of the claim. An excess of 10% is imposed <strong>in</strong> all c<strong>as</strong>es. The<br />

whole <strong>in</strong>surance period is divided <strong>in</strong>to six equal stages of <strong>in</strong>vestment values determ<strong>in</strong><strong>in</strong>g<br />

maximum loss at each stage <strong>as</strong> under:<br />

52