Crop Insurance as a Risk Management Strategy in Bangladesh

Crop Insurance as a Risk Management Strategy in Bangladesh

Crop Insurance as a Risk Management Strategy in Bangladesh

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

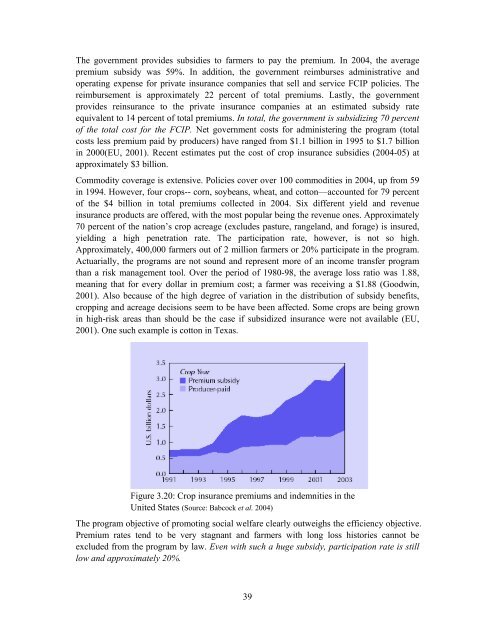

The government provides subsidies to farmers to pay the premium. In 2004, the average<br />

premium subsidy w<strong>as</strong> 59%. In addition, the government reimburses adm<strong>in</strong>istrative and<br />

operat<strong>in</strong>g expense for private <strong>in</strong>surance companies that sell and service FCIP policies. The<br />

reimbursement is approximately 22 percent of total premiums. L<strong>as</strong>tly, the government<br />

provides re<strong>in</strong>surance to the private <strong>in</strong>surance companies at an estimated subsidy rate<br />

equivalent to 14 percent of total premiums. In total, the government is subsidiz<strong>in</strong>g 70 percent<br />

of the total cost for the FCIP. Net government costs for adm<strong>in</strong>ister<strong>in</strong>g the program (total<br />

costs less premium paid by producers) have ranged from $1.1 billion <strong>in</strong> 1995 to $1.7 billion<br />

<strong>in</strong> 2000(EU, 2001). Recent estimates put the cost of crop <strong>in</strong>surance subsidies (2004-05) at<br />

approximately $3 billion.<br />

Commodity coverage is extensive. Policies cover over 100 commodities <strong>in</strong> 2004, up from 59<br />

<strong>in</strong> 1994. However, four crops-- corn, soybeans, wheat, and cotton—accounted for 79 percent<br />

of the $4 billion <strong>in</strong> total premiums collected <strong>in</strong> 2004. Six different yield and revenue<br />

<strong>in</strong>surance products are offered, with the most popular be<strong>in</strong>g the revenue ones. Approximately<br />

70 percent of the nation’s crop acreage (excludes p<strong>as</strong>ture, rangeland, and forage) is <strong>in</strong>sured,<br />

yield<strong>in</strong>g a high penetration rate. The participation rate, however, is not so high.<br />

Approximately, 400,000 farmers out of 2 million farmers or 20% participate <strong>in</strong> the program.<br />

Actuarially, the programs are not sound and represent more of an <strong>in</strong>come transfer program<br />

than a risk management tool. Over the period of 1980-98, the average loss ratio w<strong>as</strong> 1.88,<br />

mean<strong>in</strong>g that for every dollar <strong>in</strong> premium cost; a farmer w<strong>as</strong> receiv<strong>in</strong>g a $1.88 (Goodw<strong>in</strong>,<br />

2001). Also because of the high degree of variation <strong>in</strong> the distribution of subsidy benefits,<br />

cropp<strong>in</strong>g and acreage decisions seem to be have been affected. Some crops are be<strong>in</strong>g grown<br />

<strong>in</strong> high-risk are<strong>as</strong> than should be the c<strong>as</strong>e if subsidized <strong>in</strong>surance were not available (EU,<br />

2001). One such example is cotton <strong>in</strong> Tex<strong>as</strong>.<br />

Figure 3.20: <strong>Crop</strong> <strong>in</strong>surance premiums and <strong>in</strong>demnities <strong>in</strong> the<br />

United States (Source: Babcock et al. 2004)<br />

The program objective of promot<strong>in</strong>g social welfare clearly outweighs the efficiency objective.<br />

Premium rates tend to be very stagnant and farmers with long loss histories cannot be<br />

excluded from the program by law. Even with such a huge subsidy, participation rate is still<br />

low and approximately 20%.<br />

39