Crop Insurance as a Risk Management Strategy in Bangladesh

Crop Insurance as a Risk Management Strategy in Bangladesh

Crop Insurance as a Risk Management Strategy in Bangladesh

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Second, the knowledge that the government is likely to “bail out” affected parties creates<br />

moral hazard conditions and depresses the market for private crop <strong>in</strong>surance. Farmers do not<br />

do all that they can do to reduce <strong>in</strong>dividual vulnerability to adverse climatic conditions and<br />

other biological threats. Similarly, <strong>in</strong>surance companies have little <strong>in</strong>centive to enter rural<br />

markets and offer costly <strong>in</strong>surance products s<strong>in</strong>ce they fear that demand for their products<br />

will be weak s<strong>in</strong>ce farmers would prefer free ex post <strong>as</strong>sistance from the government <strong>as</strong><br />

opposed to pay<strong>in</strong>g a premium ex ante. The negative results are represented <strong>in</strong> Figure 3.13.<br />

Central governments should provide dis<strong>as</strong>ter <strong>as</strong>sistance but should set rules of eligibility so <strong>as</strong><br />

to encourage the purch<strong>as</strong>e of private <strong>in</strong>surance and/or precautionary actions to reduce<br />

vulnerability to losses.<br />

Third, well-organized groups of farmers have a strong <strong>in</strong>centive to lobby the government for<br />

relief from a wide and varied number of adverse climatic and price effects. Thus, government<br />

can be called upon to provide relief for non-cat<strong>as</strong>trophic events, which normally should be <strong>in</strong><br />

the doma<strong>in</strong> of private <strong>in</strong>surers. Many times, the farmers that are more organized and most<br />

<strong>in</strong>fluential tend not to be the poorest. Political motivation might be there <strong>as</strong> well. Thus, nonpoor<br />

farmers and a group with vested <strong>in</strong>terest might be the beneficiary there.<br />

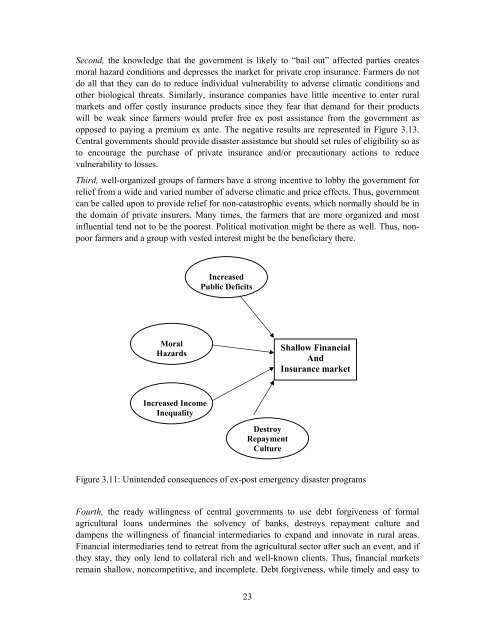

Moral<br />

Hazards<br />

Incre<strong>as</strong>ed Income<br />

Inequality<br />

Incre<strong>as</strong>ed<br />

Public Deficits<br />

Destroy<br />

Repayment<br />

Culture<br />

Figure 3.11: Un<strong>in</strong>tended consequences of ex-post emergency dis<strong>as</strong>ter programs<br />

Fourth, the ready will<strong>in</strong>gness of central governments to use debt forgiveness of formal<br />

agricultural loans underm<strong>in</strong>es the solvency of banks, destroys repayment culture and<br />

dampens the will<strong>in</strong>gness of f<strong>in</strong>ancial <strong>in</strong>termediaries to expand and <strong>in</strong>novate <strong>in</strong> rural are<strong>as</strong>.<br />

F<strong>in</strong>ancial <strong>in</strong>termediaries tend to retreat from the agricultural sector after such an event, and if<br />

they stay, they only lend to collateral rich and well-known clients. Thus, f<strong>in</strong>ancial markets<br />

rema<strong>in</strong> shallow, noncompetitive, and <strong>in</strong>complete. Debt forgiveness, while timely and e<strong>as</strong>y to<br />

23<br />

Shallow F<strong>in</strong>ancial<br />

And<br />

<strong>Insurance</strong> market