Crop Insurance as a Risk Management Strategy in Bangladesh

Crop Insurance as a Risk Management Strategy in Bangladesh

Crop Insurance as a Risk Management Strategy in Bangladesh

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

�<br />

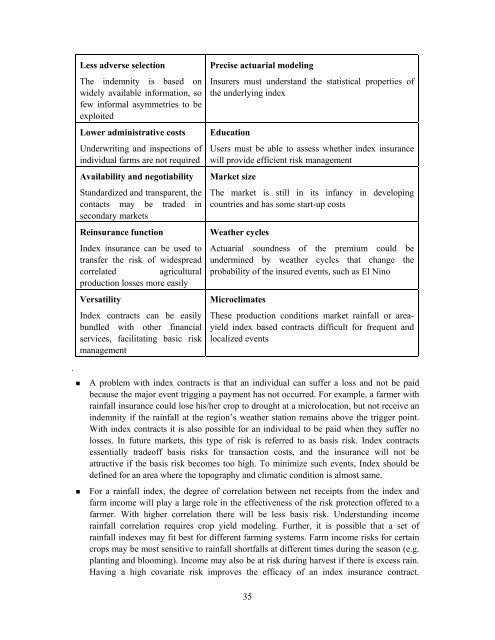

Less adverse selection<br />

The <strong>in</strong>demnity is b<strong>as</strong>ed on<br />

widely available <strong>in</strong>formation, so<br />

few <strong>in</strong>formal <strong>as</strong>ymmetries to be<br />

exploited<br />

Lower adm<strong>in</strong>istrative costs<br />

Underwrit<strong>in</strong>g and <strong>in</strong>spections of<br />

<strong>in</strong>dividual farms are not required<br />

Availability and negotiability<br />

Standardized and transparent, the<br />

contacts may be traded <strong>in</strong><br />

secondary markets<br />

Re<strong>in</strong>surance function<br />

Index <strong>in</strong>surance can be used to<br />

transfer the risk of widespread<br />

correlated agricultural<br />

production losses more e<strong>as</strong>ily<br />

Versatility<br />

Index contracts can be e<strong>as</strong>ily<br />

bundled with other f<strong>in</strong>ancial<br />

services, facilitat<strong>in</strong>g b<strong>as</strong>ic risk<br />

management<br />

Precise actuarial model<strong>in</strong>g<br />

Insurers must understand the statistical properties of<br />

the underly<strong>in</strong>g <strong>in</strong>dex<br />

Education<br />

Users must be able to <strong>as</strong>sess whether <strong>in</strong>dex <strong>in</strong>surance<br />

will provide efficient risk management<br />

Market size<br />

The market is still <strong>in</strong> its <strong>in</strong>fancy <strong>in</strong> develop<strong>in</strong>g<br />

countries and h<strong>as</strong> some start-up costs<br />

Weather cycles<br />

Actuarial soundness of the premium could be<br />

underm<strong>in</strong>ed by weather cycles that change the<br />

probability of the <strong>in</strong>sured events, such <strong>as</strong> El N<strong>in</strong>o<br />

Microclimates<br />

These production conditions market ra<strong>in</strong>fall or areayield<br />

<strong>in</strong>dex b<strong>as</strong>ed contracts difficult for frequent and<br />

localized events<br />

� A problem with <strong>in</strong>dex contracts is that an <strong>in</strong>dividual can suffer a loss and not be paid<br />

because the major event trigg<strong>in</strong>g a payment h<strong>as</strong> not occurred. For example, a farmer with<br />

ra<strong>in</strong>fall <strong>in</strong>surance could lose his/her crop to drought at a microlocation, but not receive an<br />

<strong>in</strong>demnity if the ra<strong>in</strong>fall at the region’s weather station rema<strong>in</strong>s above the trigger po<strong>in</strong>t.<br />

With <strong>in</strong>dex contracts it is also possible for an <strong>in</strong>dividual to be paid when they suffer no<br />

losses. In future markets, this type of risk is referred to <strong>as</strong> b<strong>as</strong>is risk. Index contracts<br />

essentially tradeoff b<strong>as</strong>is risks for transaction costs, and the <strong>in</strong>surance will not be<br />

attractive if the b<strong>as</strong>is risk becomes too high. To m<strong>in</strong>imize such events, Index should be<br />

def<strong>in</strong>ed for an area where the topography and climatic condition is almost same.<br />

� For a ra<strong>in</strong>fall <strong>in</strong>dex, the degree of correlation between net receipts from the <strong>in</strong>dex and<br />

farm <strong>in</strong>come will play a large role <strong>in</strong> the effectiveness of the risk protection offered to a<br />

farmer. With higher correlation there will be less b<strong>as</strong>is risk. Understand<strong>in</strong>g <strong>in</strong>come<br />

ra<strong>in</strong>fall correlation requires crop yield model<strong>in</strong>g. Further, it is possible that a set of<br />

ra<strong>in</strong>fall <strong>in</strong>dexes may fit best for different farm<strong>in</strong>g systems. Farm <strong>in</strong>come risks for certa<strong>in</strong><br />

crops may be most sensitive to ra<strong>in</strong>fall shortfalls at different times dur<strong>in</strong>g the se<strong>as</strong>on (e.g.<br />

plant<strong>in</strong>g and bloom<strong>in</strong>g). Income may also be at risk dur<strong>in</strong>g harvest if there is excess ra<strong>in</strong>.<br />

Hav<strong>in</strong>g a high covariate risk improves the efficacy of an <strong>in</strong>dex <strong>in</strong>surance contract.<br />

35