Crop Insurance as a Risk Management Strategy in Bangladesh

Crop Insurance as a Risk Management Strategy in Bangladesh

Crop Insurance as a Risk Management Strategy in Bangladesh

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

unanticipated cat<strong>as</strong>trophic natural calamities. A detail evaluation of the CI programme<br />

<strong>in</strong>troduced is expla<strong>in</strong>ed <strong>in</strong> the next section.<br />

• MFI-NGO <strong>in</strong>surance funds are not sufficient to meet the large/unusual losses;<br />

therefore, susta<strong>in</strong>ability of micro<strong>in</strong>surance is a big challenge.<br />

• However, from the climate dis<strong>as</strong>ter po<strong>in</strong>t of view, the major lacunae <strong>in</strong> the exist<strong>in</strong>g<br />

micro<strong>in</strong>surance system is the lack of cover of risks to <strong>as</strong>sets and economic outputs of<br />

the poor that they build either from their own sav<strong>in</strong>gs or from the micro-credits of<br />

MFIs.<br />

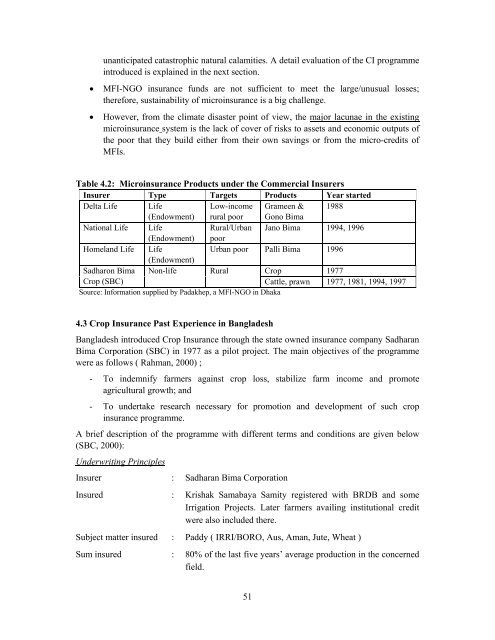

Table 4.2: Micro<strong>in</strong>surance Products under the Commercial Insurers<br />

Insurer Type Targets Products Year started<br />

Delta Life Life<br />

Low-<strong>in</strong>come Grameen & 1988<br />

(Endowment) rural poor Gono Bima<br />

National Life Life<br />

Rural/Urban Jano Bima 1994, 1996<br />

(Endowment) poor<br />

Homeland Life Life<br />

(Endowment)<br />

Urban poor Palli Bima 1996<br />

Sadharon Bima Non-life Rural <strong>Crop</strong> 1977<br />

<strong>Crop</strong> (SBC)<br />

Cattle, prawn 1977, 1981, 1994, 1997<br />

Source: Information supplied by Padakhep, a MFI-NGO <strong>in</strong> Dhaka<br />

4.3 <strong>Crop</strong> <strong>Insurance</strong> P<strong>as</strong>t Experience <strong>in</strong> <strong>Bangladesh</strong><br />

<strong>Bangladesh</strong> <strong>in</strong>troduced <strong>Crop</strong> <strong>Insurance</strong> through the state owned <strong>in</strong>surance company Sadharan<br />

Bima Corporation (SBC) <strong>in</strong> 1977 <strong>as</strong> a pilot project. The ma<strong>in</strong> objectives of the programme<br />

were <strong>as</strong> follows ( Rahman, 2000) ;<br />

- To <strong>in</strong>demnify farmers aga<strong>in</strong>st crop loss, stabilize farm <strong>in</strong>come and promote<br />

agricultural growth; and<br />

- To undertake research necessary for promotion and development of such crop<br />

<strong>in</strong>surance programme.<br />

A brief description of the programme with different terms and conditions are given below<br />

(SBC, 2000):<br />

Underwrit<strong>in</strong>g Pr<strong>in</strong>ciples<br />

Insurer : Sadharan Bima Corporation<br />

Insured : Krishak Samabaya Samity registered with BRDB and some<br />

Irrigation Projects. Later farmers avail<strong>in</strong>g <strong>in</strong>stitutional credit<br />

were also <strong>in</strong>cluded there.<br />

Subject matter <strong>in</strong>sured : Paddy ( IRRI/BORO, Aus, Aman, Jute, Wheat )<br />

Sum <strong>in</strong>sured : 80% of the l<strong>as</strong>t five years’ average production <strong>in</strong> the concerned<br />

field.<br />

51