Crop Insurance as a Risk Management Strategy in Bangladesh

Crop Insurance as a Risk Management Strategy in Bangladesh

Crop Insurance as a Risk Management Strategy in Bangladesh

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

non-borrow<strong>in</strong>g farmers the sum <strong>in</strong>sured is value of guaranteed yield, which can be extended<br />

up to value of 150 percent of the average yield.<br />

Premium rates dur<strong>in</strong>g Kharif are 3.5 per cent of the sum <strong>in</strong>sured or actuarial rate whichever is<br />

less for pearl millet and oilseeds, 2.5 per cent for other Kharif crops (June to October); 1.5<br />

per cent for wheat, and 2 per cent for other Rabi crops (November to March). In c<strong>as</strong>e of<br />

annual commercial/horticultural crops, actuarial rates are applied. The sum <strong>in</strong>sured beyond<br />

value of 100 percent of guaranteed yield attracts commercial rates of premium for all crops.<br />

The premium <strong>in</strong> c<strong>as</strong>e of small and marg<strong>in</strong>al farmers is subsidized by 50 per cent, which is<br />

shared equally by the Government of India and the State/UT. The premium subsidies to be<br />

ph<strong>as</strong>ed out on sunset b<strong>as</strong>is, over a period of five years, and at present it is 10%.<br />

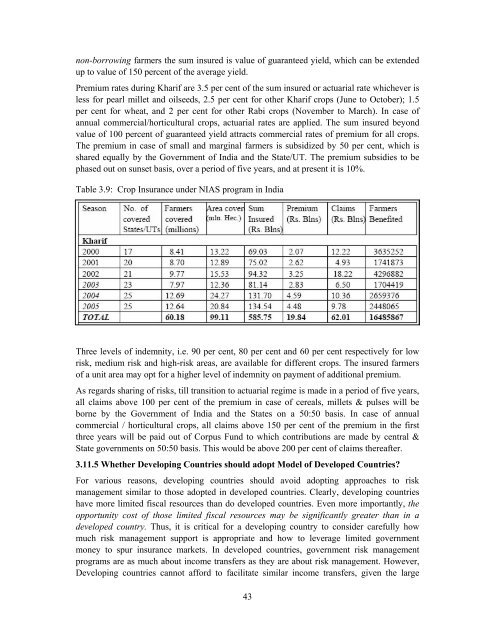

Table 3.9: <strong>Crop</strong> <strong>Insurance</strong> under NIAS program <strong>in</strong> India<br />

Three levels of <strong>in</strong>demnity, i.e. 90 per cent, 80 per cent and 60 per cent respectively for low<br />

risk, medium risk and high-risk are<strong>as</strong>, are available for different crops. The <strong>in</strong>sured farmers<br />

of a unit area may opt for a higher level of <strong>in</strong>demnity on payment of additional premium.<br />

As regards shar<strong>in</strong>g of risks, till transition to actuarial regime is made <strong>in</strong> a period of five years,<br />

all claims above 100 per cent of the premium <strong>in</strong> c<strong>as</strong>e of cereals, millets & pulses will be<br />

borne by the Government of India and the States on a 50:50 b<strong>as</strong>is. In c<strong>as</strong>e of annual<br />

commercial / horticultural crops, all claims above 150 per cent of the premium <strong>in</strong> the first<br />

three years will be paid out of Corpus Fund to which contributions are made by central &<br />

State governments on 50:50 b<strong>as</strong>is. This would be above 200 per cent of claims thereafter.<br />

3.11.5 Whether Develop<strong>in</strong>g Countries should adopt Model of Developed Countries?<br />

For various re<strong>as</strong>ons, develop<strong>in</strong>g countries should avoid adopt<strong>in</strong>g approaches to risk<br />

management similar to those adopted <strong>in</strong> developed countries. Clearly, develop<strong>in</strong>g countries<br />

have more limited fiscal resources than do developed countries. Even more importantly, the<br />

opportunity cost of those limited fiscal resources may be significantly greater than <strong>in</strong> a<br />

developed country. Thus, it is critical for a develop<strong>in</strong>g country to consider carefully how<br />

much risk management support is appropriate and how to leverage limited government<br />

money to spur <strong>in</strong>surance markets. In developed countries, government risk management<br />

programs are <strong>as</strong> much about <strong>in</strong>come transfers <strong>as</strong> they are about risk management. However,<br />

Develop<strong>in</strong>g countries cannot afford to facilitate similar <strong>in</strong>come transfers, given the large<br />

43