Crop Insurance as a Risk Management Strategy in Bangladesh

Crop Insurance as a Risk Management Strategy in Bangladesh

Crop Insurance as a Risk Management Strategy in Bangladesh

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3.11.2 Canadian Experience<br />

<strong>Crop</strong> <strong>in</strong>surance <strong>in</strong> Canada dates back to 1939 when the federal government started to provide<br />

dis<strong>as</strong>ter <strong>as</strong>sistance to gra<strong>in</strong> producers on the prairies. S<strong>in</strong>ce then, a tripartite system h<strong>as</strong><br />

evolved that consist of three separate programs: <strong>Crop</strong> <strong>Insurance</strong> (CI), the Net Income<br />

Stabilization Account (NISA), and the Agricultural Income Dis<strong>as</strong>ter Assistance (AIDA). The<br />

programs are adm<strong>in</strong>istered at the level of prov<strong>in</strong>cial governments and no private <strong>in</strong>surance<br />

companies are <strong>in</strong>volved. The Federal government sets general frameworks and shares<br />

program costs with prov<strong>in</strong>cial governments, but the latter have flexibility to modify the<br />

products to suit the specific needs of farmers <strong>in</strong> their jurisdiction. In addition, programs are<br />

highly participatory with farmers, prov<strong>in</strong>cial governments, and federal government<br />

participat<strong>in</strong>g <strong>in</strong> discuss<strong>in</strong>g surround<strong>in</strong>g product designs, rate sett<strong>in</strong>g, and performance<br />

feedback.<br />

The <strong>Crop</strong> <strong>Insurance</strong> Program (CI) provid<strong>in</strong>g a yield guarantee b<strong>as</strong>ed on historical yield data<br />

for the farm. If production falls below a yield trigger an <strong>in</strong>demnity will be paid cover<strong>in</strong>g 80-<br />

90% of the difference between the trigger and realized yield. The product is multiple peril,<br />

cover<strong>in</strong>g all losses due to natural hazards, excessive moisture, uncontrollable dise<strong>as</strong>es, and<br />

pests and even damage caused by protected migratory waterfowl. In 1999, 100,000 or 50% of<br />

all farmers participated and 50 million acres where <strong>in</strong>sured, constitut<strong>in</strong>g 55% of all crop and<br />

forage acreage (EU, 2001). For most of the 1990s, the loss ratio w<strong>as</strong> favorable, less than one,<br />

except for 1992-93. The Federal and prov<strong>in</strong>cial governments each pay 25% of the total<br />

premium and 50% of the adm<strong>in</strong>istrative costs. The comb<strong>in</strong>ed cost to the Federal and<br />

prov<strong>in</strong>cial governments h<strong>as</strong> been trend<strong>in</strong>g upward sharply, ris<strong>in</strong>g 34% from US$338 million<br />

<strong>in</strong> 1995 to US$454 <strong>in</strong> 1999 (EU, 2001). In addition to these costs, the Federal government<br />

h<strong>as</strong> re<strong>in</strong>surance agreements with four prov<strong>in</strong>ces and subsidies the re<strong>in</strong>surance premium for<br />

two other prov<strong>in</strong>ces that purch<strong>as</strong>e it <strong>in</strong> the private re<strong>in</strong>surance market.<br />

3.11.3 Experience from Caribbean and South America<br />

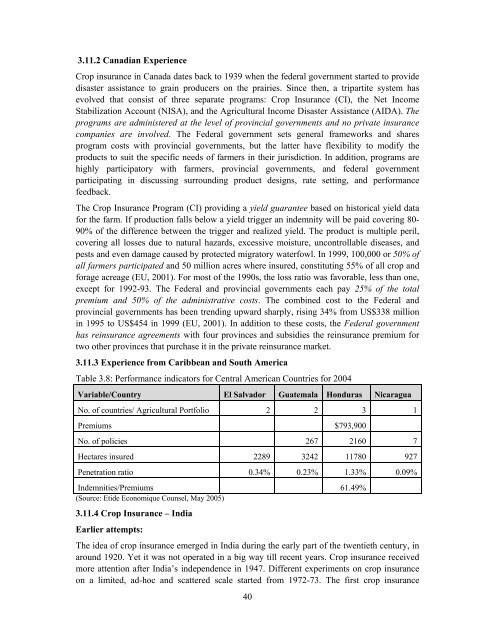

Table 3.8: Performance <strong>in</strong>dicators for Central American Countries for 2004<br />

Variable/Country El Salvador Guatemala Hondur<strong>as</strong> Nicaragua<br />

No. of countries/ Agricultural Portfolio 2 2 3 1<br />

Premiums $793,900<br />

No. of policies 267 2160 7<br />

Hectares <strong>in</strong>sured 2289 3242 11780 927<br />

Penetration ratio 0.34% 0.23% 1.33% 0.09%<br />

Indemnities/Premiums 61.49%<br />

(Source: Etide Economique Counsel, May 2005)<br />

3.11.4 <strong>Crop</strong> <strong>Insurance</strong> – India<br />

Earlier attempts:<br />

The idea of crop <strong>in</strong>surance emerged <strong>in</strong> India dur<strong>in</strong>g the early part of the twentieth century, <strong>in</strong><br />

around 1920. Yet it w<strong>as</strong> not operated <strong>in</strong> a big way till recent years. <strong>Crop</strong> <strong>in</strong>surance received<br />

more attention after India’s <strong>in</strong>dependence <strong>in</strong> 1947. Different experiments on crop <strong>in</strong>surance<br />

on a limited, ad-hoc and scattered scale started from 1972-73. The first crop <strong>in</strong>surance<br />

40