Crop Insurance as a Risk Management Strategy in Bangladesh

Crop Insurance as a Risk Management Strategy in Bangladesh

Crop Insurance as a Risk Management Strategy in Bangladesh

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3.10 <strong>Crop</strong> <strong>Insurance</strong> Experience at Different Parts of the World<br />

The f<strong>in</strong>ancial experience with publicly provided, multiple-peril crop <strong>in</strong>surance h<strong>as</strong> been<br />

dis<strong>as</strong>trous. In all c<strong>as</strong>es, programs are heavily subsidized and governments not only pay part of<br />

the premium, but also most of the delivery and service costs, and they cover aggregate losses<br />

even when the losses exceed targeted levels over long periods of time. In order to be<br />

profitable, a purely private <strong>in</strong>surer would have to structure contracts so that premiums<br />

collected exceed the average payouts (<strong>in</strong>demnities plus adm<strong>in</strong>istrative costs). Hazell<br />

quantifies the condition for susta<strong>in</strong>able <strong>in</strong>surance <strong>as</strong> follows:<br />

(A + I)/ P < 1<br />

Where, A = average adm<strong>in</strong>istrative costs<br />

I = average <strong>in</strong>demnities paid<br />

P = average premiums paid<br />

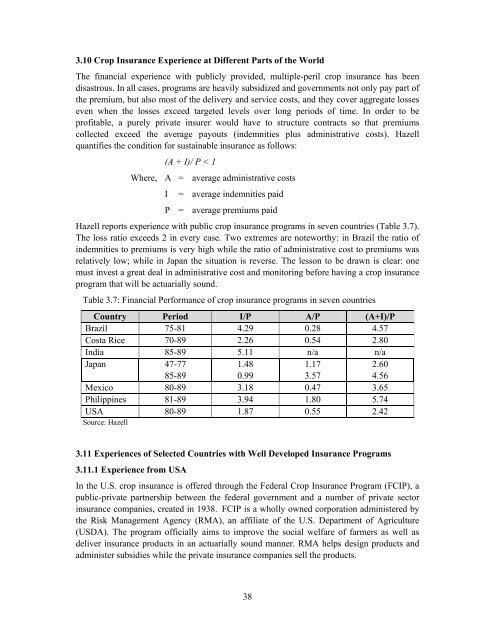

Hazell reports experience with public crop <strong>in</strong>surance programs <strong>in</strong> seven countries (Table 3.7).<br />

The loss ratio exceeds 2 <strong>in</strong> every c<strong>as</strong>e. Two extremes are noteworthy: <strong>in</strong> Brazil the ratio of<br />

<strong>in</strong>demnities to premiums is very high while the ratio of adm<strong>in</strong>istrative cost to premiums w<strong>as</strong><br />

relatively low; while <strong>in</strong> Japan the situation is reverse. The lesson to be drawn is clear: one<br />

must <strong>in</strong>vest a great deal <strong>in</strong> adm<strong>in</strong>istrative cost and monitor<strong>in</strong>g before hav<strong>in</strong>g a crop <strong>in</strong>surance<br />

program that will be actuarially sound.<br />

Table 3.7: F<strong>in</strong>ancial Performance of crop <strong>in</strong>surance programs <strong>in</strong> seven countries<br />

Country Period I/P A/P (A+I)/P<br />

Brazil 75-81 4.29 0.28 4.57<br />

Costa Rice 70-89 2.26 0.54 2.80<br />

India 85-89 5.11 n/a n/a<br />

Japan 47-77<br />

1.48<br />

1.17<br />

2.60<br />

85-89<br />

0.99<br />

3.57<br />

4.56<br />

Mexico 80-89 3.18 0.47 3.65<br />

Philipp<strong>in</strong>es 81-89 3.94 1.80 5.74<br />

USA<br />

Source: Hazell<br />

80-89 1.87 0.55 2.42<br />

3.11 Experiences of Selected Countries with Well Developed <strong>Insurance</strong> Programs<br />

3.11.1 Experience from USA<br />

In the U.S. crop <strong>in</strong>surance is offered through the Federal <strong>Crop</strong> <strong>Insurance</strong> Program (FCIP), a<br />

public-private partnership between the federal government and a number of private sector<br />

<strong>in</strong>surance companies, created <strong>in</strong> 1938. FCIP is a wholly owned corporation adm<strong>in</strong>istered by<br />

the <strong>Risk</strong> <strong>Management</strong> Agency (RMA), an affiliate of the U.S. Department of Agriculture<br />

(USDA). The program officially aims to improve the social welfare of farmers <strong>as</strong> well <strong>as</strong><br />

deliver <strong>in</strong>surance products <strong>in</strong> an actuarially sound manner. RMA helps design products and<br />

adm<strong>in</strong>ister subsidies while the private <strong>in</strong>surance companies sell the products.<br />

38