Crop Insurance as a Risk Management Strategy in Bangladesh

Crop Insurance as a Risk Management Strategy in Bangladesh

Crop Insurance as a Risk Management Strategy in Bangladesh

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Def<strong>in</strong><strong>in</strong>g risk-reduction me<strong>as</strong>ures by an outside authority (for example, requir<strong>in</strong>g squatters to<br />

evacuate are<strong>as</strong> targeted for flood-control me<strong>as</strong>ures dams) may be problematic, especially if<br />

not subject to government and stakeholder <strong>in</strong>volvement. Moreover, LDCs may f<strong>in</strong>d it<br />

difficult to f<strong>in</strong>ance mitigation me<strong>as</strong>ures that cover the imputed risk-b<strong>as</strong>ed premium. For<br />

highly exposed LDCs, this premium can be quite substantial. For example, <strong>in</strong> the recently<br />

<strong>in</strong>troduced drought <strong>in</strong>surance program <strong>in</strong> Malawi, annual premiums amounted to 6-10% of<br />

the <strong>in</strong>sured crop value (Opportunity International, 2005). F<strong>in</strong>ally, the strategy can be<br />

<strong>in</strong>efficient if the required me<strong>as</strong>ures are not cost-effective or high priority <strong>in</strong> the country.<br />

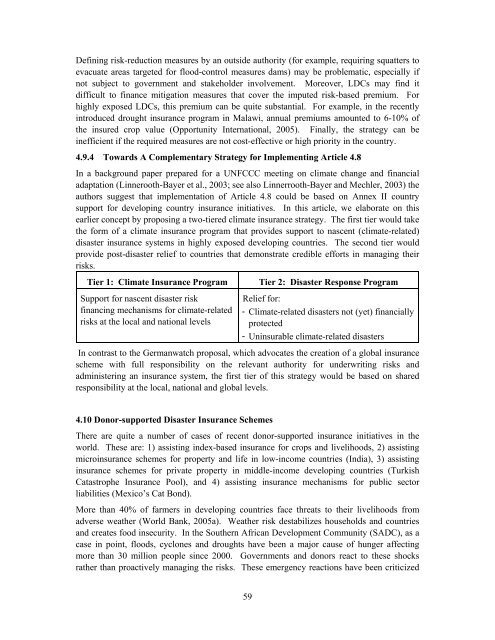

4.9.4 Towards A Complementary <strong>Strategy</strong> for Implement<strong>in</strong>g Article 4.8<br />

In a background paper prepared for a UNFCCC meet<strong>in</strong>g on climate change and f<strong>in</strong>ancial<br />

adaptation (L<strong>in</strong>nerooth-Bayer et al., 2003; see also L<strong>in</strong>nerrooth-Bayer and Mechler, 2003) the<br />

authors suggest that implementation of Article 4.8 could be b<strong>as</strong>ed on Annex II country<br />

support for develop<strong>in</strong>g country <strong>in</strong>surance <strong>in</strong>itiatives. In this article, we elaborate on this<br />

earlier concept by propos<strong>in</strong>g a two-tiered climate <strong>in</strong>surance strategy. The first tier would take<br />

the form of a climate <strong>in</strong>surance program that provides support to n<strong>as</strong>cent (climate-related)<br />

dis<strong>as</strong>ter <strong>in</strong>surance systems <strong>in</strong> highly exposed develop<strong>in</strong>g countries. The second tier would<br />

provide post-dis<strong>as</strong>ter relief to countries that demonstrate credible efforts <strong>in</strong> manag<strong>in</strong>g their<br />

risks.<br />

Tier 1: Climate <strong>Insurance</strong> Program Tier 2: Dis<strong>as</strong>ter Response Program<br />

Support for n<strong>as</strong>cent dis<strong>as</strong>ter risk<br />

f<strong>in</strong>anc<strong>in</strong>g mechanisms for climate-related<br />

risks at the local and national levels<br />

Relief for:<br />

‐ Climate-related dis<strong>as</strong>ters not (yet) f<strong>in</strong>ancially<br />

protected<br />

‐ Un<strong>in</strong>surable climate-related dis<strong>as</strong>ters<br />

In contr<strong>as</strong>t to the Germanwatch proposal, which advocates the creation of a global <strong>in</strong>surance<br />

scheme with full responsibility on the relevant authority for underwrit<strong>in</strong>g risks and<br />

adm<strong>in</strong>ister<strong>in</strong>g an <strong>in</strong>surance system, the first tier of this strategy would be b<strong>as</strong>ed on shared<br />

responsibility at the local, national and global levels.<br />

4.10 Donor-supported Dis<strong>as</strong>ter <strong>Insurance</strong> Schemes<br />

There are quite a number of c<strong>as</strong>es of recent donor-supported <strong>in</strong>surance <strong>in</strong>itiatives <strong>in</strong> the<br />

world. These are: 1) <strong>as</strong>sist<strong>in</strong>g <strong>in</strong>dex-b<strong>as</strong>ed <strong>in</strong>surance for crops and livelihoods, 2) <strong>as</strong>sist<strong>in</strong>g<br />

micro<strong>in</strong>surance schemes for property and life <strong>in</strong> low-<strong>in</strong>come countries (India), 3) <strong>as</strong>sist<strong>in</strong>g<br />

<strong>in</strong>surance schemes for private property <strong>in</strong> middle-<strong>in</strong>come develop<strong>in</strong>g countries (Turkish<br />

Cat<strong>as</strong>trophe <strong>Insurance</strong> Pool), and 4) <strong>as</strong>sist<strong>in</strong>g <strong>in</strong>surance mechanisms for public sector<br />

liabilities (Mexico’s Cat Bond).<br />

More than 40% of farmers <strong>in</strong> develop<strong>in</strong>g countries face threats to their livelihoods from<br />

adverse weather (World Bank, 2005a). Weather risk destabilizes households and countries<br />

and creates food <strong>in</strong>security. In the Southern African Development Community (SADC), <strong>as</strong> a<br />

c<strong>as</strong>e <strong>in</strong> po<strong>in</strong>t, floods, cyclones and droughts have been a major cause of hunger affect<strong>in</strong>g<br />

more than 30 million people s<strong>in</strong>ce 2000. Governments and donors react to these shocks<br />

rather than proactively manag<strong>in</strong>g the risks. These emergency reactions have been criticized<br />

59