Content2011 - PETRONAS Gas Berhad

Content2011 - PETRONAS Gas Berhad

Content2011 - PETRONAS Gas Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

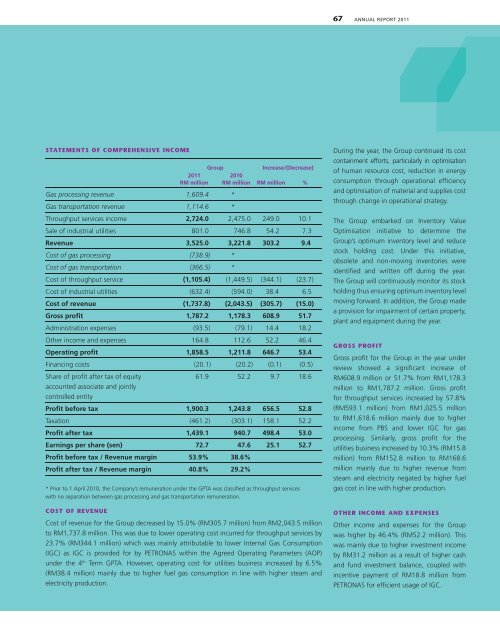

stAtements of ComPrehensive inCome<br />

2011<br />

RM million<br />

<strong>Gas</strong> processing revenue 1,609.4 *<br />

<strong>Gas</strong> transportation revenue 1,114.6 *<br />

Group Increase/(Decrease)<br />

2010<br />

RM million RM million %<br />

Throughput services income 2,724.0 2,475.0 249.0 10.1<br />

Sale of industrial utilities 801.0 746.8 54.2 7.3<br />

Revenue 3,525.0 3,221.8 303.2 9.4<br />

Cost of gas processing (738.9) *<br />

Cost of gas transportation (366.5) *<br />

Cost of throughput service (1,105.4) (1,449.5) (344.1) (23.7)<br />

Cost of industrial utilities (632.4) (594.0) 38.4 6.5<br />

Cost of revenue (1,737.8) (2,043.5) (305.7) (15.0)<br />

Gross profi t 1,787.2 1,178.3 608.9 51.7<br />

Administration expenses (93.5) (79.1) 14.4 18.2<br />

Other income and expenses 164.8 112.6 52.2 46.4<br />

Operating profi t 1,858.5 1,211.8 646.7 53.4<br />

Financing costs (20.1) (20.2) (0.1) (0.5)<br />

Share of profi t after tax of equity<br />

accounted associate and jointly<br />

controlled entity<br />

61.9 52.2 9.7 18.6<br />

Profi t before tax 1,900.3 1,243.8 656.5 52.8<br />

Taxation (461.2) (303.1) 158.1 52.2<br />

Profi t after tax 1,439.1 940.7 498.4 53.0<br />

Earnings per share (sen) 72.7 47.6 25.1 52.7<br />

Profi t before tax / Revenue margin 53.9% 38.6%<br />

Profi t after tax / Revenue margin 40.8% 29.2%<br />

* Prior to 1 April 2010, the Company’s remuneration under the GPTA was classifi ed as throughput services<br />

with no separation between gas processing and gas transportation remuneration.<br />

Cost of revenUe<br />

Cost of revenue for the Group decreased by 15.0% (RM305.7 million) from RM2,043.5 million<br />

to RM1,737.8 million. This was due to lower operating cost incurred for throughput services by<br />

23.7% (RM344.1 million) which was mainly attributable to lower Internal <strong>Gas</strong> Consumption<br />

(IGC) as IGC is provided for by <strong>PETRONAS</strong> within the Agreed Operating Parameters (AOP)<br />

under the 4th Term GPTA. However, operating cost for utilities business increased by 6.5%<br />

(RM38.4 million) mainly due to higher fuel gas consumption in line with higher steam and<br />

electricity production.<br />

67 annual report 2011<br />

During the year, the Group continued its cost<br />

containment efforts, particularly in optimisation<br />

of human resource cost, reduction in energy<br />

consumption through operational effi ciency<br />

and optimisation of material and supplies cost<br />

through change in operational strategy.<br />

The Group embarked on Inventory Value<br />

Optimisation initiative to determine the<br />

Group’s optimum inventory level and reduce<br />

stock holding cost. Under this initiative,<br />

obsolete and non-moving inventories were<br />

identifi ed and written off during the year.<br />

The Group will continuously monitor its stock<br />

holding thus ensuring optimum inventory level<br />

moving forward. In addition, the Group made<br />

a provision for impairment of certain property,<br />

plant and equipment during the year.<br />

Gross Profit<br />

Gross profi t for the Group in the year under<br />

review showed a signifi cant increase of<br />

RM608.9 million or 51.7% from RM1,178.3<br />

million to RM1,787.2 million. Gross profi t<br />

for throughput services increased by 57.8%<br />

(RM593.1 million) from RM1,025.5 million<br />

to RM1,618.6 million mainly due to higher<br />

income from PBS and lower IGC for gas<br />

processing. Similarly, gross profi t for the<br />

utilities business increased by 10.3% (RM15.8<br />

million) from RM152.8 million to RM168.6<br />

million mainly due to higher revenue from<br />

steam and electricity negated by higher fuel<br />

gas cost in line with higher production.<br />

other inCome And eXPenses<br />

Other income and expenses for the Group<br />

was higher by 46.4% (RM52.2 million). This<br />

was mainly due to higher investment income<br />

by RM31.2 million as a result of higher cash<br />

and fund investment balance, coupled with<br />

incentive payment of RM18.8 million from<br />

<strong>PETRONAS</strong> for efficient usage of IGC.