- Page 2 and 3:

Serviceeftersynet af vilka rene for

- Page 4 and 5:

3.1.4 Åben dør-området .........

- Page 6 and 7:

1 Indledning og sammenfatning 1.1 I

- Page 8 and 9:

Kontorchef Søren Gaard, Erhvervs-

- Page 10 and 11:

som selskaberne har indrettet sig e

- Page 12 and 13:

der skal deles mellem stat og retti

- Page 14 and 15:

Investeringsprojekterne i Nordsøen

- Page 16 and 17:

1.2.3 Nordsøproduktionen og staten

- Page 18 and 19:

2 pct. og 6 pct. Samme udvikling i

- Page 20 and 21:

Figur 1.5. Statens andel af det ska

- Page 22 and 23:

Danmark er endvidere, set i forhold

- Page 24 and 25:

felter eller i marginen af eksister

- Page 26 and 27:

Forskellen mellem statens andel fø

- Page 28 and 29:

form af, at indkomsten vil blive s

- Page 30 and 31:

Inddragelse under kulbrintebeskatni

- Page 32 and 33:

2 Udvikling i vilkårene for kulbri

- Page 34 and 35:

Statsdeltagelse. Fra 1. januar 2004

- Page 36 and 37:

Med indførelsen af det nye regels

- Page 38 and 39:

2.3 Ændringer i kulbrinteskattelov

- Page 40 and 41:

Fremadrettet forventes der endnu en

- Page 42 and 43:

Tabel 2.1. Provenu fra olie- og gas

- Page 44 and 45:

Figur 2.5. Statens andel af det ska

- Page 46 and 47:

3 Beskrivelse af gældende rammevil

- Page 48 and 49:

Tilladelser til efterforskning og i

- Page 50 and 51:

dergrunden i det ansøgte område.

- Page 52 and 53:

edre seismiske undersøgelsesmetode

- Page 54 and 55:

Figur 3.4. Udviklingen i antal till

- Page 56 and 57:

3.1.7 Vilkår for kommende udbudsru

- Page 58 and 59:

De enkelte elementer beskrives i de

- Page 60 and 61:

3.2.1.4 Afskrivning Udgifter til an

- Page 62 and 63:

Hvis udledningsvirksomheder ikke fo

- Page 64 and 65:

Nedsættelsen gælder både i relat

- Page 66 and 67:

3.2.1.9.2 Nye regler Satsen, som se

- Page 68 and 69:

Erfaringerne fra udviklingen i den

- Page 70 and 71:

3.3.3 Behov for teknologiforbedring

- Page 72 and 73:

I Norge og Storbritannien er der fo

- Page 74 and 75:

4.3.2 Norge Der betales 28 pct. i s

- Page 76 and 77:

Wood Mackenzie har foretaget en sam

- Page 78 and 79:

For bedre at kunne sammenligne hvor

- Page 80 and 81:

Selskabernes betaling til staten i

- Page 82 and 83:

Figur 5.1. Afkastgrad før skat ved

- Page 84 and 85:

Det højere afkast i Danmark kan fo

- Page 86 and 87:

ske muligheder, der er til rådighe

- Page 88 and 89:

udsætninger er feltet imidlertid r

- Page 90 and 91:

I beregningerne i denne rapport fas

- Page 92 and 93:

Figur 5.3. Privatøkonomisk optimal

- Page 94 and 95:

Figur 5.5. Optimalt investeringsomf

- Page 96 and 97:

Effekten af en rentestigning er min

- Page 98 and 99:

5.2.5 Reduktion af forvridningstabe

- Page 100 and 101:

5.3.1 Statsdeltagelse som alternati

- Page 102 and 103:

Samfundsøkonomisk kan det derfor g

- Page 104 and 105:

Figur 5.6. Omkostningssammenligning

- Page 106 and 107:

6 Optioner for ændring af rammevil

- Page 108 and 109:

Ved valg af overgangsregler er det

- Page 110 and 111:

For ikke både at give selskaberne

- Page 112 and 113:

6.1.1.4 Provenumæssige konsekvense

- Page 114 and 115:

udnytte fremførte underskud, hvorv

- Page 116 and 117:

Kompensationen kan således - uanse

- Page 118 and 119:

Boks 6.1. Beregning af kontantværd

- Page 120 and 121:

Tabel 6.4. Afvigelse fra de sande o

- Page 122 and 123:

Fik selskabet derimod udbetalt skat

- Page 124 and 125:

Det har med det eksisterende omkost

- Page 126 and 127:

indvinding af kulbrinter - som udga

- Page 128 and 129:

6.3.4 Indkomst fra behandling og tr

- Page 130 and 131:

Merprovenuet opstår i det omfang,

- Page 132 and 133:

Udvalget vedrørende Eftersyn af Vi

- Page 134 and 135:

Beskatning af ressourcerne i Nords

- Page 136 and 137:

Ressourcerente og beskatning princi

- Page 138 and 139:

• Impl.: Selskabsskat på hele SI

- Page 140 and 141:

• Formue (RR): Ca. 50 % af BNP

- Page 142 and 143:

• Er nuværende system “tæt p

- Page 144 and 145:

Effektiv skat af ressourcerenten Pc

- Page 146 and 147:

• Norsk vs. dansk beskatning. Nor

- Page 148 and 149:

Konklusioner (2) • Beskatningsgru

- Page 150 and 151:

Noen hovedpunkter med relevans for

- Page 152 and 153:

Lisenstildeling og konkurranse, for

- Page 154 and 155:

Statsdeltakelse og skatt • Rimeli

- Page 156 and 157:

Tilnærmet nøytralt skattesystem;

- Page 158 and 159:

Figuren viser en liten vekst i anta

- Page 160 and 161:

Oljeprisen har økt 2003-2008, noe

- Page 162 and 163:

Gjenværende utfordringer • Norsk

- Page 164 and 165:

noen kompensasjon hvis det skjer ne

- Page 166 and 167:

Hvis skattesystemet er nøytralt me

- Page 168 and 169:

7. Skatt: Fortsatt problemer og van

- Page 170 and 171:

Referanser Aarsnes, Frian, og Pette

- Page 172 and 173:

DANISH OPERATORS Grundvilkår for o

- Page 174 and 175:

DANISH OPERATORS Produktionen er fo

- Page 176 and 177:

DANISH OPERATORS Om rammevilkår...

- Page 178 and 179:

Disposition… Værdikæden Beskæf

- Page 180 and 181:

En fuldtidsansat i et olie og gasse

- Page 184 and 185:

Danish Offshore Industry

- Page 186 and 187:

Aftaleretlige muligheder for at for

- Page 188 and 189:

Opdraget • Som i overskriften •

- Page 190 and 191:

Modifikationer • ”lov og ærbar

- Page 192 and 193:

Aftalens indhold i øvrigt • Til

- Page 194 and 195:

Forudsætningslæren Hvis en foruds

- Page 196 and 197:

Forudsætningssvigt? • Indebærer

- Page 198 and 199:

Bestemmelsens baggrund • Forbruge

- Page 200 and 201:

Eksempel: Ula-sagen Nordiske Domme

- Page 202 and 203:

Om hardship og genforhandling Kende

- Page 204 and 205:

Konklusion • Svært at få øje p

- Page 206 and 207:

egeringen ikke ville have indgået

- Page 208 and 209:

Konsekvensen af at antage, at betal

- Page 210 and 211:

I forudsætningslærens tre betinge

- Page 212 and 213:

. Principielle betænkeligheder Sku

- Page 214 and 215:

enhed. Feltet viste sig at producer

- Page 216 and 217:

vinding - beskæftiger sig med muli

- Page 218 and 219:

næppe i overensstemmelse med gæld

- Page 249: Kammeradvokaten 28. FEBR AR 2013 En

- Page 260 and 261: Udvalget for Serviceeftersyn af vil

- Page 262 and 263: Fiscal Comparison/Exploration Attra

- Page 264 and 265: Fiscal Comparison/Exploration Attra

- Page 266 and 267: Fiscal Comparison/Exploration Attra

- Page 268 and 269: Fiscal Comparison/Exploration Attra

- Page 270 and 271: Fiscal Comparison/Exploration Attra

- Page 272 and 273: Fiscal Comparison/Exploration Attra

- Page 274 and 275: Fiscal Comparison/Exploration Attra

- Page 276 and 277: Fiscal Comparison/Exploration Attra

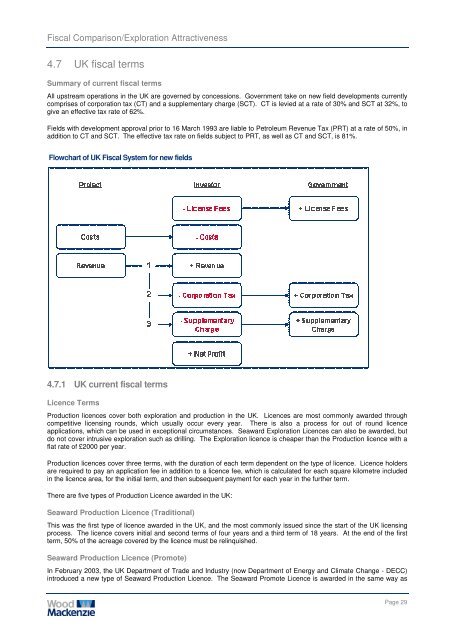

- Page 278 and 279: Fiscal Comparison/Exploration Attra

- Page 280 and 281: Fiscal Comparison/Exploration Attra

- Page 282 and 283: Fiscal Comparison/Exploration Attra

- Page 284 and 285: Fiscal Comparison/Exploration Attra

- Page 286 and 287: Fiscal Comparison/Exploration Attra

- Page 290 and 291: Fiscal Comparison/Exploration Attra

- Page 292 and 293: Fiscal Comparison/Exploration Attra

- Page 294 and 295: Fiscal Comparison/Exploration Attra

- Page 296 and 297: Fiscal Comparison/Exploration Attra

- Page 298 and 299: Fiscal Comparison/Exploration Attra

- Page 300 and 301: Fiscal Comparison/Exploration Attra

- Page 302 and 303: Fiscal Comparison/Exploration Attra

- Page 304 and 305: Fiscal Comparison/Exploration Attra

- Page 306 and 307: Fiscal Comparison/Exploration Attra

- Page 308 and 309: Fiscal Comparison/Exploration Attra

- Page 310 and 311: Fiscal Comparison/Exploration Attra

- Page 312 and 313: Fiscal Comparison/Exploration Attra

- Page 314 and 315: Fiscal Comparison/Exploration Attra

- Page 316 and 317: Fiscal Comparison/Exploration Attra

- Page 318 and 319: Fiscal Comparison/Exploration Attra

- Page 320 and 321: Fiscal Comparison/Exploration Attra

- Page 322 and 323: Fiscal Comparison/Exploration Attra

- Page 324 and 325: Fiscal Comparison/Exploration Attra

- Page 326 and 327: Fiscal Comparison/Exploration Attra

- Page 328 and 329: Fiscal Comparison/Exploration Attra

- Page 330 and 331: Fiscal Comparison/Exploration Attra

- Page 332 and 333: Fiscal Comparison/Exploration Attra

- Page 334 and 335: Ressourceopgørelsen anvendes som g

- Page 336 and 337: vanskeligt at forudse, hvilke nye t

- Page 338 and 339:

1.2 Ressourcer opdelt på de 3 omr

- Page 340 and 341:

For perioden 2004-2011 udgør gaspr

- Page 342 and 343:

Figur 1.9. Faktisk olieproduktion 2

- Page 344 and 345:

Figur 1.11. Faktisk gasproduktion 2

- Page 346 and 347:

Bilag 5: Oversigt over de ved udgan

- Page 348 and 349:

Tilladelse 4/98 Selskab Andel (%) O

- Page 350 and 351:

Tilladelse 12/06 Selskab Andel (%)