An Economic and Spatial Plan for Limerick Appendices

An Economic and Spatial Plan for Limerick Appendices

An Economic and Spatial Plan for Limerick Appendices

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Limerick</strong> 2030 <strong>An</strong> <strong>Economic</strong> <strong>and</strong> <strong>Spatial</strong> <strong>Plan</strong> <strong>for</strong> <strong>Limerick</strong><br />

The table above highlights the increasing importance of the private rented sector in the <strong>Limerick</strong><br />

Housing Market. It is important that investors are not dissuaded from entering this market, given its<br />

relative strength, which is expected to continue into the short-term. Reports suggest, however, that<br />

sentiment is at an all time low in terms of local investors, with one agent reporting that an investor<br />

returned the keys to 17 no. properties in the same estate due to increasing costs (including taxes).<br />

Vacancy rates have increased over the past ten years but have stabilised in the more recent past.<br />

This is likely to be attributable to the reported lack of development activity since 2009.<br />

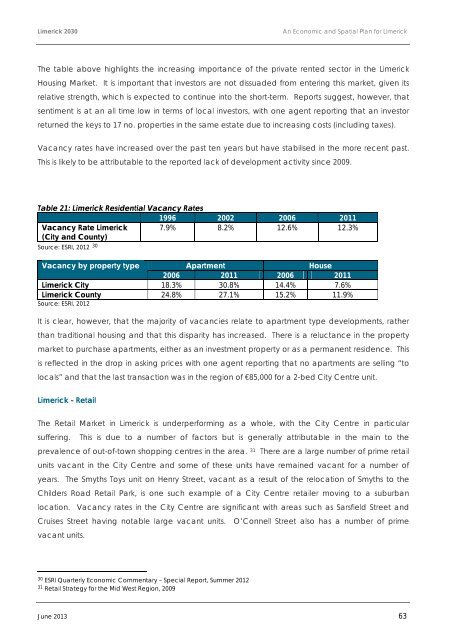

Table 21: <strong>Limerick</strong> Residential Vacancy Rates<br />

1996 2002 2006 2011<br />

Vacancy Rate <strong>Limerick</strong><br />

(City <strong>and</strong> County)<br />

7.9% 8.2% 12.6% 12.3%<br />

Source: ESRI, 2012 30<br />

Vacancy by property type<br />

Apartment House<br />

2006 2011 2006 2011<br />

<strong>Limerick</strong> City 18.3% 30.8% 14.4% 7.6%<br />

<strong>Limerick</strong> County<br />

Source: ESRI, 2012<br />

24.8% 27.1% 15.2% 11.9%<br />

It is clear, however, that the majority of vacancies relate to apartment type developments, rather<br />

than traditional housing <strong>and</strong> that this disparity has increased. There is a reluctance in the property<br />

market to purchase apartments, either as an investment property or as a permanent residence. This<br />

is reflected in the drop in asking prices with one agent reporting that no apartments are selling “to<br />

locals” <strong>and</strong> that the last transaction was in the region of €85,000 <strong>for</strong> a 2-bed City Centre unit.<br />

<strong>Limerick</strong> - Retail<br />

The Retail Market in <strong>Limerick</strong> is underper<strong>for</strong>ming as a whole, with the City Centre in particular<br />

suffering. This is due to a number of factors but is generally attributable in the main to the<br />

prevalence of out-of-town shopping centres in the area. 31 There are a large number of prime retail<br />

units vacant in the City Centre <strong>and</strong> some of these units have remained vacant <strong>for</strong> a number of<br />

years. The Smyths Toys unit on Henry Street, vacant as a result of the relocation of Smyths to the<br />

Childers Road Retail Park, is one such example of a City Centre retailer moving to a suburban<br />

location. Vacancy rates in the City Centre are significant with areas such as Sarsfield Street <strong>and</strong><br />

Cruises Street having notable large vacant units. O’Connell Street also has a number of prime<br />

vacant units.<br />

30 ESRI Quarterly <strong>Economic</strong> Commentary – Special Report, Summer 2012<br />

31 Retail Strategy <strong>for</strong> the Mid West Region, 2009<br />

June 2013 63