Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

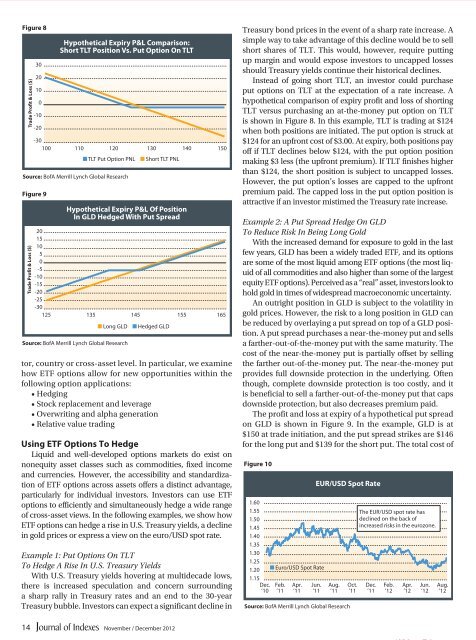

Figure 8<br />

Trade Proft & Loss ($)<br />

Source: BofA Merrill Lynch Global Research<br />

Figure 9<br />

Trade Proft & Loss ($)<br />

30<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

Hypothetical Expiry P&L Comparison:<br />

Short TLT Position Vs. Put Option On TLT<br />

-30<br />

100 110 120 130 140 150<br />

Source: BofA Merrill Lynch Global Research<br />

■ TLT Put Option PNL ■ Short TLT PNL<br />

Hypothetical Expiry P&L Of Position<br />

In GLD Hedged With Put Spread<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

-10<br />

-15<br />

-20<br />

-25<br />

-30<br />

125 135 145 155 165<br />

■ Long GLD<br />

■ Hedged GLD<br />

tor, country or cross-asset level. In particular, we examine<br />

how ETF options allow for new opportunities within the<br />

following option applications:<br />

• Hedging<br />

• Stock replacement and leverage<br />

• Overwriting and alpha generation<br />

• Relative value trading<br />

Using ETF Options To Hedge<br />

Liquid and well-developed options markets do exist on<br />

nonequity asset classes such as <strong>com</strong>modities, fixed in<strong>com</strong>e<br />

and currencies. However, the accessibility and standardization<br />

of ETF options across assets offers a distinct advantage,<br />

particularly for individual investors. Investors can use ETF<br />

options to efficiently and simultaneously hedge a wide range<br />

of cross-asset views. In the following examples, we show how<br />

ETF options can hedge a rise in U.S. Treasury yields, a decline<br />

in gold prices or express a view on the euro/USD spot rate.<br />

Example 1: Put Options On TLT<br />

To Hedge A Rise In U.S. Treasury Yields<br />

With U.S. Treasury yields hovering at multidecade lows,<br />

there is increased speculation and concern surrounding<br />

a sharp rally in Treasury rates and an end to the 30-year<br />

Treasury bubble. Investors can expect a significant decline in<br />

Treasury bond prices in the event of a sharp rate increase. A<br />

simple way to take advantage of this decline would be to sell<br />

short shares of TLT. This would, however, require putting<br />

up margin and would expose investors to uncapped losses<br />

should Treasury yields continue their historical declines.<br />

Instead of going short TLT, an investor could purchase<br />

put options on TLT at the expectation of a rate increase. A<br />

hypothetical <strong>com</strong>parison of expiry profit and loss of shorting<br />

TLT versus purchasing an at-the-money put option on TLT<br />

is shown in Figure 8. In this example, TLT is trading at $124<br />

when both positions are initiated. The put option is struck at<br />

$124 for an upfront cost of $3.00. At expiry, both positions pay<br />

off if TLT declines below $124, with the put option position<br />

making $3 less (the upfront premium). If TLT finishes higher<br />

than $124, the short position is subject to uncapped losses.<br />

However, the put option’s losses are capped to the upfront<br />

premium paid. The capped loss in the put option position is<br />

attractive if an investor mistimed the Treasury rate increase.<br />

Example 2: A Put Spread Hedge On GLD<br />

To Reduce Risk In Being Long Gold<br />

With the increased demand for exposure to gold in the last<br />

few years, GLD has been a widely traded ETF, and its options<br />

are some of the most liquid among ETF options (the most liquid<br />

of all <strong>com</strong>modities and also higher than some of the largest<br />

equity ETF options). Perceived as a “real” asset, investors look to<br />

hold gold in times of widespread macroeconomic uncertainty.<br />

An outright position in GLD is subject to the volatility in<br />

gold prices. However, the risk to a long position in GLD can<br />

be reduced by overlaying a put spread on top of a GLD position.<br />

A put spread purchases a near-the-money put and sells<br />

a farther-out-of-the-money put with the same maturity. The<br />

cost of the near-the-money put is partially offset by selling<br />

the farther out-of-the-money put. The near-the-money put<br />

provides full downside protection in the underlying. Often<br />

though, <strong><strong>com</strong>plete</strong> downside protection is too costly, and it<br />

is beneficial to sell a farther-out-of-the-money put that caps<br />

downside protection, but also decreases premium paid.<br />

The profit and loss at expiry of a hypothetical put spread<br />

on GLD is shown in Figure 9. In the example, GLD is at<br />

$150 at trade initiation, and the put spread strikes are $146<br />

for the long put and $139 for the short put. The total cost of<br />

Figure 10<br />

1.60<br />

1.55<br />

1.50<br />

1.45<br />

1.40<br />

1.35<br />

1.30<br />

1.25<br />

1.20<br />

1.15<br />

Dec.<br />

’10<br />

■ Euro/USD Spot Rate<br />

Feb.<br />

’11<br />

Apr.<br />

’11<br />

EUR/USD Spot Rate<br />

Jun.<br />

’11<br />

Aug.<br />

’11<br />

Source: BofA Merrill Lynch Global Research<br />

Oct.<br />

’11<br />

The EUR/USD spot rate has<br />

declined on the back of<br />

increased risks in the eurozone.<br />

Dec.<br />

’11<br />

Feb.<br />

’12<br />

Apr.<br />

’12<br />

Jun.<br />

’12<br />

Aug.<br />

’12<br />

14<br />

November / December 2012