Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Figure 3<br />

Net New Cash Flow For Mutual Funds<br />

$119 Billion Net New Cash Flow For Bond Mutual Funds In 2011<br />

$500<br />

$400<br />

$300<br />

$200<br />

$100<br />

$0<br />

-$100<br />

-$200<br />

-$300<br />

$109 $96<br />

-$238<br />

2007 2008 2009 2010 2011<br />

Net New Cash Flow For Bond And Equity Mutual Funds In $Billions<br />

Sources: ICI and SIFMA<br />

Figure 4<br />

1<br />

0.5<br />

0<br />

-0.5<br />

-1<br />

1/71<br />

$33<br />

■ Bond Mutual Funds<br />

$375<br />

$245<br />

-$11 -$24<br />

■ Equity Mutual Funds<br />

Rolling One-Year Correlations<br />

Of Weekly Returns To The S&P 500 Index<br />

Sources: Bloomberg and CBOE<br />

■ Russell 2000 ■ MSCI EAFE ■ S&P GSCI ■ VIX<br />

(Jan. 8, 1971 – Aug. 3, 2012)<br />

$119<br />

-$128<br />

1/81 1/91 1/01 1/11<br />

0.96<br />

0.88<br />

0.69<br />

-0.84<br />

as it collected S&P 500 index options premiums every<br />

month (see Figure 2).<br />

The sluggish stock market performance has been a key<br />

factor in the increased disillusionment of many investors<br />

toward equity investing. One clear sign of equity disenchantment<br />

has been the net new cash flows for different types of<br />

mutual funds. As shown in Figure 3, the net new cash flow<br />

for each of the past four years (2008-2011) has been negative<br />

for equity mutual funds and positive for bond mutual funds.<br />

Challenge No. 3: Higher Correlations<br />

Among Many Asset Classes<br />

Another challenge for investors in recent years is the<br />

fact that there have been higher correlations of returns<br />

among many asset classes, and this fact can make it more<br />

difficult to construct a portfolio that is well-diversified. The<br />

U.S. pension law known as ERISA requires fiduciaries to<br />

diversify “the investments of the plan so as to minimize<br />

the risk of large losses, unless under the circumstances it is<br />

clearly prudent not to do so.” 3<br />

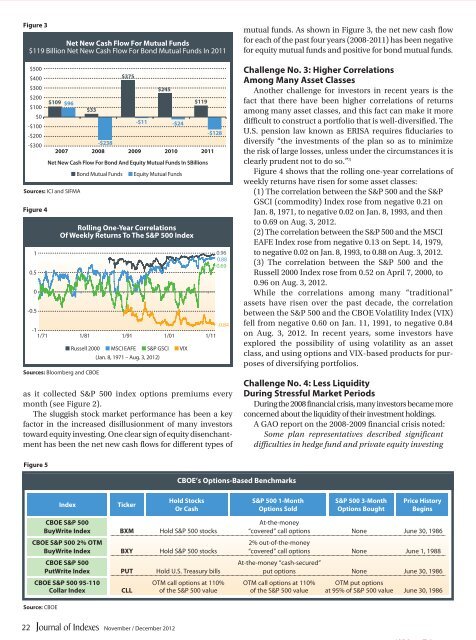

Figure 4 shows that the rolling one-year correlations of<br />

weekly returns have risen for some asset classes:<br />

(1) The correlation between the S&P 500 and the S&P<br />

GSCI (<strong>com</strong>modity) Index rose from negative 0.21 on<br />

Jan. 8, 1971, to negative 0.02 on Jan. 8, 1993, and then<br />

to 0.69 on Aug. 3, 2012.<br />

(2) The correlation between the S&P 500 and the MSCI<br />

EAFE Index rose from negative 0.13 on Sept. 14, 1979,<br />

to negative 0.02 on Jan. 8, 1993, to 0.88 on Aug. 3, 2012.<br />

(3) The correlation between the S&P 500 and the<br />

Russell 2000 Index rose from 0.52 on April 7, 2000, to<br />

0.96 on Aug. 3, 2012.<br />

While the correlations among many “traditional”<br />

assets have risen over the past decade, the correlation<br />

between the S&P 500 and the CBOE Volatility Index (VIX)<br />

fell from negative 0.60 on Jan. 11, 1991, to negative 0.84<br />

on Aug. 3, 2012. In recent years, some investors have<br />

explored the possibility of using volatility as an asset<br />

class, and using options and VIX-based products for purposes<br />

of diversifying portfolios.<br />

Challenge No. 4: Less Liquidity<br />

During Stressful Market Periods<br />

During the 2008 financial crisis, many investors became more<br />

concerned about the liquidity of their investment holdings.<br />

A GAO report on the 2008-2009 financial crisis noted:<br />

Some plan representatives described significant<br />

difficulties in hedge fund and private equity investing<br />

Figure 5<br />

CBOE’s Options-Based Benchmarks<br />

Index<br />

Ticker<br />

Hold Stocks<br />

Or Cash<br />

S&P 500 1-Month<br />

Options Sold<br />

S&P 500 3-Month<br />

Options Bought<br />

Price History<br />

Begins<br />

CBOE S&P 500<br />

At-the-money<br />

BuyWrite Index BXM Hold S&P 500 stocks “covered” call options None June 30, 1986<br />

CBOE S&P 500 2% OTM<br />

2% out-of-the-money<br />

BuyWrite Index BXY Hold S&P 500 stocks “covered” call options None June 1, 1988<br />

CBOE S&P 500<br />

At-the-money “cash-secured”<br />

PutWrite Index PUT Hold U.S. Treasury bills put options None June 30, 1986<br />

CBOE S&P 500 95-110 OTM call options at 110% OTM call options at 110% OTM put options<br />

Collar Index CLL of the S&P 500 value of the S&P 500 value at 95% of S&P 500 value June 30, 1986<br />

Source: CBOE<br />

22<br />

November / December 2012