Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Figure 2<br />

Median Notional Volume ($B)<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

Source: BofA Merrill Lynch Global Research<br />

Note: Q3-12 data is as of Sept. 7, 2012.<br />

Figure 3<br />

4%<br />

Median Daily Notional Volume<br />

Per Quarter, Q1-99 To Q3-12 ($B)<br />

0<br />

Q1<br />

’99 ’99 Q4<br />

’00 Q3<br />

’01 Q2<br />

’02 Q1<br />

’02 Q4<br />

’03 Q3<br />

’04 Q2<br />

’05 Q1<br />

’05 Q4<br />

’06 Q3<br />

’07 Q2<br />

’08 Q1<br />

’08 Q4<br />

’09 Q3<br />

’10 Q2<br />

’11 Q1<br />

’11 Q4<br />

’12<br />

Q3<br />

■ SPY ■ IWM<br />

Source: BofA Merrill Lynch Global Research<br />

■ QQQ ■ GLD ■ Other<br />

ETF Option Notional Traded Per Day By Asset Class,<br />

Excluding Top Four Traded ETF Options<br />

Outside the top four traded ETF options, there is currently close to $6B options<br />

notional traded per day in the remainder of liquid ETF options with oferings<br />

across four asset classes.<br />

10%<br />

11%<br />

75%<br />

■ Equity $4.416M<br />

■ Debt $671M<br />

■ Commodity $620M<br />

■ Currency $208M<br />

Excluded:<br />

SPY $26,296M<br />

IWM $3,392M<br />

GLD $2,433M<br />

QQQ $2,235M<br />

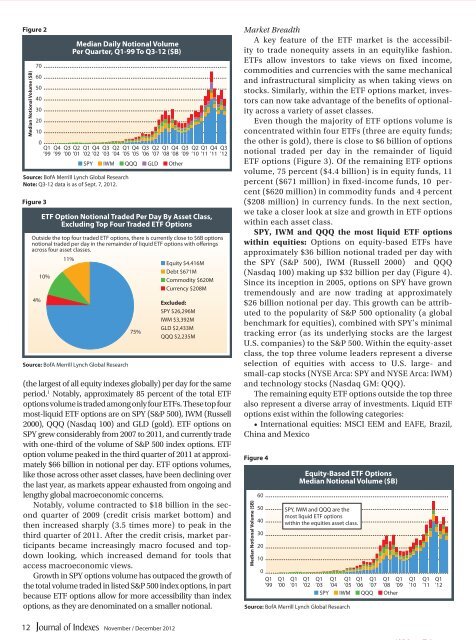

(the largest of all equity indexes globally) per day for the same<br />

period. 1 Notably, approximately 85 percent of the total ETF<br />

options volume is traded among only four ETFs. These top four<br />

most-liquid ETF options are on SPY (S&P 500), IWM (Russell<br />

2000), QQQ (Nasdaq 100) and GLD (gold). ETF options on<br />

SPY grew considerably from 2007 to 2011, and currently trade<br />

with one-third of the volume of S&P 500 index options. ETF<br />

option volume peaked in the third quarter of 2011 at approximately<br />

$66 billion in notional per day. ETF options volumes,<br />

like those across other asset classes, have been declining over<br />

the last year, as markets appear exhausted from ongoing and<br />

lengthy global macroeconomic concerns.<br />

Notably, volume contracted to $18 billion in the second<br />

quarter of 2009 (credit crisis market bottom) and<br />

then increased sharply (3.5 times more) to peak in the<br />

third quarter of 2011. After the credit crisis, market participants<br />

became increasingly macro focused and topdown<br />

looking, which increased demand for tools that<br />

access macroeconomic views.<br />

Growth in SPY options volume has outpaced the growth of<br />

the total volume traded in listed S&P 500 index options, in part<br />

because ETF options allow for more accessibility than index<br />

options, as they are denominated on a smaller notional.<br />

Market Breadth<br />

A key feature of the ETF market is the accessibility<br />

to trade nonequity assets in an equitylike fashion.<br />

ETFs allow investors to take views on fixed in<strong>com</strong>e,<br />

<strong>com</strong>modities and currencies with the same mechanical<br />

and infrastructural simplicity as when taking views on<br />

stocks. Similarly, within the ETF options market, investors<br />

can now take advantage of the benefits of optionality<br />

across a variety of asset classes.<br />

Even though the majority of ETF options volume is<br />

concentrated within four ETFs (three are equity funds;<br />

the other is gold), there is close to $6 billion of options<br />

notional traded per day in the remainder of liquid<br />

ETF options (Figure 3). Of the remaining ETF options<br />

volume, 75 percent ($4.4 billion) is in equity funds, 11<br />

percent ($671 million) in fixed-in<strong>com</strong>e funds, 10 percent<br />

($620 million) in <strong>com</strong>modity funds and 4 percent<br />

($208 million) in currency funds. In the next section,<br />

we take a closer look at size and growth in ETF options<br />

within each asset class.<br />

SPY, IWM and QQQ the most liquid ETF options<br />

within equities: Options on equity-based ETFs have<br />

approximately $36 billion notional traded per day with<br />

the SPY (S&P 500), IWM (Russell 2000) and QQQ<br />

(Nasdaq 100) making up $32 billion per day (Figure 4).<br />

Since its inception in 2005, options on SPY have grown<br />

tremendously and are now trading at approximately<br />

$26 billion notional per day. This growth can be attributed<br />

to the popularity of S&P 500 optionality (a global<br />

benchmark for equities), <strong>com</strong>bined with SPY’s minimal<br />

tracking error (as its underlying stocks are the largest<br />

U.S. <strong>com</strong>panies) to the S&P 500. Within the equity-asset<br />

class, the top three volume leaders represent a diverse<br />

selection of equities with access to U.S. large- and<br />

small-cap stocks (NYSE Arca: SPY and NYSE Arca: IWM)<br />

and technology stocks (Nasdaq GM: QQQ).<br />

The remaining equity ETF options outside the top three<br />

also represent a diverse array of investments. Liquid ETF<br />

options exist within the following categories:<br />

• International equities: MSCI EEM and EAFE, Brazil,<br />

China and Mexico<br />

Figure 4<br />

Median Notional Volume ($B)<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Q1<br />

’99<br />

Q1<br />

’00<br />

Q1<br />

’01<br />

Equity-Based ETF Options<br />

Median Notional Volume ($B)<br />

SPY, IWM and QQQ are the<br />

most liquid ETF options<br />

within the equities asset class.<br />

Q1<br />

’02<br />

Source: BofA Merrill Lynch Global Research<br />

Q1<br />

’03<br />

Q1<br />

’04<br />

Q1<br />

’05<br />

Q1<br />

’06<br />

Q1<br />

’07<br />

Q1<br />

’08<br />

Q1<br />

’09<br />

■ SPY ■ IWM ■ QQQ ■ Other<br />

Q1<br />

’10<br />

Q1<br />

’11<br />

Q1<br />

’12<br />

12<br />

November / December 2012