Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

This concept is especially important when using<br />

options to hedge a position. Consider an existing position<br />

of 100 shares of SPY. The inexperienced investor<br />

seeking to fully hedge his position would purchase one<br />

ATM put and rest easy, until the anticipated downward<br />

move occurs and he is left pondering the source of his<br />

newly minted losses. It is only through hedging the<br />

portfolio on a delta basis (delta-hedging) that it will be<br />

fully protected.<br />

These positions are examples of debit strategies, or<br />

strategies that leave investors’ accounts with debits as<br />

they are paying for access to these positions. Credit<br />

strategies are those trades that produce a net credit in<br />

investors’ accounts as they involve the writing, or selling,<br />

of option contracts.<br />

Writing or selling options has been a strategy that is<br />

be<strong>com</strong>ing increasingly popular with investors as a way<br />

to enhance returns on their existing positions. However,<br />

writing options obligates the writer to deliver or take<br />

receipt of underlying shares if the contract is exercised or<br />

assigned. If options are written against existing positions<br />

(covered either by shares or cash), then the investor may<br />

be forced to either deliver his position against the open<br />

written call or receive (purchase from the holder of the<br />

put contract) shares to close out the written put. If options<br />

are written without any collateral, they are said to be<br />

“naked.” Writing naked options can quickly lead to great<br />

financial success, as the writer could end up keeping the<br />

entire collected premium as the contracts written expire<br />

worthless, or to financial ruin as the writer could be on<br />

the hook for the difference between the underlying share<br />

price less the contract strike less collected premium.<br />

Theoretically, this obligation could be infinite.<br />

Consider the ATM September 140 SPY call. If an<br />

investor were convinced that SPY was destined to trade<br />

off sharply, he might consider selling this call. If he is<br />

correct, he realizes a gain of $293 at expiration for each<br />

contract sold. If he is incorrect, he must deliver 100<br />

shares of SPY at $140 per share regardless of the prevailing<br />

price. For example, if SPY is trading at $160 at any<br />

point prior to expiration, he would have to purchase<br />

shares in the open market at $160 and deliver (sell)<br />

them to the buyer of his contract for only $140. Multiply<br />

this scenario by 10 and you can see why the possibility<br />

of earning $2,930 is quickly outweighed by the possibility<br />

of having to source $160,000 and immediately lose<br />

$17,070 ($20,000-$2,930) on the transaction. This is<br />

why most brokerage houses permission their clients’<br />

options activity in tiers, with naked option writing being<br />

one of the highest-level activities allowed.<br />

An easy way to mitigate the risk of this lopsided trade<br />

is through a spread trade. Spread trades can take any<br />

number of forms, such as vertical spreads, horizontal<br />

(calendar) spreads, back spreads or ratio spreads, to<br />

name a few. We are going to consider the vertical spread<br />

trade; specifically, the vertical bear call spread and the<br />

vertical bull put spread.<br />

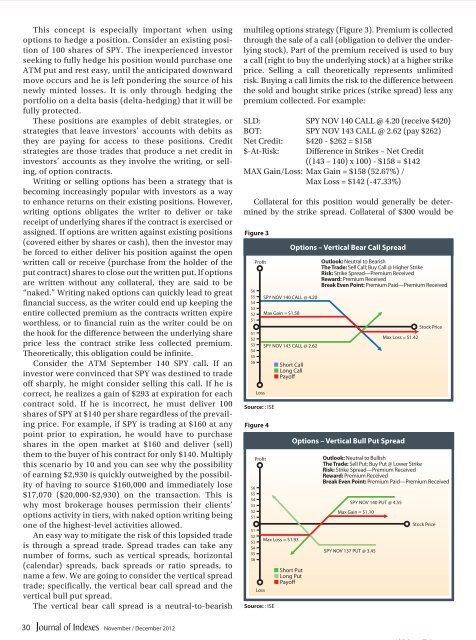

The vertical bear call spread is a neutral-to-bearish<br />

multileg options strategy (Figure 3). Premium is collected<br />

through the sale of a call (obligation to deliver the underlying<br />

stock). Part of the premium received is used to buy<br />

a call (right to buy the underlying stock) at a higher strike<br />

price. Selling a call theoretically represents unlimited<br />

risk. Buying a call limits the risk to the difference between<br />

the sold and bought strike prices (strike spread) less any<br />

premium collected. For example:<br />

SLD: SPY NOV 140 CALL @ 4.20 (receive $420)<br />

BOT: SPY NOV 143 CALL @ 2.62 (pay $262)<br />

Net Credit: $420 - $262 = $158<br />

$-At-Risk:<br />

Difference in Strikes – Net Credit<br />

((143 – 140) x 100) - $158 = $142<br />

MAX Gain/Loss: Max Gain = $158 (52.67%) /<br />

Max Loss = $142 (-47.33%)<br />

Collateral for this position would generally be determined<br />

by the strike spread. Collateral of $300 would be<br />

Figure 3<br />

$6<br />

$5<br />

$4<br />

$3<br />

$2<br />

$1<br />

$1<br />

$2<br />

$3<br />

$4<br />

$5<br />

$6<br />

Figure 4<br />

$6<br />

$5<br />

$4<br />

$3<br />

$2<br />

$1<br />

$1<br />

$2<br />

$3<br />

$4<br />

$5<br />

$6<br />

Proft<br />

-<br />

-<br />

Loss<br />

Source: : ISE<br />

Proft<br />

-<br />

-<br />

Loss<br />

Source: : ISE<br />

■ Short Call<br />

■ Long Call<br />

■ Payof<br />

Max Loss = $1.93<br />

■ Short Put<br />

■ Long Put<br />

■ Payof<br />

Options – Vertical Bear Call Spread<br />

SPY NOV 140 CALL @ 4.20<br />

Max Gain = $1.58<br />

SPY NOV 143 CALL @ 2.62<br />

Outlook: Neutral to Bearish<br />

The Trade: Sell Call; Buy Call @ Higher Strike<br />

Risk: Strike Spread—Premium Received<br />

Reward: Premium Received<br />

Break Even Point: Premium Paid—Premium Received<br />

Options – Vertical Bull Put Spread<br />

Outlook: Neutral to Bullish<br />

The Trade: Sell Put; Buy Put @ Lower Strike<br />

Risk: Strike Spread—Premium Received<br />

Reward: Premium Received<br />

Break Even Point: Premium Paid—Premium Received<br />

SPY NOV 137 PUT @ 3.45<br />

SPY NOV 140 PUT @ 4.55<br />

Max Gain = $1.10<br />

Max Loss = $1.42<br />

Stock Price<br />

Stock Price<br />

30<br />

November / December 2012