Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Relative Value Trading<br />

In lower-correlation environments, there is differentiation<br />

in performance across and within asset classes exists.<br />

Given the breadth of the ETF and ETF options market,<br />

investors can take a view on the spread between two<br />

assets—at the sector, country or cross-asset level.<br />

For example, using sector ETFs, investors can trade a<br />

single stock against a basket of its peers (same sector), thus<br />

allowing one to isolate the fundamentals of a particular<br />

<strong>com</strong>pany in a relative value trade. Or investors can trade<br />

the outperformance between two equity sectors. Likewise,<br />

with country-specific ETFs, investors can play an outperformance<br />

between regions. Even further, ETFs allow for<br />

views across assets to play the relative value between any<br />

Figure 15<br />

Hypothetical Expiry P&L<br />

Of Short Iron Condor Strategy On GLD<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

-2%<br />

-4%<br />

-6%<br />

-8%<br />

-10%<br />

-20% -15% -10% -5% 0% 5% 10% 15% 20%<br />

Source: BofA Merrill Lynch Global Research<br />

Figure 16<br />

Backtesting Results For Systematic 4-Week Iron Condors On Global Equity Indexes (From Jan. 1, 2002-Sept. 7, 2012)<br />

S&P 500 Iron Condor<br />

ESTX50 Iron Condor<br />

NKY Iron Condor<br />

Bloomberg Ticker<br />

MLBWSPAR Index<br />

MLFPEEAR Index<br />

MLEINKAR Index<br />

Annualized return since ‘02 3.8% 5.8% 6.0%<br />

Volatility since ‘02 8.3% 8.5% 8.0%<br />

Information ratio since ‘02 0.46 0.68 0.75<br />

Source: BofA Merrill Lynch Global Research<br />

Note: Backtesting is hypothetical in nature and reflects application of the trade strategy prior to its introduction.<br />

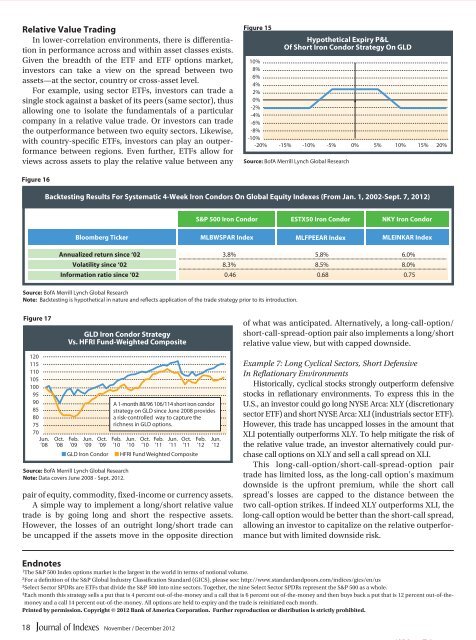

Figure 17<br />

120<br />

115<br />

110<br />

105<br />

100<br />

95<br />

90<br />

85<br />

80<br />

75<br />

70<br />

Jun.<br />

’08<br />

GLD Iron Condor Strategy<br />

Vs. HFRI Fund-Weighted Composite<br />

Oct. Feb. Jun. Oct. Feb. Jun. Oct. Feb. Jun. Oct. Feb.<br />

’08 ’09 ’09 ’09 ’10 ’10 ’10 ’11 ’11 ’11 ’12<br />

■ GLD Iron Condor<br />

Source: BofA Merrill Lynch Global Research<br />

Note: Data covers June 2008 - Sept. 2012.<br />

A 1-month 88/96 106/114 short iron condor<br />

strategy on GLD since June 2008 provides<br />

a risk-controlled way to capture the<br />

richness in GLD options.<br />

■ HFRI Fund Weighted Composite<br />

pair of equity, <strong>com</strong>modity, fixed-in<strong>com</strong>e or currency assets.<br />

A simple way to implement a long/short relative value<br />

trade is by going long and short the respective assets.<br />

However, the losses of an outright long/short trade can<br />

be uncapped if the assets move in the opposite direction<br />

Jun.<br />

’12<br />

of what was anticipated. Alternatively, a long-call-option/<br />

short-call-spread-option pair also implements a long/short<br />

relative value view, but with capped downside.<br />

Example 7: Long Cyclical Sectors, Short Defensive<br />

In Reflationary Environments<br />

Historically, cyclical stocks strongly outperform defensive<br />

stocks in reflationary environments. To express this in the<br />

U.S., an investor could go long NYSE Arca: XLY (discretionary<br />

sector ETF) and short NYSE Arca: XLI (industrials sector ETF).<br />

However, this trade has uncapped losses in the amount that<br />

XLI potentially outperforms XLY. To help mitigate the risk of<br />

the relative value trade, an investor alternatively could purchase<br />

call options on XLY and sell a call spread on XLI.<br />

This long-call-option/short-call-spread-option pair<br />

trade has limited loss, as the long-call option’s maximum<br />

downside is the upfront premium, while the short call<br />

spread’s losses are capped to the distance between the<br />

two call-option strikes. If indeed XLY outperforms XLI, the<br />

long-call option would be better than the short-call spread,<br />

allowing an investor to capitalize on the relative outperformance<br />

but with limited downside risk.<br />

Endnotes<br />

1 The S&P 500 Index options market is the largest in the world in terms of notional volume.<br />

2 For a definition of the S&P Global Industry Classification Standard (GICS), please see: http://www.standardandpoors.<strong>com</strong>/indices/gics/en/us<br />

3 Select Sector SPDRs are ETFs that divide the S&P 500 into nine sectors. Together, the nine Select Sector SPDRs represent the S&P 500 as a whole.<br />

4 Each month this strategy sells a put that is 4 percent out-of-the-money and a call that is 6 percent out of-the-money and then buys back a put that is 12 percent out-of-themoney<br />

and a call 14 percent out-of-the-money. All options are held to expiry and the trade is reinitiated each month.<br />

Printed by permission. Copyright © 2012 Bank of America Corporation. Further reproduction or distribution is strictly prohibited.<br />

18<br />

November / December 2012