Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

equired to establish this position and is the basis for all<br />

gain/loss calculations.<br />

The vertical bull put spread is a neutral-to-bullish<br />

multileg options strategy (Figure 4). Premium is collected<br />

through the sale of a put (obligation to receive the underlying<br />

stock). Part of the premium received is used to buy<br />

a put (right to sell the underlying stock) at a lower strike<br />

price. Selling a put theoretically represents risk equal to the<br />

contract strike price. Buying a put limits the risk to the difference<br />

between the sold and bought strike prices (strike<br />

spread) less any premium collected. For example:<br />

SLD: SPY NOV 140 PUT @ 4.55 (receive $455)<br />

BOT: SPY SEP 137 PUT @ 3.45 (pay $345)<br />

Net Credit: $455 - $345 = $110<br />

$-At-Risk:<br />

Difference in Strikes – Net Credit<br />

((140 – 137) x 100) - $110 = $190<br />

MAX Gain/Loss: Max Gain = $110 (36.67%) /<br />

Max Loss = $193 (-63.33%)<br />

Collateral for this position would generally be determined<br />

by the strike spread. Collateral of $300 would be required to<br />

establish this position and is the basis for all G/L calculations.<br />

Benchmarking Options Strategies<br />

The spreads described here are typical in that this<br />

trade is usually constructed to sell the ATM and use the<br />

proceeds to purchase insurance a certain percentage<br />

away from ATM. This is a classic, risk-controlled trade.<br />

ISE took the framework of this trade and blended it with<br />

modern portfolio theory to develop a truly diversified<br />

portfolio of vertical spread trades to help transform a<br />

trading vehicle into a potential investment vehicle.<br />

Spread pairs that are very close to or ATM are more<br />

likely to have the underlying stock trade through them<br />

and incur maximum losses (high delta/low gamma).<br />

Pairs that are further away from ATM are less attractive<br />

from a net credit perspective, but require larger moves<br />

of the underlying to put the position at risk (mid delta/<br />

mid gamma). Pairs that are quite far away from ATM<br />

exhibit higher levels of price volatility (low delta/high<br />

gamma) due to the low absolute-price levels at which<br />

they trade. Being positioned too close or too far away<br />

from ATM presents unique risks for each. We identified<br />

optimal spreads from each of these categories and <strong>com</strong>bine<br />

them into a single basket. In doing so, we created<br />

the ISE SPY Bear Options Overlay Index (VCS) and the<br />

ISE SPY Bull Options Overlay Index (VPS).<br />

The ISE Options Overlay indexes provide benchmarks<br />

for investors looking to track the performance of a<br />

diversified portfolio of exchange-listed options utilizing<br />

the vertical spread strategy. As indicated by the name,<br />

each index solely includes option contracts on the SPDR<br />

S&P 500 exchange-traded fund (NYSE Arca: SPY).<br />

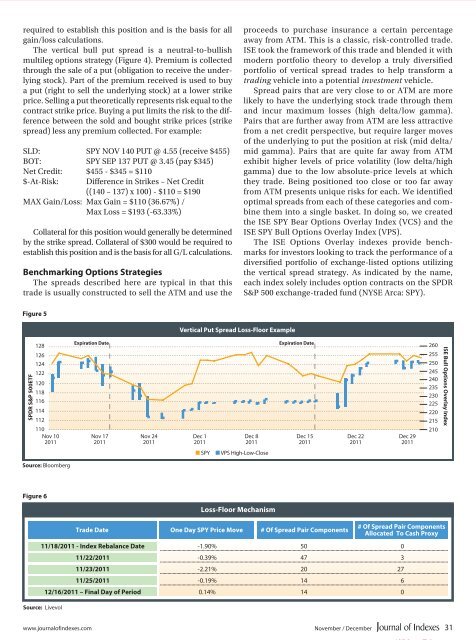

Figure 5<br />

Vertical Put Spread Loss-Floor Example<br />

SPDR S&P 500ETF<br />

128<br />

126<br />

124<br />

122<br />

120<br />

118<br />

116<br />

114<br />

112<br />

110<br />

Nov 10<br />

2011<br />

Expiration Date<br />

Nov 17<br />

2011<br />

Nov 24<br />

2011<br />

Dec 1<br />

2011<br />

Dec 8<br />

2011<br />

Expiration Date<br />

Dec 15<br />

2011<br />

Dec 22<br />

2011<br />

Dec 29<br />

2011<br />

260<br />

255<br />

250<br />

245<br />

240<br />

235<br />

230<br />

225<br />

220<br />

215<br />

210<br />

ISE Bull Options Overlay Index<br />

■ SPY<br />

■ VPS High-Low-Close<br />

Source: Bloomberg<br />

Figure 6<br />

Trading Trade Date<br />

Symbol<br />

One Day SPY Price Move<br />

# 3-Month Of Spread Average Pair Components<br />

Daily Volume<br />

# Of Spread Pair Components<br />

Allocated To Cash Proxy<br />

11/18/2011 - Index Rebalance Date -1.90% 50 0<br />

Source: Livevol<br />

Loss-Floor Mechanism<br />

11/22/2011 -0.39% 47 3<br />

11/23/2011 -2.21% 20 27<br />

11/25/2011 -0.19% 14 6<br />

12/16/2011 – Final Day of Period 0.14% 14 0<br />

www.journalofindexes.<strong>com</strong> November / December 31