Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

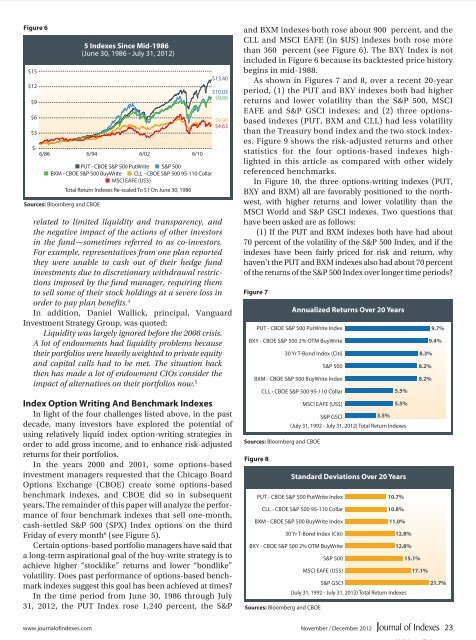

Figure 6<br />

$15<br />

$12<br />

$9<br />

$6<br />

$3<br />

5 Indexes Since Mid-1986<br />

(June 30, 1986 - July 31, 2012)<br />

$-<br />

6/86 6/94 6/02 6/10<br />

■ PUT - CBOE S&P 500 PutWrite ■ S&P 500<br />

■ BXM - CBOE S&P 500 BuyWrite ■ CLL - CBOE S&P 500 95-110 Collar<br />

■ MSCI EAFE (US$)<br />

Sources: Bloomberg and CBOE<br />

Total Return Indexes Re-scaled To $1 On June 30, 1986<br />

$13.40<br />

$10.03<br />

$9.86<br />

$4.90<br />

$4.63<br />

related to limited liquidity and transparency, and<br />

the negative impact of the actions of other investors<br />

in the fund—sometimes referred to as co-investors.<br />

For example, representatives from one plan reported<br />

they were unable to cash out of their hedge fund<br />

investments due to discretionary withdrawal restrictions<br />

imposed by the fund manager, requiring them<br />

to sell some of their stock holdings at a severe loss in<br />

order to pay plan benefits. 4<br />

In addition, Daniel Wallick, principal, Vanguard<br />

Investment Strategy Group, was quoted:<br />

Liquidity was largely ignored before the 2008 crisis.<br />

A lot of endowments had liquidity problems because<br />

their portfolios were heavily weighted to private equity<br />

and capital calls had to be met. The situation back<br />

then has made a lot of endowment CIOs consider the<br />

impact of alternatives on their portfolios now. 5<br />

Index Option Writing And Benchmark Indexes<br />

In light of the four challenges listed above, in the past<br />

decade, many investors have explored the potential of<br />

using relatively liquid index option-writing strategies in<br />

order to add gross in<strong>com</strong>e, and to enhance risk-adjusted<br />

returns for their portfolios.<br />

In the years 2000 and 2001, some options-based<br />

investment managers requested that the Chicago Board<br />

Options Exchange (CBOE) create some options-based<br />

benchmark indexes, and CBOE did so in subsequent<br />

years. The remainder of this paper will analyze the performance<br />

of four benchmark indexes that sell one-month,<br />

cash-settled S&P 500 (SPX) Index options on the third<br />

Friday of every month 6 (see Figure 5).<br />

Certain options-based portfolio managers have said that<br />

a long-term aspirational goal of the buy-write strategy is to<br />

achieve higher “stocklike” returns and lower “bondlike”<br />

volatility. Does past performance of options-based benchmark<br />

indexes suggest this goal has been achieved at times?<br />

In the time period from June 30, 1986 through July<br />

31, 2012, the PUT Index rose 1,240 percent, the S&P<br />

and BXM indexes both rose about 900 percent, and the<br />

CLL and MSCI EAFE (in $US) indexes both rose more<br />

than 360 percent (see Figure 6). The BXY Index is not<br />

included in Figure 6 because its backtested price history<br />

begins in mid-1988.<br />

As shown in Figures 7 and 8, over a recent 20-year<br />

period, (1) the PUT and BXY indexes both had higher<br />

returns and lower volatility than the S&P 500, MSCI<br />

EAFE and S&P GSCI indexes; and (2) three optionsbased<br />

indexes (PUT, BXM and CLL) had less volatility<br />

than the Treasury bond index and the two stock indexes.<br />

Figure 9 shows the risk-adjusted returns and other<br />

statistics for the four options-based indexes highlighted<br />

in this article as <strong>com</strong>pared with other widely<br />

referenced benchmarks.<br />

In Figure 10, the three options-writing indexes (PUT,<br />

BXY and BXM) all are favorably positioned to the northwest,<br />

with higher returns and lower volatility than the<br />

MSCI World and S&P GSCI indexes. Two questions that<br />

have been asked are as follows:<br />

(1) If the PUT and BXM indexes both have had about<br />

70 percent of the volatility of the S&P 500 Index, and if the<br />

indexes have been fairly priced for risk and return, why<br />

haven’t the PUT and BXM indexes also had about 70 percent<br />

of the returns of the S&P 500 Index over longer time periods?<br />

Figure 7<br />

PUT - CBOE S&P 500 PutWrite Index<br />

BXY - CBOE S&P 500 2% OTM BuyWrite<br />

30 Yr T-Bond Index (Citi)<br />

S&P 500<br />

BXM - CBOE S&P 500 BuyWrite Index<br />

CLL - CBOE S&P 500 95-110 Collar<br />

Sources: Bloomberg and CBOE<br />

Figure 8<br />

Annualized Returns Over 20 Years<br />

MSCI EAFE (US$)<br />

S&P GSCI<br />

(July 31, 1992 - July 31, 2012) Total Return Indexes<br />

PUT - CBOE S&P 500 PutWrite Index<br />

CLL - CBOE S&P 500 95-110 Collar<br />

BXM - CBOE S&P 500 BuyWrite Index<br />

30 Yr T-Bond Index (Citi)<br />

BXY - CBOE S&P 500 2% OTM BuyWrite<br />

Sources: Bloomberg and CBOE<br />

3.5%<br />

5.5%<br />

5.5%<br />

Standard Deviations Over 20 Years<br />

S&P 500<br />

MSCI EAFE (US$)<br />

S&P GSCI<br />

10.7%<br />

10.8%<br />

11.0%<br />

12.8%<br />

12.8%<br />

(July 31, 1992 - July 31, 2012) Total Return Indexes<br />

15.1%<br />

8.3%<br />

8.2%<br />

8.2%<br />

17.1%<br />

9.7%<br />

9.4%<br />

21.7%<br />

www.journalofindexes.<strong>com</strong> November / December 2012 23