Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Figure 5<br />

Median notional Volume ($B)<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

Q2<br />

’07<br />

Q4<br />

’07<br />

<strong>com</strong>modity ETF Options<br />

Median notional Volume ($B)<br />

Dominated by GLD, <strong>com</strong>modity<br />

ETF options trade $3bn<br />

notional/day.<br />

Q2<br />

’08<br />

Q4<br />

’08<br />

Q2<br />

’09<br />

Q4<br />

’09<br />

Q2<br />

’10<br />

■ GLD ■ SLV ■ USO ■ UNG<br />

Source: BofA Merrill Lynch Global Research<br />

Figure 6<br />

Median notional Volume ($B)<br />

0.8<br />

0.7<br />

0.6<br />

0.5<br />

0.4<br />

0.3<br />

0.2<br />

0.1<br />

0.0<br />

Q2<br />

’02<br />

Q2<br />

’03<br />

Q4<br />

’04<br />

Source: BofA Merrill Lynch Global Research<br />

Q4<br />

’10<br />

Q2<br />

’11<br />

■ AGQ<br />

Fixed-in<strong>com</strong>e ETF Options<br />

Median notional Volume ($B)<br />

Options on fixed in<strong>com</strong>e ETFs<br />

showing most consistent<br />

growth.<br />

Q3<br />

’05<br />

Q2<br />

’06<br />

Q1<br />

’07<br />

Q4<br />

’07<br />

Q3<br />

’08<br />

Q2<br />

’09<br />

■ TLT ■ TBT ■ HYG<br />

Q1<br />

’10<br />

Q4<br />

’10<br />

Q4<br />

’11<br />

Q3<br />

’11<br />

Q2<br />

’12<br />

Q2<br />

’12<br />

• U.S. large- and midcap stocks: Dow Jones Industrial<br />

Average and S&P 400 MidCap<br />

• U.S. sectors: S&P 500 stocks categorized by their GICS 2<br />

sectors and broader-sector access to real estate, retail, oil,<br />

gold stocks, biotech and home builders<br />

• U.S. equity volatility: Options on VXX, the short-term<br />

VIX futures ETN<br />

• Levered and inverse products: On a selection of broadbased<br />

U.S. equities, U.S. sectors and international equities.<br />

Notably, options on levered and inverse products have<br />

outsized volume versus open interest relative to other liquid<br />

ETF options. The interpretation is that options on these<br />

funds are likely used more for intraday speculation.<br />

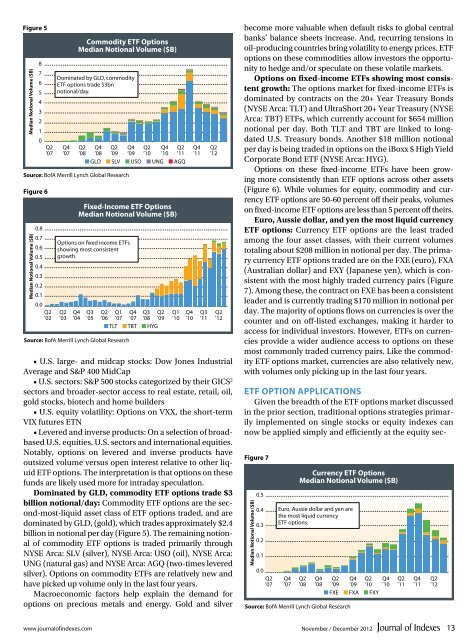

Dominated by GLD, <strong>com</strong>modity ETF options trade $3<br />

billion notional/day: Commodity ETF options are the second-most-liquid<br />

asset class of ETF options traded, and are<br />

dominated by GLD, (gold), which trades approximately $2.4<br />

billion in notional per day (Figure 5). The remaining notional<br />

of <strong>com</strong>modity ETF options is traded primarily through<br />

NYSE Arca: SLV (silver), NYSE Arca: USO (oil), NYSE Arca:<br />

UNG (natural gas) and NYSE Arca: AGQ (two-times levered<br />

silver). Options on <strong>com</strong>modity ETFs are relatively new and<br />

have picked up volume only in the last four years.<br />

Macroeconomic factors help explain the demand for<br />

options on precious metals and energy. Gold and silver<br />

be<strong>com</strong>e more valuable when default risks to global central<br />

banks’ balance sheets increase. And, recurring tensions in<br />

oil-producing countries bring volatility to energy prices. ETF<br />

options on these <strong>com</strong>modities allow investors the opportunity<br />

to hedge and/or speculate on these volatile markets.<br />

Options on fixed-in<strong>com</strong>e ETFs showing most consistent<br />

growth: The options market for fixed-in<strong>com</strong>e ETFs is<br />

dominated by contracts on the 20+ Year Treasury Bonds<br />

(NYSE Arca: TLT) and UltraShort 20+ Year Treasury (NYSE<br />

Arca: TBT) ETFs, which currently account for $654 million<br />

notional per day. Both TLT and TBT are linked to longdated<br />

U.S. Treasury bonds. Another $18 million notional<br />

per day is being traded in options on the iBoxx $ High Yield<br />

Corporate Bond ETF (NYSE Arca: HYG).<br />

Options on these fixed-in<strong>com</strong>e ETFs have been growing<br />

more consistently than ETF options across other assets<br />

(Figure 6). While volumes for equity, <strong>com</strong>modity and currency<br />

ETF options are 50-60 percent off their peaks, volumes<br />

on fixed-in<strong>com</strong>e ETF options are less than 5 percent off theirs.<br />

Euro, Aussie dollar, and yen the most liquid currency<br />

ETF options: Currency ETF options are the least traded<br />

among the four asset classes, with their current volumes<br />

totaling about $208 million in notional per day. The primary<br />

currency ETF options traded are on the FXE (euro), FXA<br />

(Australian dollar) and FXY (Japanese yen), which is consistent<br />

with the most highly traded currency pairs (Figure<br />

7). Among these, the contract on FXE has been a consistent<br />

leader and is currently trading $170 million in notional per<br />

day. The majority of options flows on currencies is over the<br />

counter and on off-listed exchanges, making it harder to<br />

access for individual investors. However, ETFs on currencies<br />

provide a wider audience access to options on these<br />

most <strong>com</strong>monly traded currency pairs. Like the <strong>com</strong>modity<br />

ETF options market, currencies are also relatively new,<br />

with volumes only picking up in the last four years.<br />

ETF Option Applications<br />

Given the breadth of the ETF options market discussed<br />

in the prior section, traditional options strategies primarily<br />

implemented on single stocks or equity indexes can<br />

now be applied simply and efficiently at the equity sec-<br />

Figure 7<br />

Median notional Volume ($B)<br />

0.5<br />

0.4<br />

0.3<br />

0.2<br />

0.1<br />

0.0<br />

Q2<br />

’07<br />

Q4<br />

’07<br />

currency ETF Options<br />

Median notional Volume ($B)<br />

Euro, Aussie dollar and yen are<br />

the most liquid currency<br />

ETF options.<br />

Q2<br />

’08<br />

Q4<br />

’08<br />

Q2<br />

’09<br />

Q4<br />

’09<br />

Q2<br />

’10<br />

■ FXE ■ FXA ■ FXY<br />

Source: BofA Merrill Lynch Global Research<br />

Q4<br />

’10<br />

Q2<br />

’11<br />

Q4<br />

’11<br />

Q2<br />

’12<br />

www.journalofindexes.<strong>com</strong> November / December 2012<br />

13