Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Exchange-traded products span a wide range of offerings,<br />

including broad style, sector, industry, country,<br />

regional and cross-asset benchmarks. A key reason<br />

for their popularity is convenience. Because exchangetraded<br />

products trade and settle like a stock, there is no<br />

additional infrastructure or documentation required. The<br />

most popular exchange-traded product is the exchangetraded<br />

fund. For the remainder of this piece, for readability<br />

and familiarity, we use the term “ETF” to mean exchangetraded<br />

fund and to include other exchange-traded products<br />

such as exchange-traded notes (ETNs).<br />

Since the credit crisis, with cross-asset correlations<br />

rising, there has been increased demand for investments<br />

with broader access. As a result, hedge funds and<br />

traditional institutional investors increasingly are using<br />

ETFs. Common applications include allocating assets,<br />

top-down investing, cash flow management, hedging<br />

either broadly or tactically within sectors and executing<br />

relative value strategies; for example, trading a stock<br />

versus its own sector. ETFs offer flexibility, and given<br />

that the products trade like ordinary equities, some<br />

institutions that are restricted from using traditional<br />

derivatives are able to use ETFs.<br />

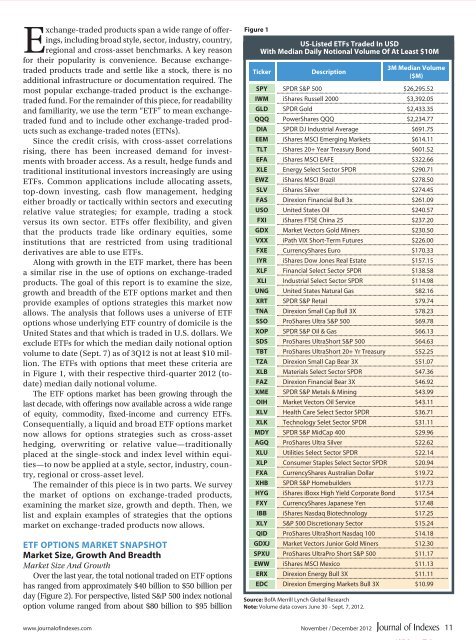

Along with growth in the ETF market, there has been<br />

a similar rise in the use of options on exchange-traded<br />

products. The goal of this report is to examine the size,<br />

growth and breadth of the ETF options market and then<br />

provide examples of options strategies this market now<br />

allows. The analysis that follows uses a universe of ETF<br />

options whose underlying ETF country of domicile is the<br />

United States and that which is traded in U.S. dollars. We<br />

exclude ETFs for which the median daily notional option<br />

volume to date (Sept. 7) as of 3Q12 is not at least $10 million.<br />

The ETFs with options that meet these criteria are<br />

in Figure 1, with their respective third-quarter 2012 (todate)<br />

median daily notional volume.<br />

The ETF options market has been growing through the<br />

last decade, with offerings now available across a wide range<br />

of equity, <strong>com</strong>modity, fixed-in<strong>com</strong>e and currency ETFs.<br />

Consequentially, a liquid and broad ETF options market<br />

now allows for options strategies such as cross-asset<br />

hedging, overwriting or relative value—traditionally<br />

placed at the single-stock and index level within equities—to<br />

now be applied at a style, sector, industry, country,<br />

regional or cross-asset level.<br />

The remainder of this piece is in two parts. We survey<br />

the market of options on exchange-traded products,<br />

examining the market size, growth and depth. Then, we<br />

list and explain examples of strategies that the options<br />

market on exchange-traded products now allows.<br />

ETF OPTIONS MARKET SNAPSHOT<br />

Market Size, Growth And Breadth<br />

Market Size And Growth<br />

Over the last year, the total notional traded on ETF options<br />

has ranged from approximately $40 billion to $50 billion per<br />

day (Figure 2). For perspective, listed S&P 500 index notional<br />

option volume ranged from about $80 billion to $95 billion<br />

Figure 1<br />

US-Listed ETFs Traded In USD<br />

With Median Daily Notional Volume Of At Least $10M<br />

Ticker<br />

Description<br />

3M Median Volume<br />

($M)<br />

SPY SPDR S&P 500 $26,295.52<br />

IWM iShares Russell 2000 $3,392.05<br />

GLD SPDR Gold $2,433.35<br />

QQQ PowerShares QQQ $2,234.77<br />

DIA SPDR DJ Industrial Average $691.75<br />

EEM iShares MSCI Emerging Markets $614.11<br />

TLT iShares 20+ Year Treasury Bond $601.52<br />

EFA iShares MSCI EAFE $322.66<br />

XLE Energy Select Sector SPDR $290.71<br />

EWZ iShares MSCI Brazil $278.50<br />

SLV iShares Silver $274.45<br />

FAS Direxion Financial Bull 3x $261.09<br />

USO United States Oil $240.57<br />

FXI iShares FTSE China 25 $237.20<br />

GDX Market Vectors Gold Miners $230.50<br />

VXX iPath VIX Short-Term Futures $226.00<br />

FXE CurrencyShares Euro $170.33<br />

IYR iShares Dow Jones Real Estate $157.15<br />

XLF Financial Select Sector SPDR $138.58<br />

XLI Industrial Select Sector SPDR $114.98<br />

UNG United States Natural Gas $82.16<br />

XRT SPDR S&P Retail $79.74<br />

TNA Direxion Small Cap Bull 3X $78.23<br />

SSO ProShares Ultra S&P 500 $69.78<br />

XOP SPDR S&P Oil & Gas $66.13<br />

SDS ProShares UltraShort S&P 500 $64.63<br />

TBT ProShares UltraShort 20+ Yr Treasury $52.25<br />

TZA Direxion Small Cap Bear 3X $51.07<br />

XLB Materials Select Sector SPDR $47.36<br />

FAZ Direxion Financial Bear 3X $46.92<br />

XME SPDR S&P Metals & Mining $43.99<br />

OIH Market Vectors Oil Service $43.11<br />

XLV Health Care Select Sector SPDR $36.71<br />

XLK Technology Selet Sector SPDR $31.11<br />

MDY SPDR S&P MidCap 400 $29.96<br />

AGQ ProShares Ultra Silver $22.62<br />

XLU Utilities Select Sector SPDR $22.14<br />

XLP Consumer Staples Select Sector SPDR $20.94<br />

FXA CurrencyShares Australian Dollar $19.72<br />

XHB SPDR S&P Homebuilders $17.73<br />

HYG iShares iBoxx High Yield Corporate Bond $17.54<br />

FXY CurrencyShares Japanese Yen $17.48<br />

IBB iShares Nasdaq Biotechnology $17.25<br />

XLY S&P 500 Discretionary Sector $15.24<br />

QID ProShares UltraShort Nasdaq 100 $14.18<br />

GDXJ Market Vectors Junior Gold Miners $12.30<br />

SPXU ProShares UltraPro Short S&P 500 $11.17<br />

EWW iShares MSCI Mexico $11.13<br />

ERX Direxion Energy Bull 3X $11.11<br />

EDC Direxion Emerging Markets Bull 3X $10.99<br />

Source: BofA Merrill Lynch Global Research<br />

Note: Volume data covers June 30 - Sept. 7, 2012.<br />

www.journalofindexes.<strong>com</strong> November / December 2012<br />

11