Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Profiles In Pensions<br />

IMRF’s Shah Stays The Course<br />

New CIO not anticipating<br />

any big changes<br />

The Journal of Indexes sat down with Dhvani Shah, who<br />

became the CIO of the Illinois Municipal Retirement<br />

Fund last December, to talk about her fund’s allocations<br />

and how it uses index strategies, among other topics.<br />

IMRF is the 51st-largest pension system in the United<br />

States and the second-largest (and one of the best-funded)<br />

public pension system in the state of Illinois.<br />

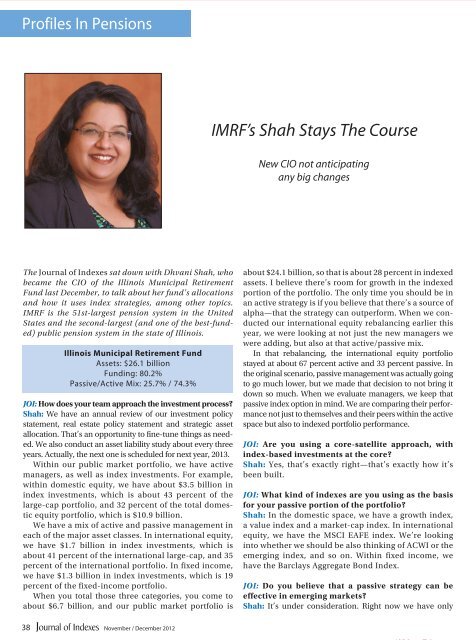

Illinois Municipal Retirement Fund<br />

Assets: $26.1 billion<br />

Funding: 80.2%<br />

Passive/Active Mix: 25.7% / 74.3%<br />

JOI: How does your team approach the investment process?<br />

Shah: We have an annual review of our investment policy<br />

statement, real estate policy statement and strategic asset<br />

allocation. That’s an opportunity to fine-tune things as needed.<br />

We also conduct an asset liability study about every three<br />

years. Actually, the next one is scheduled for next year, 2013.<br />

Within our public market portfolio, we have active<br />

managers, as well as index investments. For example,<br />

within domestic equity, we have about $3.5 billion in<br />

index investments, which is about 43 percent of the<br />

large-cap portfolio, and 32 percent of the total domestic<br />

equity portfolio, which is $10.9 billion.<br />

We have a mix of active and passive management in<br />

each of the major asset classes. In international equity,<br />

we have $1.7 billion in index investments, which is<br />

about 41 percent of the international large-cap, and 35<br />

percent of the international portfolio. In fixed in<strong>com</strong>e,<br />

we have $1.3 billion in index investments, which is 19<br />

percent of the fixed-in<strong>com</strong>e portfolio.<br />

When you total those three categories, you <strong>com</strong>e to<br />

about $6.7 billion, and our public market portfolio is<br />

about $24.1 billion, so that is about 28 percent in indexed<br />

assets. I believe there’s room for growth in the indexed<br />

portion of the portfolio. The only time you should be in<br />

an active strategy is if you believe that there’s a source of<br />

alpha—that the strategy can outperform. When we conducted<br />

our international equity rebalancing earlier this<br />

year, we were looking at not just the new managers we<br />

were adding, but also at that active/passive mix.<br />

In that rebalancing, the international equity portfolio<br />

stayed at about 67 percent active and 33 percent passive. In<br />

the original scenario, passive management was actually going<br />

to go much lower, but we made that decision to not bring it<br />

down so much. When we evaluate managers, we keep that<br />

passive index option in mind. We are <strong>com</strong>paring their performance<br />

not just to themselves and their peers within the active<br />

space but also to indexed portfolio performance.<br />

JOI: Are you using a core-satellite approach, with<br />

index-based investments at the core?<br />

Shah: Yes, that’s exactly right—that’s exactly how it’s<br />

been built.<br />

JOI: What kind of indexes are you using as the basis<br />

for your passive portion of the portfolio?<br />

Shah: In the domestic space, we have a growth index,<br />

a value index and a market-cap index. In international<br />

equity, we have the MSCI EAFE index. We’re looking<br />

into whether we should be also thinking of ACWI or the<br />

emerging index, and so on. Within fixed in<strong>com</strong>e, we<br />

have the Barclays Aggregate Bond Index.<br />

JOI: Do you believe that a passive strategy can be<br />

effective in emerging markets?<br />

Shah: It’s under consideration. Right now we have only<br />

38<br />

November / December 2012