Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

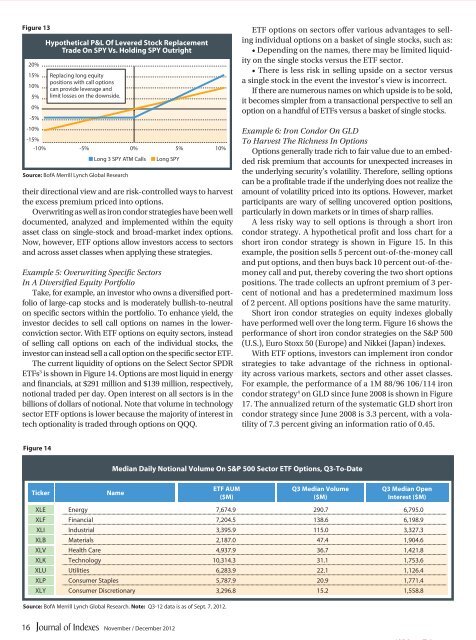

Figure 13<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

-5%<br />

-10%<br />

-15%<br />

Hypothetical P&L Of Levered Stock Replacement<br />

Trade On SPY Vs. Holding SPY Outright<br />

Replacing long equity<br />

positions with call options<br />

can provide leverage and<br />

limit losses on the downside.<br />

-10% -5% 0% 5% 10%<br />

Source: BofA Merrill Lynch Global Research<br />

■ Long 3 SPY ATM Calls ■ Long SPY<br />

their directional view and are risk-controlled ways to harvest<br />

the excess premium priced into options.<br />

Overwriting as well as iron condor strategies have been well<br />

documented, analyzed and implemented within the equity<br />

asset class on single-stock and broad-market index options.<br />

Now, however, ETF options allow investors access to sectors<br />

and across asset classes when applying these strategies.<br />

Example 5: Overwriting Specific Sectors<br />

In A Diversified Equity Portfolio<br />

Take, for example, an investor who owns a diversified portfolio<br />

of large-cap stocks and is moderately bullish-to-neutral<br />

on specific sectors within the portfolio. To enhance yield, the<br />

investor decides to sell call options on names in the lowerconviction<br />

sector. With ETF options on equity sectors, instead<br />

of selling call options on each of the individual stocks, the<br />

investor can instead sell a call option on the specific sector ETF.<br />

The current liquidity of options on the Select Sector SPDR<br />

ETFs 3 is shown in Figure 14. Options are most liquid in energy<br />

and financials, at $291 million and $139 million, respectively,<br />

notional traded per day. Open interest on all sectors is in the<br />

billions of dollars of notional. Note that volume in technology<br />

sector ETF options is lower because the majority of interest in<br />

tech optionality is traded through options on QQQ.<br />

ETF options on sectors offer various advantages to selling<br />

individual options on a basket of single stocks, such as:<br />

• Depending on the names, there may be limited liquidity<br />

on the single stocks versus the ETF sector.<br />

• There is less risk in selling upside on a sector versus<br />

a single stock in the event the investor’s view is incorrect.<br />

If there are numerous names on which upside is to be sold,<br />

it be<strong>com</strong>es simpler from a transactional perspective to sell an<br />

option on a handful of ETFs versus a basket of single stocks.<br />

Example 6: Iron Condor On GLD<br />

To Harvest The Richness In Options<br />

Options generally trade rich to fair value due to an embedded<br />

risk premium that accounts for unexpected increases in<br />

the underlying security’s volatility. Therefore, selling options<br />

can be a profitable trade if the underlying does not realize the<br />

amount of volatility priced into its options. However, market<br />

participants are wary of selling uncovered option positions,<br />

particularly in down markets or in times of sharp rallies.<br />

A less risky way to sell options is through a short iron<br />

condor strategy. A hypothetical profit and loss chart for a<br />

short iron condor strategy is shown in Figure 15. In this<br />

example, the position sells 5 percent out-of-the-money call<br />

and put options, and then buys back 10 percent out-of-themoney<br />

call and put, thereby covering the two short options<br />

positions. The trade collects an upfront premium of 3 percent<br />

of notional and has a predetermined maximum loss<br />

of 2 percent. All options positions have the same maturity.<br />

Short iron condor strategies on equity indexes globally<br />

have performed well over the long term. Figure 16 shows the<br />

performance of short iron condor strategies on the S&P 500<br />

(U.S.), Euro Stoxx 50 (Europe) and Nikkei (Japan) indexes.<br />

With ETF options, investors can implement iron condor<br />

strategies to take advantage of the richness in optionality<br />

across various markets, sectors and other asset classes.<br />

For example, the performance of a 1M 88/96 106/114 iron<br />

condor strategy 4 on GLD since June 2008 is shown in Figure<br />

17. The annualized return of the systematic GLD short iron<br />

condor strategy since June 2008 is 3.3 percent, with a volatility<br />

of 7.3 percent giving an information ratio of 0.45.<br />

Figure 14<br />

Median Daily Notional Volume On S&P 500 Sector ETF Options, Q3-To-Date<br />

Ticker<br />

Name<br />

ETF AUM<br />

($M)<br />

Q3 Median Volume<br />

($M)<br />

Q3 Median Open<br />

Interest ($M)<br />

XLE Energy 7,674.9 290.7 6,795.0<br />

XLF Financial 7,204.5 138.6 6,198.9<br />

XLI Industrial 3,395.9 115.0 3,327.3<br />

XLB Materials 2,187.0 47.4 1,904.6<br />

XLV Health Care 4,937.9 36.7 1,421.8<br />

XLK Technology 10,314.3 31.1 1,753.6<br />

XLU Utilities 6,283.9 22.1 1,126.4<br />

XLP Consumer Staples 5,787.9 20.9 1,771.4<br />

XLY Consumer Discretionary 3,296.8 15.2 1,558.8<br />

Source: BofA Merrill Lynch Global Research. Note: Q3-12 data is as of Sept. 7, 2012.<br />

16<br />

November / December 2012