Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

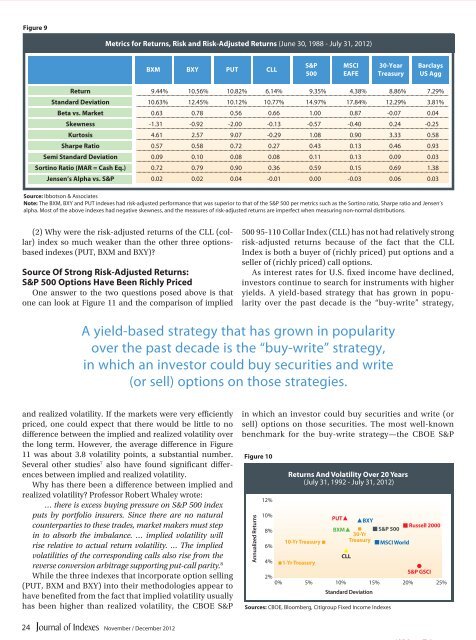

Figure 9<br />

Metrics for Returns, Risk and Risk-Adjusted Returns (June 30, 1988 - July 31, 2012)<br />

BXM BXY PUT CLL<br />

S&P<br />

500<br />

MSCI<br />

EAFE<br />

30-Year<br />

Treasury<br />

Barclays<br />

US Agg<br />

Return 9.44% 10.56% 10.82% 6.14% 9.35% 4.38% 8.86% 7.29%<br />

Standard Deviation 10.63% 12.45% 10.12% 10.77% 14.97% 17.84% 12.29% 3.81%<br />

Beta vs. Market 0.63 0.78 0.56 0.66 1.00 0.87 -0.07 0.04<br />

Skewness -1.31 -0.92 -2.00 -0.13 -0.57 -0.40 0.24 -0.25<br />

Kurtosis 4.61 2.57 9.07 -0.29 1.08 0.90 3.33 0.58<br />

Sharpe Ratio 0.57 0.58 0.72 0.27 0.43 0.13 0.46 0.93<br />

Semi Standard Deviation 0.09 0.10 0.08 0.08 0.11 0.13 0.09 0.03<br />

Sortino Ratio (MAR = Cash Eq.) 0.72 0.79 0.90 0.36 0.59 0.15 0.69 1.38<br />

Jensen’s Alpha vs. S&P 0.02 0.02 0.04 -0.01 0.00 -0.03 0.06 0.03<br />

Source: Ibbotson & Associates<br />

Note: The BXM, BXY and PUT indexes had risk-adjusted performance that was superior to that of the S&P 500 per metrics such as the Sortino ratio, Sharpe ratio and Jensen’s<br />

alpha. Most of the above indexes had negative skewness, and the measures of risk-adjusted returns are imperfect when measuring non-normal distributions.<br />

(2) Why were the risk-adjusted returns of the CLL (collar)<br />

index so much weaker than the other three optionsbased<br />

indexes (PUT, BXM and BXY)?<br />

Source Of Strong Risk-Adjusted Returns:<br />

S&P 500 Options Have Been Richly Priced<br />

One answer to the two questions posed above is that<br />

one can look at Figure 11 and the <strong>com</strong>parison of implied<br />

500 95-110 Collar Index (CLL) has not had relatively strong<br />

risk-adjusted returns because of the fact that the CLL<br />

Index is both a buyer of (richly priced) put options and a<br />

seller of (richly priced) call options.<br />

As interest rates for U.S. fixed in<strong>com</strong>e have declined,<br />

investors continue to search for instruments with higher<br />

yields. A yield-based strategy that has grown in popularity<br />

over the past decade is the “buy-write” strategy,<br />

A yield-based strategy that has grown in popularity<br />

over the past decade is the “buy-write” strategy,<br />

in which an investor could buy securities and write<br />

(or sell) options on those strategies.<br />

and realized volatility. If the markets were very efficiently<br />

priced, one could expect that there would be little to no<br />

difference between the implied and realized volatility over<br />

the long term. However, the average difference in Figure<br />

11 was about 3.8 volatility points, a substantial number.<br />

Several other studies 7 also have found significant differences<br />

between implied and realized volatility.<br />

Why has there been a difference between implied and<br />

realized volatility? Professor Robert Whaley wrote:<br />

… there is excess buying pressure on S&P 500 index<br />

puts by portfolio insurers. Since there are no natural<br />

counterparties to these trades, market makers must step<br />

in to absorb the imbalance. … implied volatility will<br />

rise relative to actual return volatility. … The implied<br />

volatilities of the corresponding calls also rise from the<br />

reverse conversion arbitrage supporting put-call parity. 8<br />

While the three indexes that incorporate option selling<br />

(PUT, BXM and BXY) into their methodologies appear to<br />

have benefited from the fact that implied volatility usually<br />

has been higher than realized volatility, the CBOE S&P<br />

in which an investor could buy securities and write (or<br />

sell) options on those securities. The most well-known<br />

benchmark for the buy-write strategy—the CBOE S&P<br />

Figure 10<br />

Annualized Returns<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

Returns And Volatility Over 20 Years<br />

(July 31, 1992 - July 31, 2012)<br />

10-Yr Treasury<br />

1-Yr Treasury<br />

PUT<br />

BXM<br />

CLL<br />

BXY<br />

30-Yr<br />

Treasury<br />

S&P GSCI<br />

2%<br />

0% 5% 10% 15% 20% 25%<br />

Standard Deviation<br />

S&P 500<br />

Sources: CBOE, Bloomberg, Citigroup Fixed In<strong>com</strong>e Indexes<br />

MSCI World<br />

Russell 2000<br />

24<br />

November / December 2012