pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

NOTE 26. FAIR VALUE (Continued)<br />

Loan impairment is reported when full payment under the loan terms is not expected. Impaired loans are carried at the<br />

present value of estimated future cash flows using the loan's existing rate, or the fair value of collateral if the loan is<br />

collateral dependent. A portion of the allowance for loan losses is allocated to impaired loans if the value of such loans is<br />

deemed to be less than the unpaid balance. If these allocations cause the allowance for loan losses to require an <strong>inc</strong>rease,<br />

such <strong>inc</strong>rease is reported as a component of the provision for loan losses. Loan losses are charged against the allowance<br />

when management believes the uncollectibility of a loan is confirmed. During 2009, certain impaired loans were partially<br />

charged-off or re-evaluated for impairment resulting in a remaining balance for these loans, net of specific allowances, of<br />

$80,723,630 as of December 31, 2009. When the fair value of the collateral is based on an observable market price or a<br />

current appraised value, the Company records the loan impairment as nonrecurring Level 2. When an appraised value is<br />

not available or management determines the fair value of the collateral is further impaired below the appraised value and<br />

there is no observable market price, the Company records the loan impairment as nonrecurring Level 3.<br />

Foreclosed assets are adjusted to fair value upon transfer of the loans to foreclosed assets. Subsequently, foreclosed assets<br />

are carried at the lower of carrying value or fair value. Fair value is based upon independent market prices, appraised<br />

values of the collateral or management’s estimation of the value of the collateral. When the fair value of the collateral is<br />

based on an observable market price or a current appraised value, the Company records the foreclosed assets as<br />

nonrecurring Level 2. When an appraised value is not available or management determines the fair value of the collateral<br />

is further impaired below the appraised value and there is no observable market price, the Company records the foreclosed<br />

asset as nonrecurring Level 3.<br />

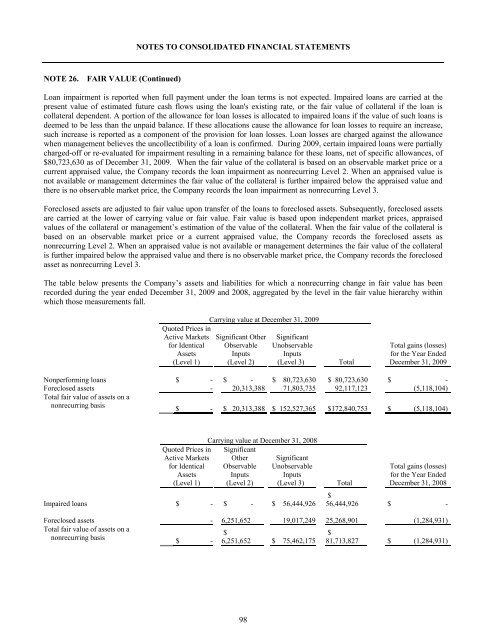

The table below presents the Company’s assets and liabilities for which a nonrecurring change in fair value has been<br />

recorded during the year ended December 31, 2009 and 2008, aggregated by the level in the fair value hierarchy within<br />

which those measurements fall.<br />

Quoted Prices in<br />

Active Markets<br />

for Identical<br />

Assets<br />

(Level 1)<br />

Carrying value at December 31, 2009<br />

Significant Other<br />

Observable<br />

Inputs<br />

(Level 2)<br />

Significant<br />

Unobservable<br />

Inputs<br />

(Level 3)<br />

Total<br />

Total gains (losses)<br />

for the Year Ended<br />

December 31, 2009<br />

Nonperforming loans $ - $ - $ 80,723,630 $ 80,723,630 $ -<br />

Foreclosed assets - 20,313,388 71,803,735 92,117,123 (5,118,104)<br />

Total fair value of assets on a<br />

nonrecurring basis<br />

$ - $ 20,313,388 $ 152,527,365 $172,840,753 $ (5,118,104)<br />

Carrying value at December 31, 2008<br />

Quoted Prices in<br />

Active Markets<br />

for Identical<br />

Assets<br />

(Level 1)<br />

Significant<br />

Other<br />

Observable<br />

Inputs<br />

(Level 2)<br />

Significant<br />

Unobservable<br />

Inputs<br />

(Level 3)<br />

Impaired loans $ - $ - $ 56,444,926<br />

Total<br />

Total gains (losses)<br />

for the Year Ended<br />

December 31, 2008<br />

$<br />

56,444,926 $ -<br />

Foreclosed assets - 6,251,652 19,017,249 25,268,901 (1,284,931)<br />

Total fair value of assets on a<br />

$<br />

$<br />

nonrecurring basis<br />

$ - 6,251,652 $ 75,462,175 81,713,827 $ (1,284,931)<br />

98