pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

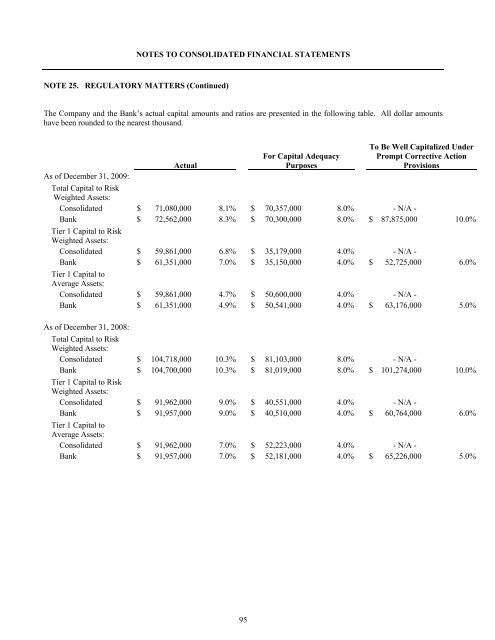

NOTE 25. REGULATORY MATTERS (Continued)<br />

The Company and the Bank’s actual capital amounts and ratios are presented in the following table. All dollar amounts<br />

have been rounded to the nearest thousand.<br />

As of December 31, 2009:<br />

Actual<br />

For Capital Adequacy<br />

Purposes<br />

To Be Well Capitalized Under<br />

Prompt Corrective Action<br />

Provisions<br />

Total Capital to Risk<br />

Weighted Assets:<br />

Consolidated $ 71,080,000 8.1% $ 70,357,000 8.0% - N/A -<br />

Bank $ 72,562,000 8.3% $ 70,300,000 8.0% $ 87,875,000 10.0%<br />

Tier 1 Capital to Risk<br />

Weighted Assets:<br />

Consolidated<br />

Bank<br />

$<br />

$<br />

59,861,000<br />

61,351,000<br />

6.8%<br />

7.0%<br />

$<br />

$<br />

35,179,000<br />

35,150,000<br />

4.0%<br />

4.0% $<br />

- N/A -<br />

52,725,000 6.0%<br />

Tier 1 Capital to<br />

Average Assets:<br />

Consolidated $ 59,861,000 4.7% $ 50,600,000 4.0% - N/A -<br />

Bank $ 61,351,000 4.9% $ 50,541,000 4.0% $ 63,176,000 5.0%<br />

As of December 31, 2008:<br />

Total Capital to Risk<br />

Weighted Assets:<br />

Consolidated $ 104,718,000 10.3% $ 81,103,000 8.0% - N/A -<br />

Bank $ 104,700,000 10.3% $ 81,019,000 8.0% $ 101,274,000 10.0%<br />

Tier 1 Capital to Risk<br />

Weighted Assets:<br />

Consolidated $ 91,962,000 9.0% $ 40,551,000 4.0% - N/A -<br />

Bank $ 91,957,000 9.0% $ 40,510,000 4.0% $ 60,764,000 6.0%<br />

Tier 1 Capital to<br />

Average Assets:<br />

Consolidated $ 91,962,000 7.0% $ 52,223,000 4.0% - N/A -<br />

Bank<br />

$ 91,957,000 7.0% $ 52,181,000 4.0% $ 65,226,000 5.0%<br />

95