pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

NOTE 16.<br />

EARNINGS PER COMMON SHARE<br />

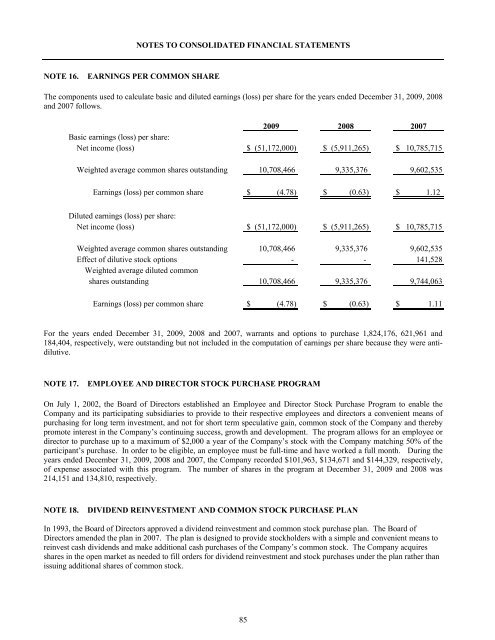

The components used to calculate basic and diluted earnings (loss) per share for the years ended December 31, 2009, 2008<br />

and 2007 follows.<br />

2009 2008 2007<br />

Basic earnings (loss) per share:<br />

Net <strong>inc</strong>ome (loss) $ (51,172,000) $ (5,911,265) $ 10,785,715<br />

Weighted average common shares outstanding 10,708,466 9,335,376 9,602,535<br />

Earnings (loss) per common share $ (4.78) $ (0.63) $ 1.12<br />

Diluted earnings (loss) per share:<br />

Net <strong>inc</strong>ome (loss) $ (51,172,000) $ (5,911,265) $ 10,785,715<br />

Weighted average common shares outstanding 10,708,466 9,335,376 9,602,535<br />

Effect of dilutive stock options - - 141,528<br />

Weighted average diluted common<br />

shares outstanding 10,708,466 9,335,376 9,744,063<br />

Earnings (loss) per common share $ (4.78) $ (0.63) $ 1.11<br />

For the years ended December 31, 2009, 2008 and 2007, warrants and options to purchase 1,824,176, 621,961 and<br />

184,404, respectively, were outstanding but not <strong>inc</strong>luded in the computation of earnings per share because they were antidilutive.<br />

NOTE 17.<br />

EMPLOYEE AND DIRECTOR STOCK PURCHASE PROGRAM<br />

On July 1, 2002, the Board of Directors established an Employee and Director Stock Purchase Program to enable the<br />

Company and its participating subsidiaries to provide to their respective employees and directors a convenient means of<br />

purchasing for long term investment, and not for short term speculative gain, common stock of the Company and thereby<br />

promote interest in the Company’s continuing success, growth and development. The program allows for an employee or<br />

director to purchase up to a maximum of $2,000 a year of the Company’s stock with the Company matching 50% of the<br />

participant’s purchase. In order to be eligible, an employee must be full-time and have worked a full month. During the<br />

years ended December 31, 2009, 2008 and 2007, the Company recorded $101,963, $134,671 and $144,329, respectively,<br />

of expense associated with this program. The number of shares in the program at December 31, 2009 and 2008 was<br />

214,151 and 134,810, respectively.<br />

NOTE 18.<br />

DIVIDEND REINVESTMENT AND COMMON STOCK PURCHASE PLAN<br />

In 1993, the Board of Directors approved a dividend reinvestment and common stock purchase plan. The Board of<br />

Directors amended the plan in 2007. The plan is designed to provide stockholders with a simple and convenient means to<br />

reinvest cash dividends and make additional cash purchases of the Company’s common stock. The Company acquires<br />

shares in the open market as needed to fill orders for dividend reinvestment and stock purchases under the plan rather than<br />

issuing additional shares of common stock.<br />

85