pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ITEM 3. LEGAL PROCEEDINGS<br />

The nature of the business of PAB and the Bank ordinarily results in a certain amount of litigation. Accordingly, we are<br />

party to a limited number of lawsuits <strong>inc</strong>idental to our respective businesses. In our opinion, the ultimate disposition of<br />

these matters will not have a material adverse impact on our consolidated financial position or results of operations.<br />

PART II<br />

ITEM 4. RESERVED<br />

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS<br />

AND ISSUER PURCHASES OF EQUITY SECURITIES<br />

Our common stock has been traded on NASDAQ under the symbol “PABK” s<strong>inc</strong>e November 1, 2005. Prior to that time,<br />

our common stock was listed s<strong>inc</strong>e 1996 for quotation on the American Stock Exchange under the symbol “PAB”. On<br />

February 26, 2010, there were 2,135 holders of record of our common stock.<br />

Our ability to pay dividends is primarily dependent on earnings from operations, the adequacy of capital and the<br />

availability of liquid assets for distribution. Our ability to generate liquid assets for distribution is primarily dependent on<br />

the ability of the Bank to pay dividends up to the parent holding company. The payment of dividends is an integral part of<br />

our goal to retain sufficient capital to support future growth and to meet regulatory requirements while providing a<br />

competitive return on investment to our stockholders. When possible, it was our intent to pay out 35-50% of our net<br />

earnings in the form of cash dividends to our stockholders on a quarterly basis. However, in the third quarter of 2008, we<br />

suspended our quarterly dividends to shareholders due to a decline in earnings. We did not pay a dividend in 2009 and we<br />

do not intend to pay a dividend in 2010 due to continued pressure on earnings and capital. Further, under the terms of the<br />

Written Agreement, we are not permitted to declare or pay any dividend without the prior written approval of our<br />

regulators. As a result, we currently cannot declare a dividend on our common shares. We do not expect to be granted a<br />

waiver or be released from this restriction until our financial performance improves significantly. Assuming our regulators<br />

permit us to pay dividends in the future, our ability to pay dividends will be limited by regulatory restrictions and the need<br />

to maintain sufficient consolidated capital. For a discussion on the statutory and regulatory limitations on our ability to<br />

pay dividends, see “Business – Supervision and Regulation.” Holders of our common stock are only entitled to receive<br />

the dividends that our board of directors declare out of funds legally available for those payments. We can provide no<br />

assurances regarding whether, and if so when, we will be able to resume payments of dividends in the future.<br />

In addition, on September 4, 2009, we began exercising our right to defer quarterly interest payments on our Floating Rate<br />

Junior Subordinated Debentures we issued to PAB Bankshares Capital Trust II, a statutory business trust created for the<br />

sole purpose of issuing trust preferred securities and investing the proceeds in the debentures. We expect to defer the<br />

interest payments indefinitely. During this period of deferral, we are precluded from paying dividends on our common<br />

stock.<br />

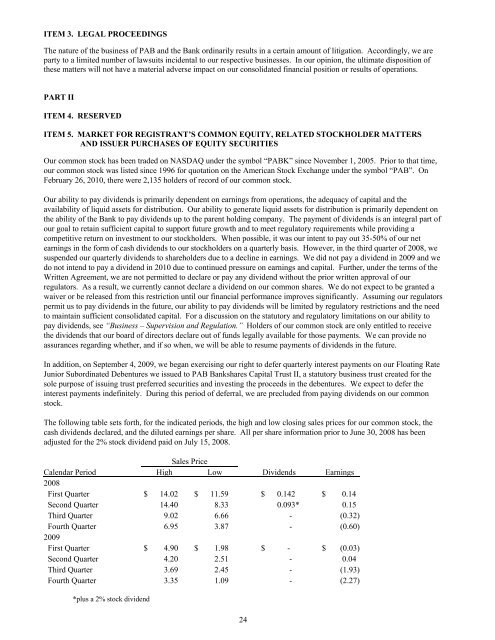

The following table sets forth, for the indicated periods, the high and low closing sales prices for our common stock, the<br />

cash dividends declared, and the diluted earnings per share. All per share information prior to June 30, 2008 has been<br />

adjusted for the 2% stock dividend paid on July 15, 2008.<br />

Sales Price<br />

Calendar Period High Low Dividends Earnings<br />

2008<br />

First Quarter $ 14.02 $ 11.59 $ 0.142 $ 0.14<br />

Second Quarter 14.40 8.33 0.093* 0.15<br />

Third Quarter 9.02 6.66 - (0.32)<br />

Fourth Quarter 6.95 3.87 - (0.60)<br />

2009<br />

First Quarter $ 4.90 $ 1.98 $ - $ (0.03)<br />

Second Quarter 4.20 2.51 - 0.04<br />

Third Quarter 3.69 2.45 - (1.93)<br />

Fourth Quarter 3.35 1.09 - (2.27)<br />

*plus a 2% stock dividend<br />

24