pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

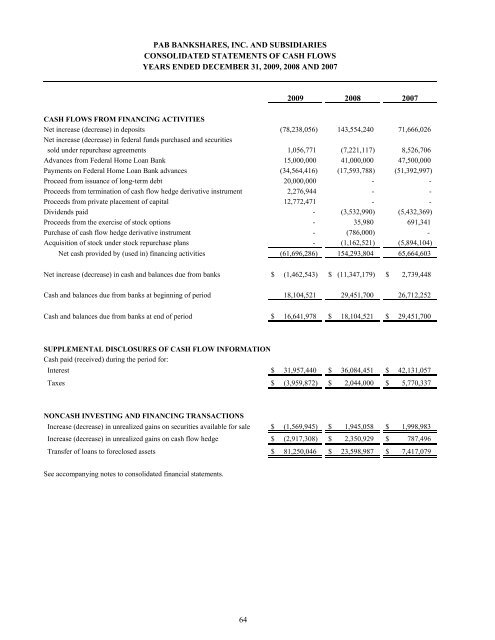

PAB BANKSHARES, INC. AND SUBSIDIARIES<br />

CONSOLIDATED STATEMENTS OF CASH FLOWS<br />

YEARS ENDED DECEMBER 31, 2009, 2008 AND 2007<br />

2009 2008 2007<br />

CASH FLOWS FROM FINANCING ACTIVITIES<br />

Net <strong>inc</strong>rease (decrease) in deposits (78,238,056) 143,554,240 71,666,026<br />

Net <strong>inc</strong>rease (decrease) in federal funds purchased and securities<br />

sold under repurchase agreements 1,056,771 (7,221,117) 8,526,706<br />

Advances from Federal Home Loan Bank 15,000,000 41,000,000 47,500,000<br />

Payments on Federal Home Loan Bank advances (34,564,416) (17,593,788) (51,392,997)<br />

Proceed from issuance of long-term debt 20,000,000 - -<br />

Proceeds from termination of cash flow hedge derivative instrument 2,276,944 - -<br />

Proceeds from private placement of capital 12,772,471 - -<br />

Dividends paid - (3,532,990) (5,432,369)<br />

Proceeds from the exercise of stock options - 35,980 691,341<br />

Purchase of cash flow hedge derivative instrument - (786,000) -<br />

Acquisition of stock under stock repurchase plans - (1,162,521) (5,894,104)<br />

Net cash provided by (used in) financing activities (61,696,286) 154,293,804 65,664,603<br />

Net <strong>inc</strong>rease (decrease) in cash and balances due from banks $ (1,462,543) $ (11,347,179) $ 2,739,448<br />

Cash and balances due from banks at beginning of period 18,104,521 29,451,700 26,712,252<br />

Cash and balances due from banks at end of period $ 16,641,978 $ 18,104,521 $ 29,451,700<br />

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION<br />

Cash paid (received) during the period for:<br />

Interest $ 31,957,440 $ 36,084,451 $ 42,131,057<br />

Taxes $ (3,959,872) $ 2,044,000 $ 5,770,337<br />

NONCASH INVESTING AND FINANCING TRANSACTIONS<br />

Increase (decrease) in unrealized gains on securities available for sale $ (1,569,945) $ 1,945,058 $ 1,998,983<br />

Increase (decrease) in unrealized gains on cash flow hedge $ (2,917,308) $ 2,350,929 $ 787,496<br />

Transfer of loans to foreclosed assets $ 81,250,046 $ 23,598,987 $ 7,417,079<br />

See accompanying notes to consolidated financial statements.<br />

64