pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

NOTE 19.<br />

STOCK PLANS AND STOCK-BASED EMPLOYEE COMPENSATION (Continued)<br />

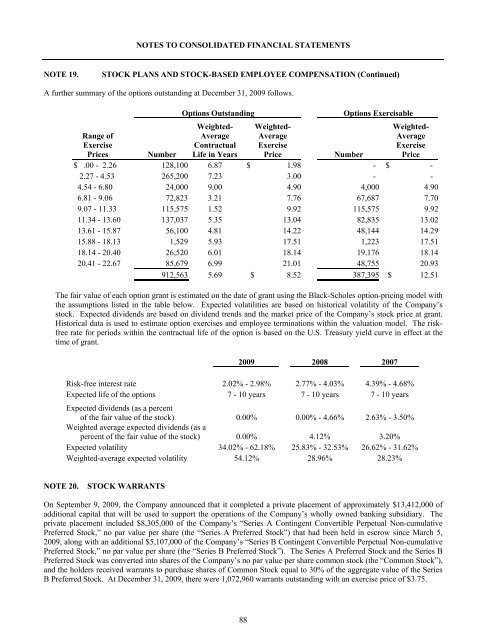

A further summary of the options outstanding at December 31, 2009 follows.<br />

Options Outstanding<br />

Options Exercisable<br />

Range of<br />

Exercise<br />

Prices Number<br />

Weighted-<br />

Average<br />

Contractual<br />

Life in Years<br />

Weighted-<br />

Average<br />

Exercise<br />

Price<br />

Number<br />

Weighted-<br />

Average<br />

Exercise<br />

Price<br />

$ .00 - 2.26 128,100 6.87 $ 1.98 - $ -<br />

2.27 - 4.53 265,200 7.23 3.00 - -<br />

4.54 - 6.80 24,000 9.00 4.90 4,000<br />

4.90<br />

6.81 - 9.06 72,823 3.21 7.76 67,687 7.70<br />

9.07 - 11.33 115,575 1.52 9.92 115,575 9.92<br />

11.34 - 13.60 137,037 5.35 13.04 82,835 13.02<br />

13.61 - 15.87 56,100 4.81 14.22 48,144 14.29<br />

15.88 - 18.13 1,529 5.93 17.51 1,223 17.51<br />

18.14 - 20.40 26,520 6.01 18.14 19,176 18.14<br />

20.41 - 22.67<br />

85,679 6.99 21.01 48,755 20.93<br />

912,563 5.69 $ 8.52 387,395 $ 12.51<br />

The fair value of each option grant is estimated on the date of grant using the Black-Scholes option-pricing model with<br />

the assumptions listed in the table below. Expected volatilities are based on historical volatility of the Company’s<br />

stock. Expected dividends are based on dividend trends and the market price of the Company’s stock price at grant.<br />

Historical data is used to estimate option exercises and employee terminations within the valuation model. The riskfree<br />

rate for periods within the contractual life of the option is based on the U.S. Treasury yield curve in effect at the<br />

time of grant.<br />

2009 2008 2007<br />

Risk-free interest rate 2.02% - 2.98% 2.77% - 4.03% 4.39% - 4.68%<br />

Expected life of the options<br />

7 - 10 years 7 - 10 years 7 - 10 years<br />

Expected dividends (as a percent<br />

of the fair value of the stock) 0.00% 0.00% - 4.66% 2.63% - 3.50%<br />

Weighted average expected dividends (as a<br />

percent of the fair value of the stock) 0.00% 4.12%<br />

3.20%<br />

Expected volatility 34.02% - 62.18% 25.83% - 32.53% 26.62% - 31.62%<br />

Weighted-average expected volatility<br />

54.12% 28.96% 28.23%<br />

NOTE 20.<br />

STOCK WARRANTS<br />

On September 9, 2009, the Company announced that it completed a private placement of approximately $13,412,000 of<br />

additional capital that will be used to support the operations of the Company’s wholly owned banking subsidiary. The<br />

private placement <strong>inc</strong>luded $8,305,000 of the Company’s “Series A Contingent Convertible Perpetual Non-cumulative<br />

Preferred Stock,” no par value per share (the “Series A Preferred Stock”) that had been held in escrow s<strong>inc</strong>e March 5,<br />

2009, along with an additional $5,107,000 of the Company’s “Series B Contingent Convertible Perpetual Non-cumulative<br />

Preferred Stock,” no par value per share (the “Series B Preferred Stock”). The Series A Preferred Stock and the Series B<br />

Preferred Stock was converted into shares of the Company’s no par value per share common stock (the “Common Stock”),<br />

and the holders received warrants to purchase shares of Common Stock equal to 30% of the aggregate value of the Series<br />

B Preferred Stock. At December 31, 2009, there were 1,072,960 warrants outstanding with an exercise price of $3.75.<br />

88