pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

NOTE 8.<br />

DEPOSITS<br />

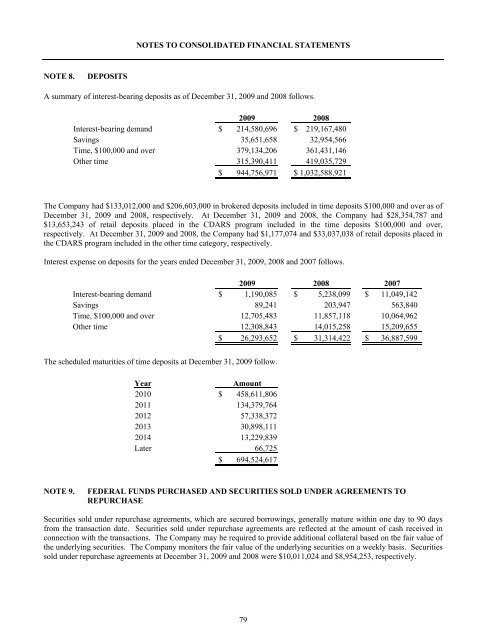

A summary of interest-bearing deposits as of December 31, 2009 and 2008 follows.<br />

2009 2008<br />

Interest-bearing demand $ 214,580,696 $ 219,167,480<br />

Savings 35,651,658 32,954,566<br />

Time, $100,000 and over 379,134,206 361,431,146<br />

Other time 315,390,411 419,035,729<br />

$ 944,756,971 $ 1,032,588,921<br />

The Company had $133,012,000 and $206,603,000 in brokered deposits <strong>inc</strong>luded in time deposits $100,000 and over as of<br />

December 31, 2009 and 2008, respectively. At December 31, 2009 and 2008, the Company had $28,354,787 and<br />

$13,653,243 of retail deposits placed in the CDARS program <strong>inc</strong>luded in the time deposits $100,000 and over,<br />

respectively. At December 31, 2009 and 2008, the Company had $1,177,074 and $33,037,038 of retail deposits placed in<br />

the CDARS program <strong>inc</strong>luded in the other time category, respectively.<br />

Interest expense on deposits for the years ended December 31, 2009, 2008 and 2007 follows.<br />

2009 2008 2007<br />

Interest-bearing demand $ 1,190,085 $ 5,238,099 $ 11,049,142<br />

Savings 89,241<br />

203,947 563,840<br />

Time, $100,000 and over 12,705,483 11,857,118 10,064,962<br />

Other time 12,308,843 14,015,258 15,209,655<br />

$ 26,293,652 $ 31,314,422 $ 36,887,599<br />

The scheduled maturities of time deposits at December 31, 2009 follow.<br />

Year<br />

Amount<br />

2010<br />

$ 458,611,806<br />

2011 134,379,764<br />

2012 57,338,372<br />

2013 30,898,111<br />

2014 13,229,839<br />

Later 66,725<br />

$ 694,524,617<br />

NOTE 9.<br />

FEDERAL FUNDS PURCHASED AND SECURITIES SOLD UNDER AGREEMENTS TO<br />

REPURCHASE<br />

Securities sold under repurchase agreements, which are secured borrowings, generally mature within one day to 90 days<br />

from the transaction date. Securities sold under repurchase agreements are reflected at the amount of cash received in<br />

connection with the transactions. The Company may be required to provide additional collateral based on the fair value of<br />

the underlying securities. The Company monitors the fair value of the underlying securities on a weekly basis. Securities<br />

sold under repurchase agreements at December 31, 2009 and 2008 were $10,011,024 and $8,954,253, respectively.<br />

79