pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

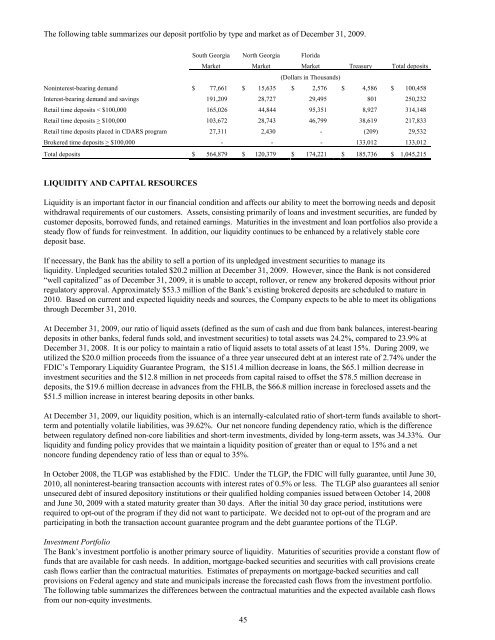

The following table summarizes our deposit portfolio by type and market as of December 31, 2009.<br />

South Georgia North Georgia Florida<br />

Market Market Market Treasury Total deposits<br />

(Dollars in Thousands)<br />

Noninterest-bearing demand $ 77,661 $ 15,635 $ 2,576 $ 4,586 $ 100,458<br />

Interest-bearing demand and savings 191,209 28,727 29,495 801 250,232<br />

Retail time deposits < $100,000 165,026 44,844 95,351 8,927 314,148<br />

Retail time deposits > $100,000 103,672 28,743 46,799 38,619 217,833<br />

Retail time deposits placed in CDARS program 27,311 2,430 - (209) 29,532<br />

Brokered time deposits > $100,000 - - - 133,012 133,012<br />

Total deposits $ 564,879 $ 120,379 $ 174,221 $ 185,736 $ 1,045,215<br />

LIQUIDITY AND CAPITAL RESOURCES<br />

Liquidity is an important factor in our financial condition and affects our ability to meet the borrowing needs and deposit<br />

withdrawal requirements of our customers. Assets, consisting primarily of loans and investment securities, are funded by<br />

customer deposits, borrowed funds, and retained earnings. Maturities in the investment and loan portfolios also provide a<br />

steady flow of funds for reinvestment. In addition, our liquidity continues to be enhanced by a relatively stable core<br />

deposit base.<br />

If necessary, the Bank has the ability to sell a portion of its unpledged investment securities to manage its<br />

liquidity. Unpledged securities totaled $20.2 million at December 31, 2009. However, s<strong>inc</strong>e the Bank is not considered<br />

“well capitalized” as of December 31, 2009, it is unable to accept, rollover, or renew any brokered deposits without prior<br />

regulatory approval. Approximately $53.3 million of the Bank’s existing brokered deposits are scheduled to mature in<br />

2010. Based on current and expected liquidity needs and sources, the Company expects to be able to meet its obligations<br />

through December 31, 2010.<br />

At December 31, 2009, our ratio of liquid assets (defined as the sum of cash and due from bank balances, interest-bearing<br />

deposits in other banks, federal funds sold, and investment securities) to total assets was 24.2%, compared to 23.9% at<br />

December 31, 2008. It is our policy to maintain a ratio of liquid assets to total assets of at least 15%. During 2009, we<br />

utilized the $20.0 million proceeds from the issuance of a three year unsecured debt at an interest rate of 2.74% under the<br />

FDIC’s Temporary Liquidity Guarantee Program, the $151.4 million decrease in loans, the $65.1 million decrease in<br />

investment securities and the $12.8 million in net proceeds from capital raised to offset the $78.5 million decrease in<br />

deposits, the $19.6 million decrease in advances from the FHLB, the $66.8 million <strong>inc</strong>rease in foreclosed assets and the<br />

$51.5 million <strong>inc</strong>rease in interest bearing deposits in other banks.<br />

At December 31, 2009, our liquidity position, which is an internally-calculated ratio of short-term funds available to shortterm<br />

and potentially volatile liabilities, was 39.62%. Our net noncore funding dependency ratio, which is the difference<br />

between regulatory defined non-core liabilities and short-term investments, divided by long-term assets, was 34.33%. Our<br />

liquidity and funding policy provides that we maintain a liquidity position of greater than or equal to 15% and a net<br />

noncore funding dependency ratio of less than or equal to 35%.<br />

In October 2008, the TLGP was established by the FDIC. Under the TLGP, the FDIC will fully guarantee, until June 30,<br />

2010, all noninterest-bearing transaction accounts with interest rates of 0.5% or less. The TLGP also guarantees all senior<br />

unsecured debt of insured depository institutions or their qualified holding companies issued between October 14, 2008<br />

and June 30, 2009 with a stated maturity greater than 30 days. After the initial 30 day grace period, institutions were<br />

required to opt-out of the program if they did not want to participate. We decided not to opt-out of the program and are<br />

participating in both the transaction account guarantee program and the debt guarantee portions of the TLGP.<br />

Investment Portfolio<br />

The Bank’s investment portfolio is another primary source of liquidity. Maturities of securities provide a constant flow of<br />

funds that are available for cash needs. In addition, mortgage-backed securities and securities with call provisions create<br />

cash flows earlier than the contractual maturities. Estimates of prepayments on mortgage-backed securities and call<br />

provisions on Federal agency and state and municipals <strong>inc</strong>rease the forecasted cash flows from the investment portfolio.<br />

The following table summarizes the differences between the contractual maturities and the expected available cash flows<br />

from our non-equity investments.<br />

45