pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

NOTE 4.<br />

INVESTMENT SECURITIES (Continued)<br />

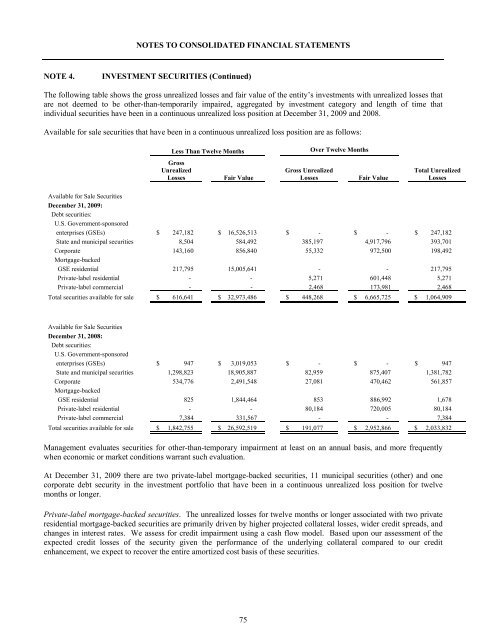

The following table shows the gross unrealized losses and fair value of the entity’s investments with unrealized losses that<br />

are not deemed to be other-than-temporarily impaired, aggregated by investment category and length of time that<br />

individual securities have been in a continuous unrealized loss position at December 31, 2009 and 2008.<br />

Available for sale securities that have been in a continuous unrealized loss position are as follows:<br />

Less Than Twelve Months<br />

Over Twelve Months<br />

Gross<br />

Unrealized<br />

Losses<br />

Fair Value<br />

Gross Unrealized<br />

Losses<br />

Fair Value<br />

Total Unrealized<br />

Losses<br />

Available for Sale Securities<br />

December 31, 2009:<br />

Debt securities:<br />

U.S. Government-sponsored<br />

enterprises (GSEs)<br />

State and municipal securities<br />

$ 247,182<br />

8,504<br />

$ 16,526,513<br />

584,492<br />

$ -<br />

385,197<br />

$ -<br />

4,917,796<br />

$ 247,182<br />

393,701<br />

Corporate<br />

Mortgage-backed<br />

143,160<br />

856,840 55,332 972,500 198,492<br />

GSE residential<br />

Private-label residential<br />

Private-label commercial<br />

217,795<br />

-<br />

-<br />

15,005,641<br />

-<br />

-<br />

-<br />

5,271<br />

2,468<br />

-<br />

601,448<br />

173,981<br />

217,795<br />

5,271<br />

2,468<br />

Total securities available for sale $ 616,641 $ 32,973,486 $ 448,268 $ 6,665,725 $ 1,064,909<br />

Available for Sale Securities<br />

December 31, 2008:<br />

Debt securities:<br />

U.S. Government-sponsored<br />

enterprises (GSEs) $ 947 $ 3,019,053 $ - $ - $ 947<br />

State and municipal securities 1,298,823 18,905,887 82,959<br />

875,407 1,381,782<br />

Corporate 534,776 2,491,548 27,081 470,462 561,857<br />

Mortgage-backed<br />

GSE residential 825 1,844,464 853 886,992 1,678<br />

Private-label residential - - 80,184 720,005<br />

80,184<br />

Private-label commercial 7,384 331,567 -<br />

- 7,384<br />

Total securities available for sale $ 1,842,755 $ 26,592,519 $ 191,077 $ 2,952,866 $ 2,033,832<br />

Management evaluates securities for other-than-temporary impairment at least on an annual basis, and more frequently<br />

when economic or market conditions warrant such evaluation.<br />

At December 31, 2009 there are two private-label mortgage-backed securities, 11 municipal securities (other) and one<br />

corporate debt security in the investment portfolio that have been in a continuous unrealized loss position for twelve<br />

months or longer.<br />

Private-label mortgage-backed securities. The unrealized losses for twelve months or longer associated with two private<br />

residential mortgage-backed securities are primarily driven by higher projected collateral losses, wider credit spreads, and<br />

changes in interest rates. We assess for credit impairment using a cash flow model. Based upon our assessment of the<br />

expected credit losses of the security given the performance of the underlying collateral compared to our credit<br />

enhancement, we expect to recover the entire amortized cost basis of these securities.<br />

75