pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

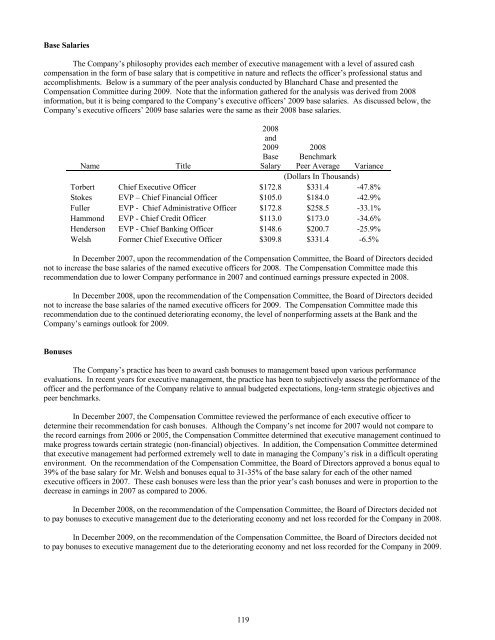

Base Salaries<br />

The Company’s philosophy provides each member of executive management with a level of assured cash<br />

compensation in the form of base salary that is competitive in nature and reflects the officer’s professional status and<br />

accomplishments. Below is a summary of the peer analysis conducted by Blanchard Chase and presented the<br />

Compensation Committee during 2009. Note that the information gathered for the analysis was derived from 2008<br />

information, but it is being compared to the Company’s executive officers’ 2009 base salaries. As discussed below, the<br />

Company’s executive officers’ 2009 base salaries were the same as their 2008 base salaries.<br />

2008<br />

and<br />

2009<br />

Base<br />

Salary<br />

2008<br />

Benchmark<br />

Peer Average<br />

Name<br />

Title<br />

Variance<br />

(Dollars In Thousands)<br />

Torbert Chief Executive Officer $172.8 $331.4 -47.8%<br />

Stokes EVP – Chief <strong>Financial</strong> Officer $105.0 $184.0 -42.9%<br />

Fuller EVP - Chief Administrative Officer $172.8 $258.5 -33.1%<br />

Hammond EVP - Chief Credit Officer $113.0 $173.0 -34.6%<br />

Henderson EVP - Chief Banking Officer $148.6 $200.7 -25.9%<br />

Welsh Former Chief Executive Officer $309.8 $331.4 -6.5%<br />

In December 2007, upon the recommendation of the Compensation Committee, the Board of Directors decided<br />

not to <strong>inc</strong>rease the base salaries of the named executive officers for 2008. The Compensation Committee made this<br />

recommendation due to lower Company performance in 2007 and continued earnings pressure expected in 2008.<br />

In December 2008, upon the recommendation of the Compensation Committee, the Board of Directors decided<br />

not to <strong>inc</strong>rease the base salaries of the named executive officers for 2009. The Compensation Committee made this<br />

recommendation due to the continued deteriorating economy, the level of nonperforming assets at the Bank and the<br />

Company’s earnings outlook for 2009.<br />

Bonuses<br />

The Company’s practice has been to award cash bonuses to management based upon various performance<br />

evaluations. In recent years for executive management, the practice has been to subjectively assess the performance of the<br />

officer and the performance of the Company relative to annual budgeted expectations, long-term strategic objectives and<br />

peer benchmarks.<br />

In December 2007, the Compensation Committee reviewed the performance of each executive officer to<br />

determine their recommendation for cash bonuses. Although the Company’s net <strong>inc</strong>ome for 2007 would not compare to<br />

the record earnings from 2006 or 2005, the Compensation Committee determined that executive management continued to<br />

make progress towards certain strategic (non-financial) objectives. In addition, the Compensation Committee determined<br />

that executive management had performed extremely well to date in managing the Company’s risk in a difficult operating<br />

environment. On the recommendation of the Compensation Committee, the Board of Directors approved a bonus equal to<br />

39% of the base salary for Mr. Welsh and bonuses equal to 31-35% of the base salary for each of the other named<br />

executive officers in 2007. These cash bonuses were less than the prior year’s cash bonuses and were in proportion to the<br />

decrease in earnings in 2007 as compared to 2006.<br />

In December 2008, on the recommendation of the Compensation Committee, the Board of Directors decided not<br />

to pay bonuses to executive management due to the deteriorating economy and net loss recorded for the Company in 2008.<br />

In December 2009, on the recommendation of the Compensation Committee, the Board of Directors decided not<br />

to pay bonuses to executive management due to the deteriorating economy and net loss recorded for the Company in 2009.<br />

119