pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

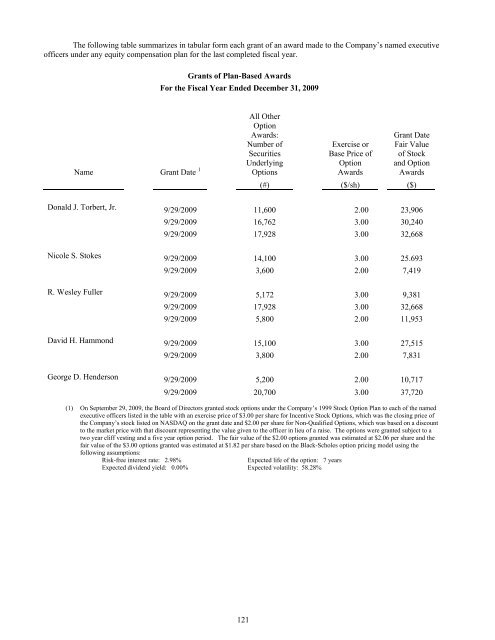

The following table summarizes in tabular form each grant of an award made to the Company’s named executive<br />

officers under any equity compensation plan for the last completed fiscal year.<br />

Grants of Plan-Based Awards<br />

For the Fiscal Year Ended December 31, 2009<br />

All Other<br />

Option<br />

Awards:<br />

Name Grant Date 1 Number of<br />

Securities<br />

Underlying<br />

Options<br />

Exercise or<br />

Base Price of<br />

Option<br />

Awards<br />

Grant Date<br />

Fair Value<br />

of Stock<br />

and Option<br />

Awards<br />

(#) ($/sh) ($)<br />

Donald J. Torbert, Jr.<br />

Nicole S. Stokes<br />

R. Wesley Fuller<br />

9/29/2009 11,600<br />

2.00 23,906<br />

9/29/2009 16,762 3.00 30,240<br />

9/29/2009 17,928 3.00 32,668<br />

9/29/2009 14,100 3.00 25.693<br />

9/29/2009 3,600 2.00 7,419<br />

9/29/2009 5,172 3.00 9,381<br />

9/29/2009 17,928 3.00 32,668<br />

9/29/2009<br />

5,800 2.00 11,953<br />

David H. Hammond 9/29/2009<br />

15,100 3.00 27,515<br />

9/29/2009<br />

3,800 2.00 7,831<br />

George D. Henderson 9/29/2009 5,200 2.00 10,717<br />

9/29/2009 20,700 3.00 37,720<br />

(1) On September 29, 2009, the Board of Directors granted stock options under the Company’s 1999 Stock Option Plan to each of the named<br />

executive officers listed in the table with an exercise price of $3.00 per share for Incentive Stock Options, which was the closing price of<br />

the Company’s stock listed on NASDAQ on the grant date and $2.00 per share for Non-Qualified Options, which was based on a discount<br />

to the market price with that discount representing the value given to the officer in lieu of a raise. The options were granted subject to a<br />

two year cliff vesting and a five year option period. The fair value of the $2.00 options granted was estimated at $2.06 per share and the<br />

fair value of the $3.00 options granted was estimated at $1.82 per share based on the Black-Scholes option pricing model using the<br />

following assumptions:<br />

Risk-free interest rate: 2.98%<br />

Expected life of the option: 7 years<br />

Expected dividend yield: 0.00% Expected volatility: 58.28%<br />

121