pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

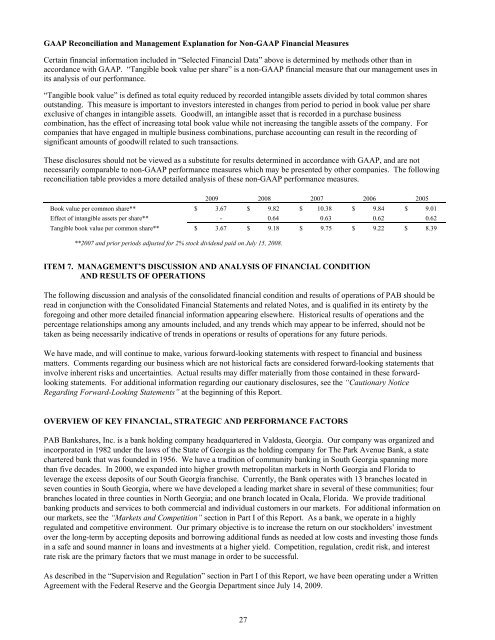

GAAP Reconciliation and Management Explanation for Non-GAAP <strong>Financial</strong> Measures<br />

Certain financial information <strong>inc</strong>luded in “Selected <strong>Financial</strong> Data” above is determined by methods other than in<br />

accordance with GAAP. “Tangible book value per share” is a non-GAAP financial measure that our management uses in<br />

its analysis of our performance.<br />

“Tangible book value” is defined as total equity reduced by recorded intangible assets divided by total common shares<br />

outstanding. This measure is important to investors interested in changes from period to period in book value per share<br />

exclusive of changes in intangible assets. Goodwill, an intangible asset that is recorded in a purchase business<br />

combination, has the effect of <strong>inc</strong>reasing total book value while not <strong>inc</strong>reasing the tangible assets of the company. For<br />

companies that have engaged in multiple business combinations, purchase accounting can result in the recording of<br />

significant amounts of goodwill related to such transactions.<br />

These disclosures should not be viewed as a substitute for results determined in accordance with GAAP, and are not<br />

necessarily comparable to non-GAAP performance measures which may be presented by other companies. The following<br />

reconciliation table provides a more detailed analysis of these non-GAAP performance measures.<br />

2009 2008 2007 2006 2005<br />

Book value per common share** $ 3.67 $ 9.82 $ 10.38 $ 9.84 $ 9.01<br />

Effect of intangible assets per share** - 0.64 0.63 0.62 0.62<br />

Tangible book value per common share** $ 3.67 $ 9.18 $ 9.75 $ 9.22 $ 8.39<br />

**2007 and prior periods adjusted for 2% stock dividend paid on July 15, 2008.<br />

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION<br />

AND RESULTS OF OPERATIONS<br />

The following discussion and analysis of the consolidated financial condition and results of operations of PAB should be<br />

read in conjunction with the Consolidated <strong>Financial</strong> Statements and related Notes, and is qualified in its entirety by the<br />

foregoing and other more detailed financial information appearing elsewhere. Historical results of operations and the<br />

percentage relationships among any amounts <strong>inc</strong>luded, and any trends which may appear to be inferred, should not be<br />

taken as being necessarily indicative of trends in operations or results of operations for any future periods.<br />

We have made, and will continue to make, various forward-looking statements with respect to financial and business<br />

matters. Comments regarding our business which are not historical facts are considered forward-looking statements that<br />

involve inherent risks and uncertainties. Actual results may differ materially from those contained in these forwardlooking<br />

statements. For additional information regarding our cautionary disclosures, see the “Cautionary Notice<br />

Regarding Forward-Looking Statements” at the beginning of this Report.<br />

OVERVIEW OF KEY FINANCIAL, STRATEGIC AND PERFORMANCE FACTORS<br />

PAB Bankshares, Inc. is a bank holding company headquartered in Valdosta, Georgia. Our company was organized and<br />

<strong>inc</strong>orporated in 1982 under the laws of the State of Georgia as the holding company for The Park Avenue Bank, a state<br />

chartered bank that was founded in 1956. We have a tradition of community banking in South Georgia spanning more<br />

than five decades. In 2000, we expanded into higher growth metropolitan markets in North Georgia and Florida to<br />

leverage the excess deposits of our South Georgia franchise. Currently, the Bank operates with 13 branches located in<br />

seven counties in South Georgia, where we have developed a leading market share in several of these communities; four<br />

branches located in three counties in North Georgia; and one branch located in Ocala, Florida. We provide traditional<br />

banking products and services to both commercial and individual customers in our markets. For additional information on<br />

our markets, see the “Markets and Competition” section in Part I of this Report. As a bank, we operate in a highly<br />

regulated and competitive environment. Our primary objective is to <strong>inc</strong>rease the return on our stockholders’ investment<br />

over the long-term by accepting deposits and borrowing additional funds as needed at low costs and investing those funds<br />

in a safe and sound manner in loans and investments at a higher yield. Competition, regulation, credit risk, and interest<br />

rate risk are the primary factors that we must manage in order to be successful.<br />

As described in the “Supervision and Regulation” section in Part I of this Report, we have been operating under a Written<br />

Agreement with the Federal Reserve and the Georgia Department s<strong>inc</strong>e July 14, 2009.<br />

27