pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

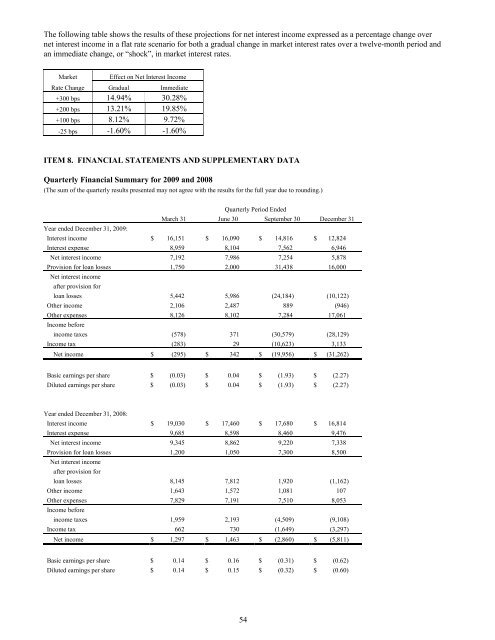

The following table shows the results of these projections for net interest <strong>inc</strong>ome expressed as a percentage change over<br />

net interest <strong>inc</strong>ome in a flat rate scenario for both a gradual change in market interest rates over a twelve-month period and<br />

an immediate change, or “shock”, in market interest rates.<br />

Market<br />

Effect on Net Interest Income<br />

Rate Change Gradual Immediate<br />

+300 bps 14.94% 30.28%<br />

+200 bps 13.21% 19.85%<br />

+100 bps 8.12% 9.72%<br />

-25 bps -1.60% -1.60%<br />

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA<br />

Quarterly <strong>Financial</strong> Summary for 2009 and 2008<br />

(The sum of the quarterly results presented may not agree with the results for the full year due to rounding.)<br />

Quarterly Period Ended<br />

March 31 June 30 September 30 December 31<br />

Year ended December 31, 2009:<br />

Interest <strong>inc</strong>ome $ 16,151 $ 16,090 $ 14,816 $ 12,824<br />

Interest expense 8,959 8,104 7,562 6,946<br />

Net interest <strong>inc</strong>ome 7,192 7,986<br />

7,254 5,878<br />

Provision for loan losses<br />

1,750 2,000 31,438 16,000<br />

Net interest <strong>inc</strong>ome<br />

after provision for<br />

loan losses<br />

5,442 5,986 (24,184) (10,122)<br />

Other <strong>inc</strong>ome 2,106 2,487 889<br />

(946)<br />

Other expenses<br />

8,126 8,102 7,284 17,061<br />

Income before<br />

<strong>inc</strong>ome taxes (578) 371<br />

(30,579) (28,129)<br />

Income tax (283) 29 (10,623)<br />

3,133<br />

Net <strong>inc</strong>ome $ (295) $ 342 $ (19,956) $ (31,262)<br />

Basic earnings per share $ (0.03) $ 0.04 $ (1.93) $ (2.27)<br />

Diluted earnings per share $ (0.03) $ 0.04 $ (1.93) $ (2.27)<br />

Year ended December 31, 2008:<br />

Interest <strong>inc</strong>ome $ 19,030 $ 17,460 $ 17,680 $ 16,814<br />

Interest expense 9,685 8,598<br />

8,460 9,476<br />

Net interest <strong>inc</strong>ome 9,345 8,862 9,220 7,338<br />

Provision for loan losses 1,200<br />

1,050 7,300 8,500<br />

Net interest <strong>inc</strong>ome<br />

after provision for<br />

loan losses 8,145 7,812<br />

1,920 (1,162)<br />

Other <strong>inc</strong>ome 1,643 1,572 1,081 107<br />

Other expenses<br />

7,829 7,191 7,510 8,053<br />

Income before<br />

<strong>inc</strong>ome taxes 1,959 2,193 (4,509) (9,108)<br />

Income tax 662<br />

730 (1,649) (3,297)<br />

Net <strong>inc</strong>ome $ 1,297 $ 1,463 $ (2,860) $ (5,811)<br />

Basic earnings per share $ 0.14 $ 0.16 $ (0.31) $ (0.62)<br />

Diluted earnings per share $ 0.14 $ 0.15 $ (0.32) $ (0.60)<br />

54