pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

NOTE 12.<br />

INCOME TAXES (Continued)<br />

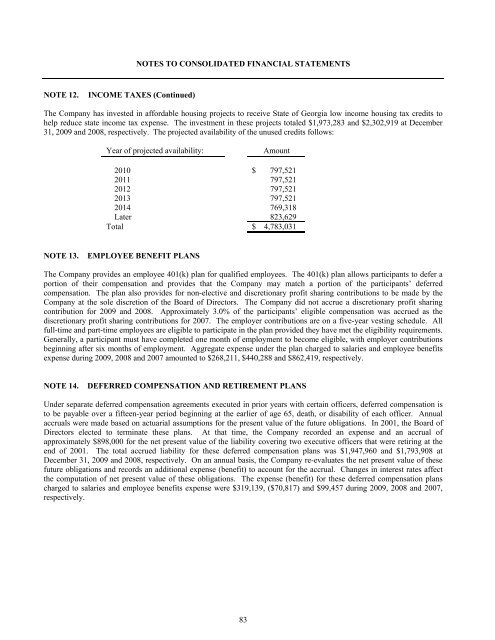

The Company has invested in affordable housing projects to receive State of Georgia low <strong>inc</strong>ome housing tax credits to<br />

help reduce state <strong>inc</strong>ome tax expense. The investment in these projects totaled $1,973,283 and $2,302,919 at December<br />

31, 2009 and 2008, respectively. The projected availability of the unused credits follows:<br />

Year of projected availability:<br />

Amount<br />

2010 $ 797,521<br />

2011 797,521<br />

2012 797,521<br />

2013 797,521<br />

2014 769,318<br />

Later 823,629<br />

Total $ 4,783,031<br />

NOTE 13.<br />

EMPLOYEE BENEFIT PLANS<br />

The Company provides an employee 401(k) plan for qualified employees. The 401(k) plan allows participants to defer a<br />

portion of their compensation and provides that the Company may match a portion of the participants’ deferred<br />

compensation. The plan also provides for non-elective and discretionary profit sharing contributions to be made by the<br />

Company at the sole discretion of the Board of Directors. The Company did not accrue a discretionary profit sharing<br />

contribution for 2009 and 2008. Approximately 3.0% of the participants’ eligible compensation was accrued as the<br />

discretionary profit sharing contributions for 2007. The employer contributions are on a five-year vesting schedule. All<br />

full-time and part-time employees are eligible to participate in the plan provided they have met the eligibility requirements.<br />

Generally, a participant must have completed one month of employment to become eligible, with employer contributions<br />

beginning after six months of employment. Aggregate expense under the plan charged to salaries and employee benefits<br />

expense during 2009, 2008 and 2007 amounted to $268,211, $440,288 and $862,419, respectively.<br />

NOTE 14.<br />

DEFERRED COMPENSATION AND RETIREMENT PLANS<br />

Under separate deferred compensation agreements executed in prior years with certain officers, deferred compensation is<br />

to be payable over a fifteen-year period beginning at the earlier of age 65, death, or disability of each officer. Annual<br />

accruals were made based on actuarial assumptions for the present value of the future obligations. In 2001, the Board of<br />

Directors elected to terminate these plans. At that time, the Company recorded an expense and an accrual of<br />

approximately $898,000 for the net present value of the liability covering two executive officers that were retiring at the<br />

end of 2001. The total accrued liability for these deferred compensation plans was $1,947,960 and $1,793,908 at<br />

December 31, 2009 and 2008, respectively. On an annual basis, the Company re-evaluates the net present value of these<br />

future obligations and records an additional expense (benefit) to account for the accrual. Changes in interest rates affect<br />

the computation of net present value of these obligations. The expense (benefit) for these deferred compensation plans<br />

charged to salaries and employee benefits expense were $319,139, ($70,817) and $99,457 during 2009, 2008 and 2007,<br />

respectively.<br />

83