pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

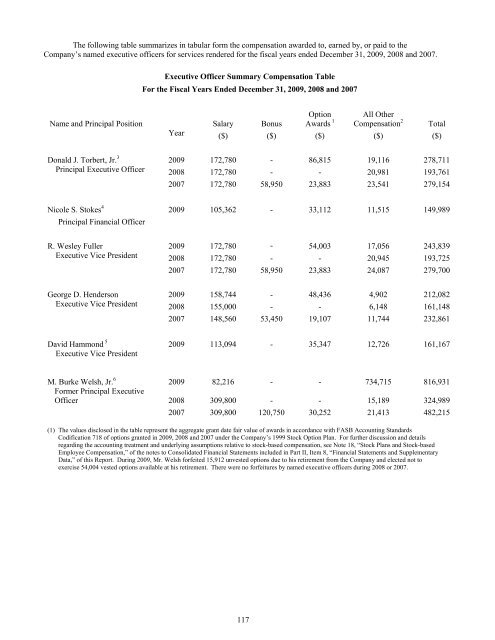

The following table summarizes in tabular form the compensation awarded to, earned by, or paid to the<br />

Company’s named executive officers for services rendered for the fiscal years ended December 31, 2009, 2008 and 2007.<br />

Executive Officer Summary Compensation Table<br />

For the Fiscal Years Ended December 31, 2009, 2008 and 2007<br />

Option All Other<br />

Name and Pr<strong>inc</strong>ipal Position Salary Bonus Awards 1 Compensation 2 Total<br />

Year ($) ($) ($) ($)<br />

($)<br />

Donald J. Torbert, Jr. 3 2009 172,780 - 86,815 19,116 278,711<br />

Pr<strong>inc</strong>ipal Executive Officer 2008 172,780 - - 20,981 193,761<br />

2007 172,780 58,950 23,883 23,541 279,154<br />

Nicole S. Stokes 4 2009 105,362 - 33,112 11,515 149,989<br />

Pr<strong>inc</strong>ipal <strong>Financial</strong> Officer<br />

R. Wesley Fuller 2009 172,780 -<br />

54,003<br />

-<br />

17,056 243,839<br />

2007 172,780 58,950 23,883 24,087 279,700<br />

George D. Henderson 2009 158,744 - 48,436 4,902 212,082<br />

Executive Vice President 2008 155,000 - - 6,148 161,148<br />

2007 148,560 53,450 19,107 11,744 232,861<br />

David Hammond 5 2009 113,094 - 35,347 12,726 161,167<br />

Executive Vice President<br />

M. Burke Welsh, Jr . 6 2009 82,216 -<br />

- 734,715 816,931<br />

Former Pr<strong>inc</strong>ipal Executive<br />

Officer 2008 309,800 - - 15,189 324,989<br />

2007 309,800 120,750 30,252 21,413 482,215<br />

(1) The values disclosed in the table represent the aggregate grant date fair value of awards in accordance with FASB Accounting Standards<br />

Codification 718 of options granted in 2009, 2008 and 2007 under the Company’s 1999 Stock Option Plan. For further discussion and details<br />

regarding the accounting treatment and underlying assumptions relative to stock-based compensation, see Note 18, “Stock Plans and Stock-based<br />

Employee Compensation,” of the notes to Consolidated <strong>Financial</strong> Statements <strong>inc</strong>luded in Part II, Item 8, “<strong>Financial</strong> Statements and Supplementary<br />

Data,” of this Report. During 2009, Mr. Welsh forfeited 15,912 unvested options due to his retirement from the Company and elected not to<br />

exercise 54,004 vested options available at his retirement. There were no forfeitures by named executive officers during 2008 or 2007.<br />

117