pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

On September 4, 2009, the Company began exercising its right to defer quarterly interest payments for its Debentures. We<br />

have provided notice of our deferral of the two interest payments from September 30, 2009 to December 31, 2009. We<br />

expect to defer the interest payments into the foreseeable future. During this period of deferral, the Company is precluded<br />

from repurchasing shares of common stock and from paying dividends on outstanding common stock. We will continue to<br />

accrue for the interest payable after the deferral period in our consolidated statement of <strong>inc</strong>ome (loss).<br />

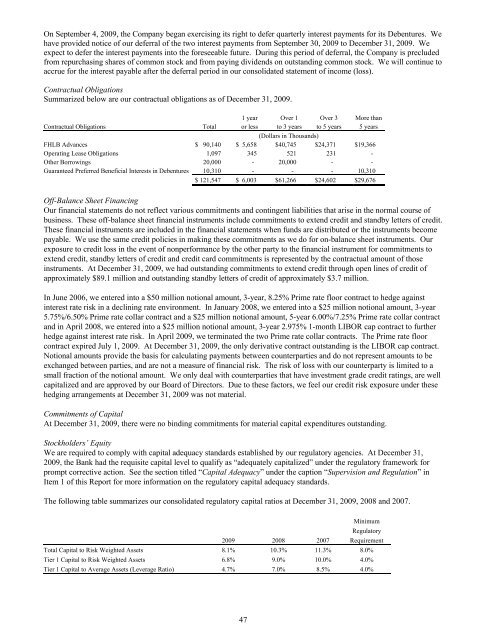

Contractual Obligations<br />

Summarized below are our contractual obligations as of December 31, 2009.<br />

1 year Over 1 Over 3 More than<br />

Contractual Obligations Total or less to 3 years to 5 years 5 years<br />

(Dollars in Thousands)<br />

FHLB Advances $ 90,140 $ 5,658 $40,745 $24,371 $19,366<br />

Operating Lease Obligations 1,097 345 521 231 -<br />

Other Borrowings 20,000 - 20,000 - -<br />

Guaranteed Preferred Beneficial Interests in Debentures 10,310 - - - 10,310<br />

$ 121,547 $ 6,003 $61,266 $24,602 $29,676<br />

Off-Balance Sheet Financing<br />

Our financial statements do not reflect various commitments and contingent liabilities that arise in the normal course of<br />

business. These off-balance sheet financial instruments <strong>inc</strong>lude commitments to extend credit and standby letters of credit.<br />

These financial instruments are <strong>inc</strong>luded in the financial statements when funds are distributed or the instruments become<br />

payable. We use the same credit policies in making these commitments as we do for on-balance sheet instruments. Our<br />

exposure to credit loss in the event of nonperformance by the other party to the financial instrument for commitments to<br />

extend credit, standby letters of credit and credit card commitments is represented by the contractual amount of those<br />

instruments. At December 31, 2009, we had outstanding commitments to extend credit through open lines of credit of<br />

approximately $89.1 million and outstanding standby letters of credit of approximately $3.7 million.<br />

In June 2006, we entered into a $50 million notional amount, 3-year, 8.25% Prime rate floor contract to hedge against<br />

interest rate risk in a declining rate environment. In January 2008, we entered into a $25 million notional amount, 3-year<br />

5.75%/6.50% Prime rate collar contract and a $25 million notional amount, 5-year 6.00%/7.25% Prime rate collar contract<br />

and in April 2008, we entered into a $25 million notional amount, 3-year 2.975% 1-month LIBOR cap contract to further<br />

hedge against interest rate risk. In April 2009, we terminated the two Prime rate collar contracts. The Prime rate floor<br />

contract expired July 1, 2009. At December 31, 2009, the only derivative contract outstanding is the LIBOR cap contract.<br />

Notional amounts provide the basis for calculating payments between counterparties and do not represent amounts to be<br />

exchanged between parties, and are not a measure of financial risk. The risk of loss with our counterparty is limited to a<br />

small fraction of the notional amount. We only deal with counterparties that have investment grade credit ratings, are well<br />

capitalized and are approved by our Board of Directors. Due to these factors, we feel our credit risk exposure under these<br />

hedging arrangements at December 31, 2009 was not material.<br />

Commitments of Capital<br />

At December 31, 2009, there were no binding commitments for material capital expenditures outstanding.<br />

Stockholders’ Equity<br />

We are required to comply with capital adequacy standards established by our regulatory agencies. At December 31,<br />

2009, the Bank had the requisite capital level to qualify as “adequately capitalized” under the regulatory framework for<br />

prompt corrective action. See the section titled “Capital Adequacy” under the caption “Supervision and Regulation” in<br />

Item 1 of this Report for more information on the regulatory capital adequacy standards.<br />

The following table summarizes our consolidated regulatory capital ratios at December 31, 2009, 2008 and 2007.<br />

Minimum<br />

Regulatory<br />

2009 2008 2007 Requirement<br />

Total Capital to Risk Weighted Assets 8.1% 10.3% 11.3% 8.0%<br />

Tier 1 Capital to Risk Weighted Assets 6.8% 9.0% 10.0% 4.0%<br />

Tier 1 Capital to Average Assets (Leverage Ratio) 4.7% 7.0% 8.5% 4.0%<br />

47