pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

NOTE 4.<br />

INVESTMENT SECURITIES (Continued)<br />

Corporate bonds. The unrealized losses for twelve months or longer on investment in one corporate bond relates to an<br />

investment in a company within the financial services sector. The unrealized losses are primarily caused by recent<br />

decreases in profitability and profit forecasts by industry analysts. The contractual terms of those investments do not<br />

permit the Company to settle the security at a price less than the par value of the investments. The Company currently<br />

does not believe it is probable that it will be unable to collect all amounts due according to the contractual terms of the<br />

investments. Because the Company does not intend to sell the investment and it is not more likely than not that the<br />

Company will be required to sell the investments before recovery of its par value, which may be maturity, it does not<br />

consider these investments to be other-than-temporarily impaired at December 31, 2009.<br />

State and municipal securities. The unrealized losses for twelve months or longer relates to 11 municipal securities. The<br />

unrealized losses are primarily caused by securities no longer being insured and/or ratings being withdrawn given the<br />

current economic environment. Because the Company does not intend to sell the investments and it is not more likely than<br />

not that the Company will be required to sell the investments before recovery of their amortized cost bases, which may be<br />

maturity, the Company does not consider those investments to be other-than-temporarily impaired at December 31, 2009.<br />

NOTE 5.<br />

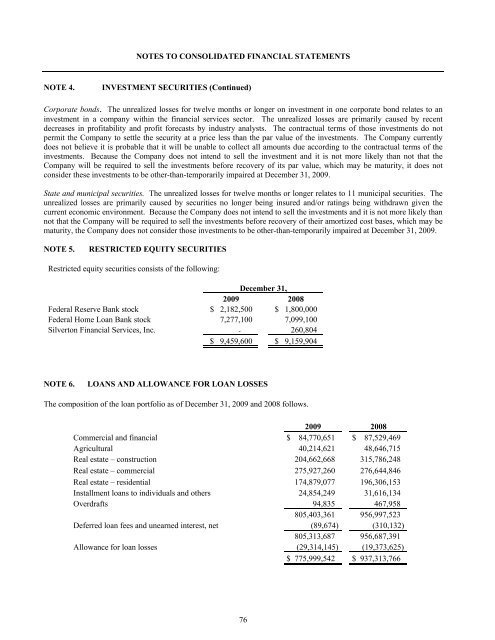

RESTRICTED EQUITY SECURITIES<br />

Restricted equity securities consists of the following:<br />

December 31,<br />

2009 2008<br />

Federal Reserve Bank stock $ 2,182,500 $ 1,800,000<br />

Federal Home Loan Bank stock 7,277,100 7,099,100<br />

Silverton <strong>Financial</strong> Services, Inc. - 260,804<br />

$ 9,459,600 $ 9,159,904<br />

NOTE 6.<br />

LOANS AND ALLOWANCE FOR LOAN LOSSES<br />

The composition of the loan portfolio as of December 31, 2009 and 2008 follows.<br />

2009 2008<br />

Commercial and financial $ 84,770,651 $ 87,529,469<br />

Agricultural 40,214,621 48,646,715<br />

Real estate – construction 204,662,668 315,786,248<br />

Real estate – commercial 275,927,260 276,644,846<br />

Real estate – residential 174,879,077 196,306,153<br />

Installment loans to individuals and others<br />

24,854,249 31,616,134<br />

Overdrafts 94,835 467,958<br />

805,403,361 956,997,523<br />

Deferred loan fees and unearned interest, net (89,674) (310,132)<br />

805,313,687 956,687,391<br />

Allowance for loan losses (29,314,145) (19,373,625)<br />

$ 775,999,542 $ 937,313,766<br />

76