pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

NOTE 22. DERIVATIVE FINANCIAL INSTRUMENTS (Continued)<br />

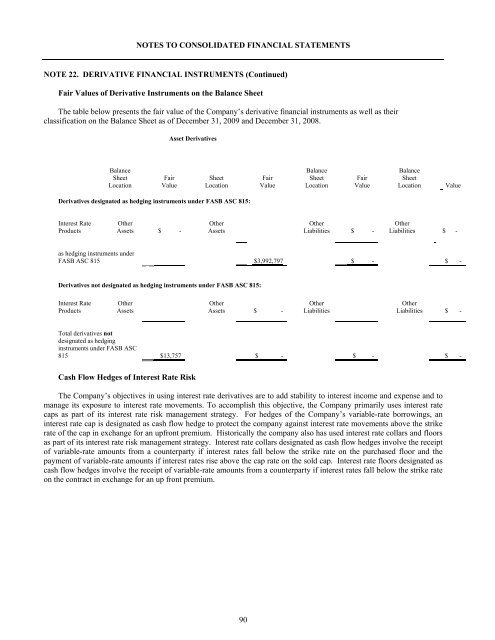

Fair Values of Derivative Instruments on the Balance Sheet<br />

The table below presents the fair value of the Company’s derivative financial instruments as well as their<br />

classification on the Balance Sheet as of December 31, 2009 and December 31, 2008.<br />

Asset Derivatives<br />

Liability Derivatives<br />

As of December 31, 2009 As of December 31, 2008 As of December 31, 2009 As of December 31, 2008<br />

Balance<br />

Sheet<br />

Location<br />

Fair<br />

Value<br />

Balance<br />

Sheet<br />

Location<br />

Fair<br />

Value<br />

Balance<br />

Sheet<br />

Location<br />

Fair<br />

Value<br />

Balance<br />

Sheet<br />

Location<br />

Fair<br />

Value<br />

Derivatives designated as hedging instruments under FASB ASC 815:<br />

Interest Rate<br />

Products<br />

Other<br />

Assets $ -<br />

Other<br />

Assets $3,992,797<br />

Other<br />

Liabilities $ -<br />

Other<br />

Liabilities<br />

$ -<br />

Total derivatives designated<br />

as hedging instruments under<br />

FASB ASC 815 $ - $3,992,797 $ -<br />

$ -<br />

Derivatives not designated as hedging instruments under FASB ASC 815:<br />

Interest Rate<br />

Products<br />

Other<br />

Assets $13,757<br />

Other<br />

Assets $ -<br />

Other<br />

Other<br />

Liabilities $ - Liabilities $ -<br />

Total derivatives not<br />

designated as hedging<br />

instruments under FASB ASC<br />

815 $13,757<br />

$ - $ - $ -<br />

Cash Flow Hedges of Interest Rate Risk<br />

The Company’s objectives in using interest rate derivatives are to add stability to interest <strong>inc</strong>ome and expense and to<br />

manage its exposure to interest rate movements. To accomplish this objective, the Company primarily uses interest rate<br />

caps as part of its interest rate risk management strategy. For hedges of the Company’s variable-rate borrowings, an<br />

interest rate cap is designated as cash flow hedge to protect the company against interest rate movements above the strike<br />

rate of the cap in exchange for an upfront premium. Historically the company also has used interest rate collars and floors<br />

as part of its interest rate risk management strategy. Interest rate collars designated as cash flow hedges involve the receipt<br />

of variable-rate amounts from a counterparty if interest rates fall below the strike rate on the purchased floor and the<br />

payment of variable-rate amounts if interest rates rise above the cap rate on the sold cap. Interest rate floors designated as<br />

cash flow hedges involve the receipt of variable-rate amounts from a counterparty if interest rates fall below the strike rate<br />

on the contract in exchange for an up front premium.<br />

90