pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

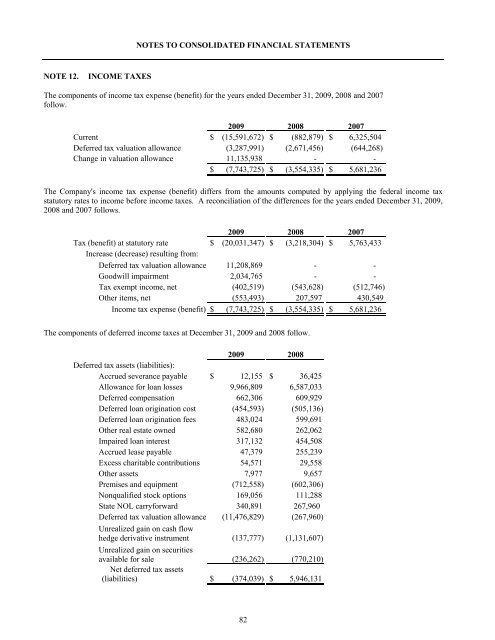

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

NOTE 12.<br />

INCOME TAXES<br />

The components of <strong>inc</strong>ome tax expense (benefit) for the years ended December 31, 2009, 2008 and 2007<br />

follow.<br />

2009 2008 2007<br />

Current $ (15,591,672) $ (882,879) $ 6,325,504<br />

Deferred tax valuation allowance (3,287,991) (2,671,456) (644,268)<br />

Change in valuation allowance 11,135,938 - -<br />

$ (7,743,725) $ (3,554,335) $ 5,681,236<br />

The Company's <strong>inc</strong>ome tax expense (benefit) differs from the amounts computed by applying the federal <strong>inc</strong>ome tax<br />

statutory rates to <strong>inc</strong>ome before <strong>inc</strong>ome taxes. A reconciliation of the differences for the years ended December 31, 2009,<br />

2008 and 2007 follows.<br />

2009 2008 2007<br />

Tax (benefit) at statutory rate $ (20,031,347) $ (3,218,304) $ 5,763,433<br />

Increase (decrease) resulting from:<br />

Deferred tax valuation allowance 11,208,869 - -<br />

Goodwill impairment 2,034,765 - -<br />

Tax exempt <strong>inc</strong>ome, net (402,519) (543,628) (512,746)<br />

Other items, net (553,493) 207,597 430,549<br />

Income tax expense (benefit) $ (7,743,725) $ (3,554,335) $ 5,681,236<br />

The components of deferred <strong>inc</strong>ome taxes at December 31, 2009 and 2008 follow.<br />

2009 2008<br />

Deferred tax assets (liabilities):<br />

Accrued severance payable $ 12,155 $ 36,425<br />

Allowance for loan losses 9,966,809 6,587,033<br />

Deferred compensation 662,306 609,929<br />

Deferred loan origination cost (454,593) (505,136)<br />

Deferred loan origination fees 483,024 599,691<br />

Other real estate owned<br />

Impaired loan interest<br />

582,680<br />

317,132<br />

262,062<br />

454,508<br />

Accrued lease payable<br />

Excess charitable contributions<br />

Other assets<br />

47,379<br />

54,571<br />

7,977<br />

255,239<br />

29,558<br />

9,657<br />

Premises and equipment<br />

(712,558) (602,306)<br />

Nonqualified stock options 169,056 111,288<br />

State NOL carryforward 340,891 267,960<br />

Deferred tax valuation allowance (11,476,829) (267,960)<br />

Unrealized gain on cash flow<br />

hedge derivative instrument (137,777) (1,131,607)<br />

Unrealized gain on securities<br />

available for sale<br />

(236,262) (770,210)<br />

Net deferred tax assets<br />

(liabilities) $ (374,039) $ 5,946,131<br />

82