pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

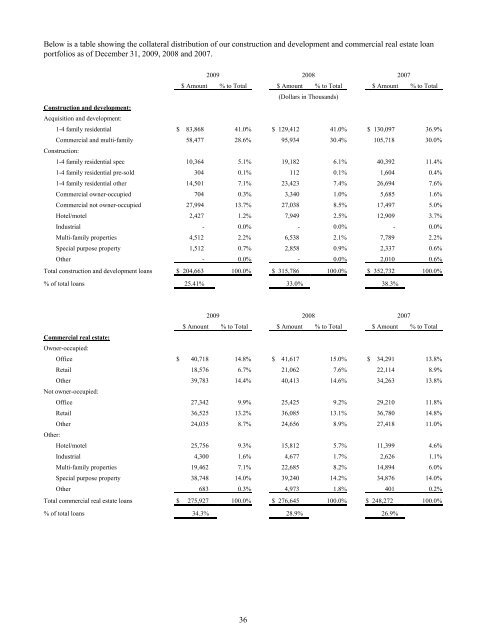

Below is a table showing the collateral distribution of our construction and development and commercial real estate loan<br />

portfolios as of December 31, 2009, 2008 and 2007.<br />

2009 2008 2007<br />

$ Amount % to Total $ Amount % to Total $ Amount % to Total<br />

(Dollars in Thousands)<br />

Construction and development:<br />

Acquisition and development:<br />

1-4 family residential $ 83,868 41.0% $ 129,412 41.0% $ 130,097 36.9%<br />

Commercial and multi-family 58,477 28.6% 95,934 30.4% 105,718 30.0%<br />

Construction:<br />

1-4 family residential spec 10,364 5.1% 19,182 6.1% 40,392 11.4%<br />

1-4 family residential pre-sold 304 0.1% 112 0.1% 1,604 0.4%<br />

1-4 family residential other 14,501 7.1% 23,423 7.4% 26,694 7.6%<br />

Commercial owner-occupied 704 0.3% 3,340 1.0% 5,685 1.6%<br />

Commercial not owner-occupied 27,994 13.7% 27,038 8.5% 17,497 5.0%<br />

Hotel/motel 2,427 1.2% 7,949 2.5% 12,909 3.7%<br />

Industrial - 0.0% - 0.0% - 0.0%<br />

Multi-family properties 4,512 2.2% 6,538 2.1% 7,789 2.2%<br />

Special purpose property 1,512 0.7% 2,858 0.9% 2,337 0.6%<br />

Other - 0.0% - 0.0% 2,010 0.6%<br />

Total construction and development loans $ 204,663 100.0% $ 315,786 100.0% $ 352,732 100.0%<br />

% of total loans 25.41% 33.0% 38.3%<br />

2009 2008 2007<br />

$ Amount % to Total $ Amount % to Total $ Amount % to Total<br />

Commercial real estate:<br />

Owner-occupied:<br />

Office $ 40,718 14.8% $ 41,617 15.0% $ 34,291 13.8%<br />

Retail 18,576 6.7% 21,062 7.6% 22,114 8.9%<br />

Other 39,783 14.4% 40,413 14.6% 34,263 13.8%<br />

Not owner-occupied:<br />

Office 27,342 9.9% 25,425 9.2% 29,210 11.8%<br />

Retail 36,525 13.2% 36,085 13.1% 36,780 14.8%<br />

Other 24,035 8.7% 24,656 8.9% 27,418 11.0%<br />

Other:<br />

Hotel/motel 25,756 9.3% 15,812 5.7% 11,399 4.6%<br />

Industrial 4,300 1.6% 4,677 1.7% 2,626 1.1%<br />

Multi-family properties 19,462 7.1% 22,685 8.2% 14,894 6.0%<br />

Special purpose property 38,748 14.0% 39,240 14.2% 34,876 14.0%<br />

Other 683 0.3% 4,973 1.8% 401 0.2%<br />

Total commercial real estate loans $ 275,927 100.0% $ 276,645 100.0% $ 248,272 100.0%<br />

% of total loans 34.3% 28.9% 26.9%<br />

36