pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

NOTE 22. DERIVATIVE FINANCIAL INSTRUMENTS (Continued)<br />

Non-designated Hedges<br />

The Company does not use derivatives for trading or speculative purposes. Derivatives not designated as hedges are<br />

used to manage the Company’s exposure to interest rate movements and other identified risks but do not meet the strict<br />

hedge accounting requirements of FASB ASC 815. Changes in the fair value of derivatives not designated in hedging<br />

relationships are recorded directly in earnings. As of December 31, 2009 the Company had one outstanding derivative, a<br />

$25 million dollar notional cap, which failed to qualify for hedge accounting as of September 30, 2009 due to a mismatch<br />

between the cap notional and the money market account balances being hedged. Subsequently, the changes in fair value of<br />

the cap from June 30, 2009 through December 31, 2009 were recognized directly in earnings which resulted in a loss for<br />

the period of $15,074.<br />

During the quarter ended June 30, 2009 the Company terminated a $25 million notional collar that failed to qualify for<br />

hedge accounting; accordingly, the changes in fair value of the collar during the six months ended June 30, 2009 of<br />

$137,150 has been recognized directly in earnings as a loss.<br />

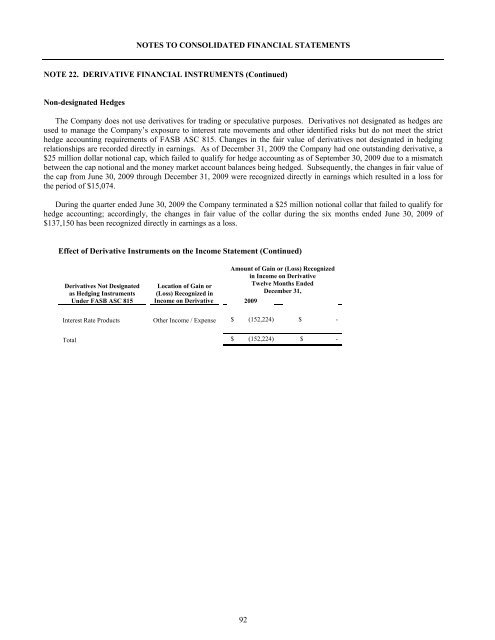

Effect of Derivative Instruments on the Income Statement (Continued)<br />

Derivatives Not Designated<br />

as Hedging Instruments<br />

Under FASB ASC 815<br />

Amount of Gain or (Loss) Recognized<br />

in Income on Derivative<br />

Location of Gain or<br />

Twelve Months Ended<br />

(Loss) Recognized in<br />

December 31,<br />

Income on Derivative 2009<br />

2008<br />

Interest Rate Products Other Income / Expense $ (152,224)<br />

$ -<br />

Total $ (152,224) $ -<br />

92