pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

pab bankshares, inc. - SNL Financial

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

earned and corresponding expenses in 2009 are not expected in 2010.<br />

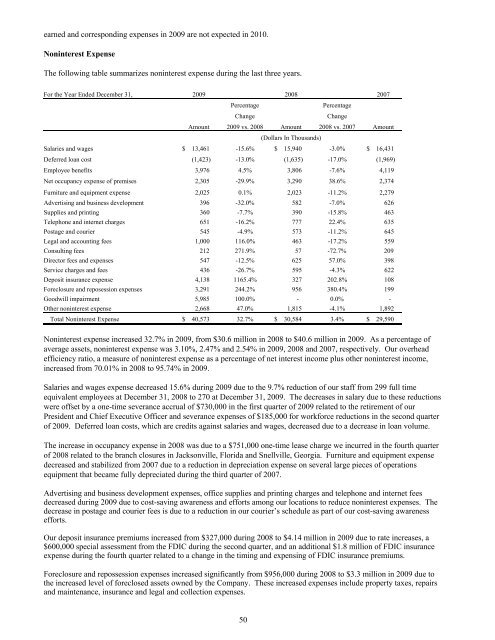

Noninterest Expense<br />

The following table summarizes noninterest expense during the last three years.<br />

For the Year Ended December 31, 2009 2008 2007<br />

Percentage<br />

Percentage<br />

Change<br />

Change<br />

Amount 2009 vs. 2008 Amount 2008 vs. 2007 Amount<br />

(Dollars In Thousands)<br />

Salaries and wages $ 13,461 -15.6% $ 15,940 -3.0% $ 16,431<br />

Deferred loan cost (1,423) -13.0% (1,635) -17.0% (1,969)<br />

Employee benefits 3,976 4.5% 3,806 -7.6% 4,119<br />

Net occupancy expense of premises 2,305 -29.9% 3,290 38.6% 2,374<br />

Furniture and equipment expense 2,025 0.1% 2,023 -11.2% 2,279<br />

Advertising and business development 396 -32.0% 582 -7.0% 626<br />

Supplies and printing 360 -7.7% 390 -15.8% 463<br />

Telephone and internet charges 651 -16.2% 777 22.4% 635<br />

Postage and courier 545 -4.9% 573 -11.2% 645<br />

Legal and accounting fees 1,000 116.0% 463 -17.2% 559<br />

Consulting fees 212 271.9% 57 -72.7% 209<br />

Director fees and expenses 547 -12.5% 625 57.0% 398<br />

Service charges and fees 436 -26.7% 595 -4.3% 622<br />

Deposit insurance expense 4,138 1165.4% 327 202.8% 108<br />

Foreclosure and reposession expenses 3,291 244.2% 956 380.4% 199<br />

Goodwill impairment 5,985 100.0% - 0.0% -<br />

Other noninterest expense 2,668 47.0% 1,815 -4.1% 1,892<br />

Total Noninterest Expense $ 40,573 32.7% $ 30,584 3.4% $ 29,590<br />

Noninterest expense <strong>inc</strong>reased 32.7% in 2009, from $30.6 million in 2008 to $40.6 million in 2009. As a percentage of<br />

average assets, noninterest expense was 3.10%, 2.47% and 2.54% in 2009, 2008 and 2007, respectively. Our overhead<br />

efficiency ratio, a measure of noninterest expense as a percentage of net interest <strong>inc</strong>ome plus other noninterest <strong>inc</strong>ome,<br />

<strong>inc</strong>reased from 70.01% in 2008 to 95.74% in 2009.<br />

Salaries and wages expense decreased 15.6% during 2009 due to the 9.7% reduction of our staff from 299 full time<br />

equivalent employees at December 31, 2008 to 270 at December 31, 2009. The decreases in salary due to these reductions<br />

were offset by a one-time severance accrual of $730,000 in the first quarter of 2009 related to the retirement of our<br />

President and Chief Executive Officer and severance expenses of $185,000 for workforce reductions in the second quarter<br />

of 2009. Deferred loan costs, which are credits against salaries and wages, decreased due to a decrease in loan volume.<br />

The <strong>inc</strong>rease in occupancy expense in 2008 was due to a $751,000 one-time lease charge we <strong>inc</strong>urred in the fourth quarter<br />

of 2008 related to the branch closures in Jacksonville, Florida and Snellville, Georgia. Furniture and equipment expense<br />

decreased and stabilized from 2007 due to a reduction in depreciation expense on several large pieces of operations<br />

equipment that became fully depreciated during the third quarter of 2007.<br />

Advertising and business development expenses, office supplies and printing charges and telephone and internet fees<br />

decreased during 2009 due to cost-saving awareness and efforts among our locations to reduce noninterest expenses. The<br />

decrease in postage and courier fees is due to a reduction in our courier’s schedule as part of our cost-saving awareness<br />

efforts.<br />

Our deposit insurance premiums <strong>inc</strong>reased from $327,000 during 2008 to $4.14 million in 2009 due to rate <strong>inc</strong>reases, a<br />

$600,000 special assessment from the FDIC during the second quarter, and an additional $1.8 million of FDIC insurance<br />

expense during the fourth quarter related to a change in the timing and expensing of FDIC insurance premiums.<br />

Foreclosure and repossession expenses <strong>inc</strong>reased significantly from $956,000 during 2008 to $3.3 million in 2009 due to<br />

the <strong>inc</strong>reased level of foreclosed assets owned by the Company. These <strong>inc</strong>reased expenses <strong>inc</strong>lude property taxes, repairs<br />

and maintenance, insurance and legal and collection expenses.<br />

50