manitou springs city council regular meeting agenda city council

manitou springs city council regular meeting agenda city council

manitou springs city council regular meeting agenda city council

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

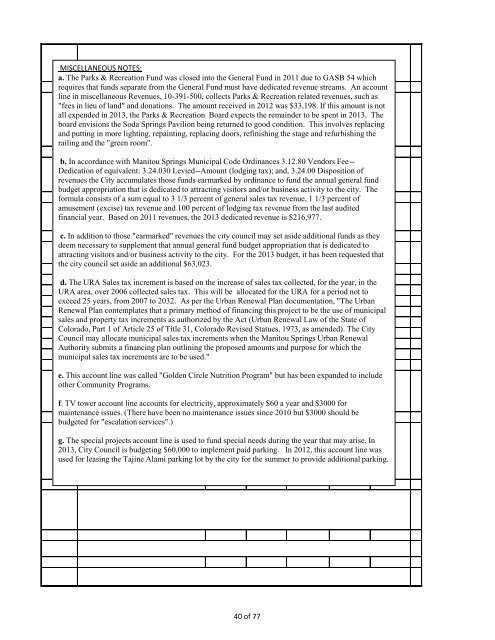

MISCELLANEOUS NOTES:<br />

a. The Parks & Recreation Fund was closed into the General Fund in 2011 due to GASB 54 which<br />

requires that funds separate from the General Fund must have dedicated revenue streams. An account<br />

line in miscellaneous Revenues, 10-391-500, collects Parks & Recreation related revenues, such as<br />

"fees in lieu of land" and donations. The amount received in 2012 was $33,198. If this amount is not<br />

all expended in 2013, the Parks & Recreation Board expects the remainder to be spent in 2013. The<br />

board envisions the Soda Springs Pavilion being returned to good condition. This involves replacing<br />

and putting in more lighting, repainting, replacing doors, refinishing the stage and refurbishing the<br />

railing and the "green room".<br />

b. In accordance with Manitou Springs Municipal Code Ordinances 3.12.80 Vendors Fee--<br />

Dedication of equivalent: 3.24.030 Levied--Amount (lodging tax); and, 3.24.00 Disposition of<br />

revenues the City accumulates those funds earmarked by ordinance to fund the annual general fund<br />

budget appropriation that is dedicated to attracting visitors and/or business activity to the <strong>city</strong>. The<br />

formula consists of a sum equal to 3 1/3 percent of general sales tax revenue, 1 1/3 percent of<br />

amusement (excise) tax revenue and 100 percent of lodging tax revenue from the last audited<br />

financial year. Based on 2011 revenues, the 2013 dedicated revenue is $216,977.<br />

c. In addition to those "earmarked" revenues the <strong>city</strong> <strong>council</strong> may set aside additional funds as they<br />

deem necessary to supplement that annual general fund budget appropriation that is dedicated to<br />

attracting visitors and/or business activity to the <strong>city</strong>. For the 2013 budget, it has been requested that<br />

the <strong>city</strong> <strong>council</strong> set aside an additional $63,023.<br />

d. The URA Sales tax increment is based on the increase of sales tax collected, for the year, in the<br />

URA area, over 2006 collected sales tax. This will be allocated for the URA for a period not to<br />

exceed 25 years, from 2007 to 2032. As per the Urban Renewal Plan documentation, "The Urban<br />

Renewal Plan contemplates that a primary method of financing this project to be the use of municipal<br />

sales and property tax increments as authorized by the Act (Urban Renewal Law of the State of<br />

Colorado, Part 1 of Article 25 of Title 31, Colorado Revised Statues, 1973, as amended). The City<br />

Council may allocate municipal sales tax increments when the Manitou Springs Urban Renewal<br />

Authority submits a financing plan outlining the proposed amounts and purpose for which the<br />

municipal sales tax increments are to be used."<br />

e. This account line was called "Golden Circle Nutrition Program" but has been expanded to include<br />

other Community Programs.<br />

f. TV tower account line accounts for electri<strong>city</strong>, approximately $60 a year and $3000 for<br />

maintenance issues. (There have been no maintenance issues since 2010 but $3000 should be<br />

budgeted for "escalation services".)<br />

g. The special projects account line is used to fund special needs during the year that may arise. In<br />

2013, City Council is budgeting $60,000 to implement paid parking. In 2012, this account line was<br />

used for leasing the Tajine Alami parking lot by the <strong>city</strong> for the summer to provide additional parking.<br />

40 of 77