Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

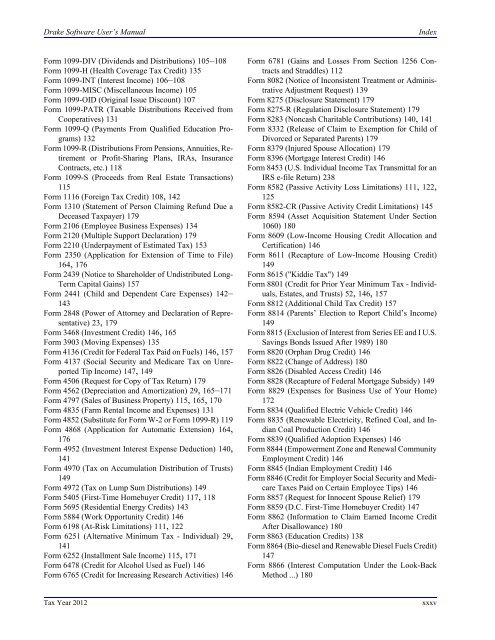

<strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong><br />

Index<br />

Form 1099-DIV (Dividends and Distributions) 105–108<br />

Form 1099-H (Health Coverage Tax Credit) 135<br />

Form 1099-INT (Interest Income) 106–108<br />

Form 1099-MISC (Miscellaneous Income) 105<br />

Form 1099-OID (Original Issue Discount) 107<br />

Form 1099-PATR (Taxable Distributions Received from<br />

Cooperatives) 131<br />

Form 1099-Q (Payments From Qualified Education Programs)<br />

132<br />

Form 1099-R (Distributions From Pensions, Annuities, Retirement<br />

or Profit-Sharing Plans, IRAs, Insurance<br />

Contracts, etc.) 118<br />

Form 1099-S (Proceeds from Real Estate Transactions)<br />

115<br />

Form 1116 (Foreign Tax Credit) 108, 142<br />

Form 1310 (Statement of Person Claiming Refund Due a<br />

Deceased Taxpayer) 179<br />

Form 2106 (Employee Business Expenses) 134<br />

Form 2120 (Multiple Support Declaration) 179<br />

Form 2210 (Underpayment of Estimated Tax) 153<br />

Form 2350 (Application for Extension of Time to File)<br />

164, 176<br />

Form 2439 (Notice to Shareholder of Undistributed Long-<br />

Term Capital Gains) 157<br />

Form 2441 (Child and Dependent Care Expenses) 142–<br />

143<br />

Form 2848 (Power of Attorney and Declaration of Representative)<br />

23, 179<br />

Form 3468 (Investment Credit) 146, 165<br />

Form 3903 (Moving Expenses) 135<br />

Form 4136 (Credit for Federal Tax Paid on Fuels) 146, 157<br />

Form 4137 (Social Security and Medicare Tax on Unreported<br />

Tip Income) 147, 149<br />

Form 4506 (Request for Copy of Tax Return) 179<br />

Form 4562 (Depreciation and Amortization) 29, 165–171<br />

Form 4797 (Sales of Business Property) 115, 165, 170<br />

Form 4835 (Farm Rental Income and Expenses) 131<br />

Form 4852 (Substitute for Form W-2 or Form 1099-R) 119<br />

Form 4868 (Application for Automatic Extension) 164,<br />

176<br />

Form 4952 (Investment Interest Expense Deduction) 140,<br />

141<br />

Form 4970 (Tax on Accumulation Distribution of Trusts)<br />

149<br />

Form 4972 (Tax on Lump Sum Distributions) 149<br />

Form 5405 (First-Time Homebuyer Credit) 117, 118<br />

Form 5695 (Residential Energy Credits) 143<br />

Form 5884 (Work Opportunity Credit) 146<br />

Form 6198 (At-Risk Limitations) 111, 122<br />

Form 6251 (Alternative Minimum Tax - Individual) 29,<br />

141<br />

Form 6252 (Installment Sale Income) 115, 171<br />

Form 6478 (Credit for Alcohol Used as Fuel) 146<br />

Form 6765 (Credit for Increasing Research Activities) 146<br />

Form 6781 (Gains and Losses From Section 1256 Contracts<br />

and Straddles) 112<br />

Form 8082 (Notice of Inconsistent Treatment or Administrative<br />

Adjustment Request) 139<br />

Form 8275 (Disclosure Statement) 179<br />

Form 8275-R (Regulation Disclosure Statement) 179<br />

Form 8283 (Noncash Charitable Contributions) 140, 141<br />

Form 8332 (Release of Claim to Exemption for Child of<br />

Divorced or Separated Parents) 179<br />

Form 8379 (Injured Spouse Allocation) 179<br />

Form 8396 (Mortgage Interest Credit) 146<br />

Form 8453 (U.S. Individual Income Tax Transmittal for an<br />

IRS e-file Return) 238<br />

Form 8582 (Passive Activity Loss Limitations) 111, 122,<br />

125<br />

Form 8582-CR (Passive Activity Credit Limitations) 145<br />

Form 8594 (Asset Acquisition Statement Under Section<br />

1060) 180<br />

Form 8609 (Low-Income Housing Credit Allocation and<br />

Certification) 146<br />

Form 8611 (Recapture of Low-Income Housing Credit)<br />

149<br />

Form 8615 ("Kiddie Tax") 149<br />

Form 8801 (Credit for Prior Year Minimum Tax - Individuals,<br />

Estates, and Trusts) 52, 146, 157<br />

Form 8812 (Additional Child Tax Credit) 157<br />

Form 8814 (Parents’ Election to Report Child’s Income)<br />

149<br />

Form 8815 (Exclusion of Interest from Series EE and I U.S.<br />

Savings Bonds Issued After 1989) 180<br />

Form 8820 (Orphan Drug Credit) 146<br />

Form 8822 (Change of Address) 180<br />

Form 8826 (Disabled Access Credit) 146<br />

Form 8828 (Recapture of Federal Mortgage Subsidy) 149<br />

Form 8829 (Expenses for Business Use of Your Home)<br />

172<br />

Form 8834 (Qualified Electric Vehicle Credit) 146<br />

Form 8835 (Renewable Electricity, Refined Coal, and Indian<br />

Coal Production Credit) 146<br />

Form 8839 (Qualified Adoption Expenses) 146<br />

Form 8844 (Empowerment Zone and Renewal Community<br />

Employment Credit) 146<br />

Form 8845 (Indian Employment Credit) 146<br />

Form 8846 (Credit for Employer Social Security and Medicare<br />

Taxes Paid on Certain Employee Tips) 146<br />

Form 8857 (Request for Innocent Spouse Relief) 179<br />

Form 8859 (D.C. First-Time Homebuyer Credit) 147<br />

Form 8862 (Information to Claim Earned Income Credit<br />

After Disallowance) 180<br />

Form 8863 (Education Credits) 138<br />

Form 8864 (Bio-diesel and Renewable Diesel Fuels Credit)<br />

147<br />

Form 8866 (Interest Computation Under the Look-Back<br />

Method ...) 180<br />

Tax Year 2012<br />

xxxv