You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

128 ANNUAL<br />

SPECIFIC INFORMATION<br />

<strong>Capgemini</strong><br />

SHARE CAPITAL<br />

Amount of capital<br />

As of December 31, 2006, the Company’s share capital amounted<br />

to €1,152,654,464, represented by 144,081,808 fully paid-up<br />

common shares with a par value of €8.<br />

Shares may be issued in either registered or bearer form, at the<br />

shareholder’s discretion.<br />

REPORT 2006 <strong>Capgemini</strong><br />

Financial authorizations<br />

Financial authorizations currently applicable<br />

The Combined Shareholders’ Meeting of May 11, 2006 authorized<br />

the Board of Directors to carry out various transactions in respect<br />

of the Company’s capital. Under the authorizations the Board of<br />

Directors may increase capital by a maximum nominal amount<br />

of €450 million (excluding capital increase through capitalization<br />

of retained earnings or reserved for employees) and carry<br />

out issues for an aggregate amount of €3 billion, subject to the<br />

following ceilings:<br />

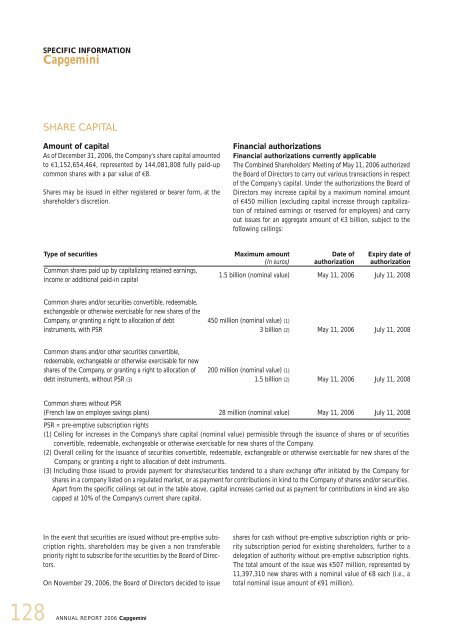

Type of securities Maximum amount<br />

Date of Expiry date of<br />

(in euros) authorization authorization<br />

Common shares paid up by capitalizing retained earnings,<br />

income or additional paid-in capital<br />

1.5 billion (nominal value) May 11, 2006 July 11, 2008<br />

Common shares and/or securities convertible, redeemable,<br />

exchangeable or otherwise exercisable for new shares of the<br />

Company, or granting a right to allocation of debt<br />

instruments, with PSR<br />

Common shares and/or other securities convertible,<br />

redeemable, exchangeable or otherwise exercisable for new<br />

shares of the Company, or granting a right to allocation of<br />

debt instruments, without PSR (3)<br />

450 million (nominal value) (1)<br />

3 billion (2) May 11, 2006 July 11, 2008<br />

200 million (nominal value) (1)<br />

1.5 billion (2) May 11, 2006 July 11, 2008<br />

Common shares without PSR<br />

(French law on employee savings plans) 28 million (nominal value) May 11, 2006 July 11, 2008<br />

PSR = pre-emptive subscription rights<br />

(1) Ceiling for increases in the Company’s share capital (nominal value) permissible through the issuance of shares or of securities<br />

convertible, redeemable, exchangeable or otherwise exercisable for new shares of the Company.<br />

(2) Overall ceiling for the issuance of securities convertible, redeemable, exchangeable or otherwise exercisable for new shares of the<br />

Company, or granting a right to allocation of debt instruments.<br />

(3) Including those issued to provide payment for shares/securities tendered to a share exchange offer initiated by the Company for<br />

shares in a company listed on a regulated market, or as payment for contributions in kind to the Company of shares and/or securities.<br />

Apart from the specific ceilings set out in the table above, capital increases carried out as payment for contributions in kind are also<br />

capped at 10% of the Company’s current share capital.<br />

In the event that securities are issued without pre-emptive subscription<br />

rights, shareholders may be given a non transferable<br />

priority right to subscribe for the securities by the Board of Directors.<br />

On November 29, 2006, the Board of Directors decided to issue<br />

shares for cash without pre-emptive subscription rights or priority<br />

subscription period for existing shareholders, further to a<br />

delegation of authority without pre-emptive subscription rights.<br />

The total amount of the issue was €507 million, represented by<br />

11,397,310 new shares with a nominal value of €8 each (i.e., a<br />

total nominal issue amount of €91 million).